FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

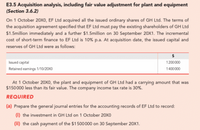

Transcribed Image Text:E3.5 Acquisition analysis, including fair value adjustment for plant and equipment

(Section 3.6.2)

On 1 October 20XO, EF Ltd acquired all the issued ordinary shares of GH Ltd. The terms of

the acquisition agreement specified that EF Ltd must pay the existing shareholders of GH Ltd

$1.5million immediately and a further $1.5million on 30 September 20X1. The incremental

cost of short-term finance to EF Ltd is 10% p.a. At acquisition date, the issued capital and

reserves of GH Ltd were as follows:

Issued capital

1 200000

Retained eamings 1/10/20X0

1400000

At 1 October 20xO, the plant and equipment of GH Ltd had a carrying amount that was

$150000 less than its fair value. The company income tax rate is 30%.

REQUIRED

(a) Prepare the general journal entries for the accounting records of EF Ltd to record:

(i) the investment in GH Ltd on 1 October 20X0

(ii) the cash payment of the $1500 000 on 30 September 20X1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- On December 18, 2020, Stephanie Corporation acquired 100 percent of a Swiss company for 4.022 million Swiss francs (CHF), which is indicative of book and fair value. At the acquisition date, the exchange rate was $1.00 = CHF 1. On December 18, 2020, the book and fair values of the subsidiary’s assets and liabilities were as follows: Cash CHF 822,000 Inventory 1,322,000 Property, plant, and equipment 4,022,000 Notes payable (2,144,000 ) Stephanie prepares consolidated financial statements on December 31, 2020. By that date, the Swiss franc has appreciated to $1.10 = CHF 1. Because of the year-end holidays, no transactions took place prior to consolidation. Determine the translation adjustment to be reported on Stephanie’s December 31, 2020, consolidated balance sheet, assuming that the Swiss franc is the Swiss subsidiary’s functional currency. What is the economic relevance of this translation adjustment? Determine the remeasurement gain or loss…arrow_forwardOn December 18, 2020, Stephanie Corporation acquired 100 percent of a Swiss company for 4.004 million Swiss francs (CHF), which is indicative of book and fair value. At the acquisition date, the exchange rate was $1.00 = CHF 1. On December 18, 2020, the book and fair values of the subsidiary’s assets and liabilities were as follows: Cash CHF 804,000 Inventory 1,304,000 Property, plant, and equipment 4,004,000 Notes payable (2,108,000 ) Stephanie prepares consolidated financial statements on December 31, 2020. By that date, the Swiss franc has appreciated to $1.10 = CHF 1. Because of the year-end holidays, no transactions took place prior to consolidation. Determine the translation adjustment to be reported on Stephanie’s December 31, 2020, consolidated balance sheet, assuming that the Swiss franc is the Swiss subsidiary’s functional currency. What is the economic relevance of this translation adjustment? Determine the remeasurement gain or loss…arrow_forwardOn December 18, 2020, Stephanie Corporation acquired 100 percent of a Swiss company for 4.006 million Swiss francs (CHF), which is indicative of book and fair value. At the acquisition date, the exchange rate was $1.00 = CHF 1. On December 18, 2020, the book and fair values of the subsidiary's assets and liabilities were as follows: Cash CHF Inventory Property, plant, and equipment Notes payable 806,000 1,306,000 4,006,000 (2,112,000) Stephanie prepares consolidated financial statements on December 31, 2020. By that date, the Swiss franc has appreciated to $1.10 = CHF 1. Because of the year-end holidays, no transactions took place prior to consolidation. a. Determine the translation adjustment to be reported on Stephanie's December 31, 2020, consolidated balance sheet, assuming that the Swiss franc is the Swiss subsidiary's functional currency. What is the economic relevance of this translation adjustment? b. Determine the remeasurement gain or loss to be reported in Stephanie's 2020…arrow_forward

- V6. A company purchases land, building and equipment for $1,500,000. An independent appraisal shows that the best available indications of fair value at the time of purchase are: land: $760,000; building: $540,000; and equipment: $320,000. The purchase is financed through long-term debt. Required: Prepare the journal entry to record the purchase Prepare the journal entry to record the purchase:arrow_forward1. PKT Ltd acquired 80% of the ordinary shares of CF Ltd. The net assets were fairly valued on 1 January 2021 except for machinery that were undervalued by R550 000. The machine was purchased on 1 January 2020 for R1 250 000 and had a useful life of 5 years. No adjustments at acquisition for the above matter. Required: Prepare the journal entries (with narrations) for the year ended 31 December 2022. Assume a tax Rate of 30% 1.2. PKT Ltd wanted to achieve a 25% GP for each sale completed. Inventory sales between AB and CF Ltd amounted to R1875 000 for the year ended 31 December 2022. Inventory on hand in CF Ltd previously Purchased from PKT Ltd: R620 000 (31 December 2022) R750 000 (31 December 2021) Required: Prepare the journal entries (with narrations) for the year ended 31 December 2022. Assume a tax rate of 30%.arrow_forwardOn December 18, 2020, Stephanie Corporation acquired 100 percent of a Swiss company for 4.002 million Swiss francs (CHF), which is indicative of book and fair value. At the acquisition date, the exchange rate was $1.00 = CHF 1. On December 18, 2020, the book and fair values of the subsidiary’s assets and liabilities were as follows: Cash CHF 802,000 Inventory 1,302,000 Property, plant, and equipment 4,002,000 Notes payable (2,104,000 ) Stephanie prepares consolidated financial statements on December 31, 2020. By that date, the Swiss franc has appreciated to $1.10 = CHF 1. Because of the year-end holidays, no transactions took place prior to consolidation. Determine the translation adjustment to be reported on Stephanie’s December 31, 2020, consolidated balance sheet, assuming that the Swiss franc is the Swiss subsidiary’s functional currency. What is the economic relevance of this translation adjustment? Determine the remeasurement gain or loss…arrow_forward

- Assume that Bailey Company gains control of Moloney, its subsidiary, with the purchase of a 30% interest paid in cash. The Equity Investment account reports a balance of $250,000 on the acquisition date and represents a 40% interest in Moloney. The total value of Moloney on the acquisition date is $700,000 (assume no premium for control). The journal entry to record the acquisition includes: Select one: A. Cash, credit, $700,000 B. Gain on revaluation of Moloney, credit, $30,000 C. Loss on revaluation of Moloney, debit, $30,000 D. None of the above PreviousSave AnswersNextarrow_forwardA-1arrow_forwardOn December 18, 2020, Stephanie Corporation acquired 100 percent of a Swiss company for 4.018 million Swiss francs (CHF), which is indicative of book and fair value. At the acquisition date, the exchange rate was $1.00 = CHF 1. On December 18, 2020, the book and fair values of the subsidiary’s assets and liabilities were as follows: Cash CHF 818,000 Inventory 1,318,000 Property, plant, and equipment 4,018,000 Notes payable (2,136,000 ) Stephanie prepares consolidated financial statements on December 31, 2020. By that date, the Swiss franc has appreciated to $1.10 = CHF 1. Because of the year-end holidays, no transactions took place prior to consolidation. Determine the translation adjustment to be reported on Stephanie’s December 31, 2020, consolidated balance sheet, assuming that the Swiss franc is the Swiss subsidiary’s functional currency. What is the economic relevance of this translation adjustment? Determine the remeasurement gain or loss…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education