FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

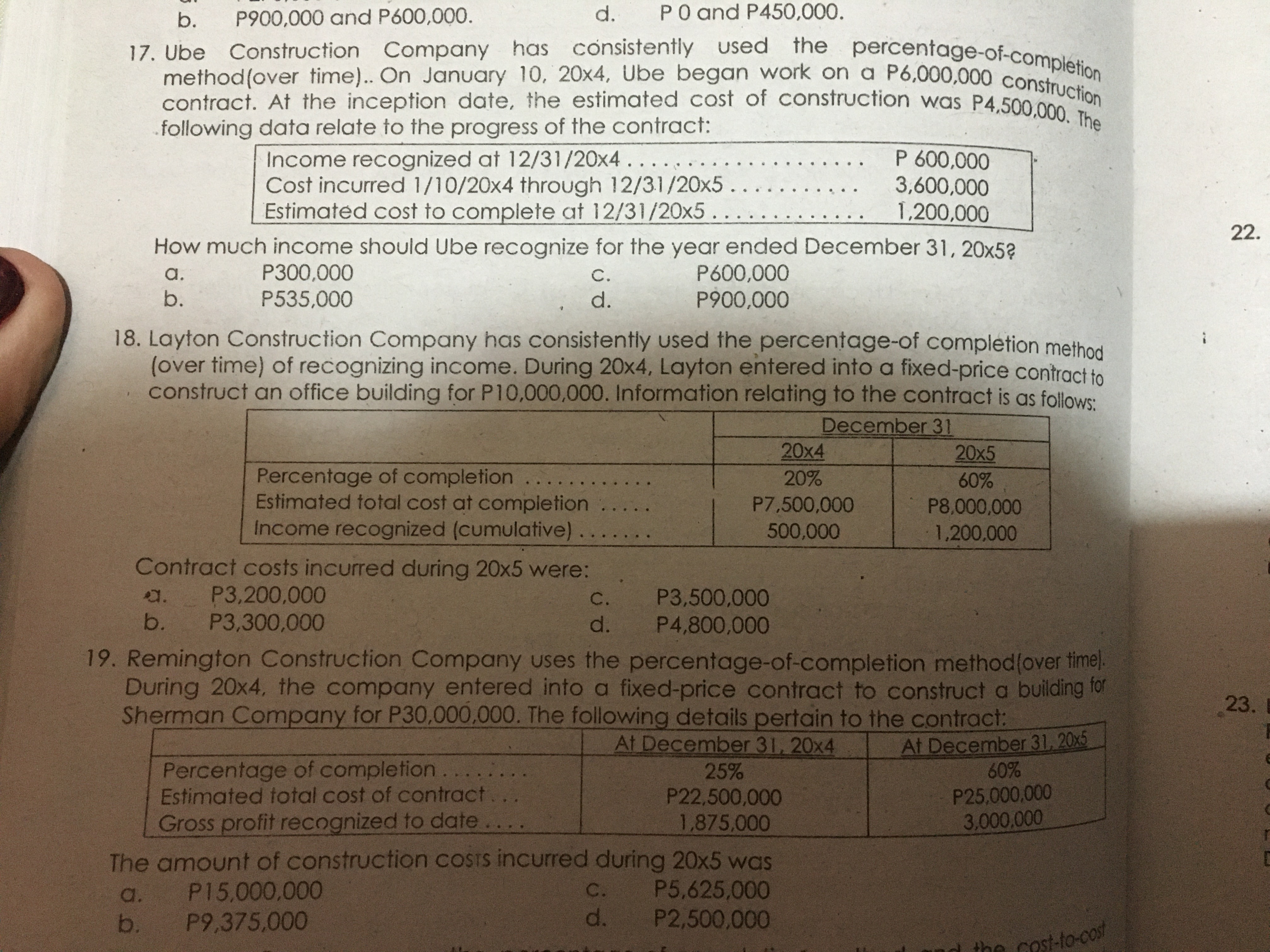

Kindly answer the 17, 18 and 19 question thank you

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- nt Aid Home | Federal Student Aid Filling Out the FAFSA® Form F X M Question 6-CH4 Class - Connec X G [The following information appli x p.mheducation.com/ext/map/index.html?_con-con&external_browser=0&launch Url=https%253A%252F%252Fbbhosted.cuny.edu%252Fwebapps%252Fportal%252Ffra S Saved Common categories of a classified balance sheet include Current Assets, Long-Term Investments, Plant Assets, Intangible Assets, Current Liabilities, Long-Term Liabilities, and Equity. For each of the following items, identify the balance sheet category where the item typically would best appear. If an item does not appear on the balance, indicate that instead. Account Title 1. Long-term investment in stock 2. Depreciation expense-Building 3. Prepaid rent (2 months of rent) 4. Interest receivable S 5. Taxes payable (due in 5 weeks) 6. Automobiles 7. Notes payable (due in 3 years) 8. Accounts payable 9. Cash 10. Patents Classification Account Title 11. Unearned services revenue 12. Accumulated…arrow_forwardKindly answer the 8 and 9 thank youarrow_forwardPumpkin Ltd. received the following information from its pension plan trustee concerning their defined benefit pension plan for the year ended December 31, 2020: December 31, 2020 $3,500,000 Defined benefit obligation Fair value of plan assets 1,750,000 For 2020, the service cost is $210,000 and past service cost (effective Jan 1, 2020) is $100,000. During 2020, Pumpkin contributed $595,000 to the plan, and paid 89,000 to the retirees throughout the year. The actual return of the plan assets is $90,000. The company was also informed by the consulting firm that an actuarial gain of $750 should be reported. Pumpkin uses discount rates of 6%. Pumpkin uses the immediate recognition approach under IFRS. Instructions Please calculate Pumpkin's DBO and Plan Assets ending balance and net defined pension asset/liability by completing the following worksheet. No separate journal entry necessary.arrow_forward

- Aid Home | Federal Student Aid X Filling Out the FAFSAⓇ Form | Fox M Question 2-CH4 Class-Connec X G [The following information ap mheducation.com/ext/map/index.html?_con-con&external_browser=0&launch Url=https%253A%252F%252Fbbhosted.cuny.edu%252Fwebapps%252Fportal Saved M. Muncel, Capital Dated May 31 PR Debit Account Number 301 Credit Use the May 31 fiscal year-end information from the following ledger accounts (assume that all accounts have normal balances). General Ledger Balance Account Number 622 Credit Salaries Expense Date PR Debit Balance G2 40,000 May 31 G2 20,000 M. Muncel, Withdrawals Date PR Debit Account Number 302 Credit Insurance Expense Balance Date PR Debit Account Number 637 Credit May 31 G2 23,000 May 31 G2 Balance 4,400 Services Revenue Date PR Debit Account Number 403 Credit Rent Expense Balance Date PR Debit Account Number 640 Credit May 31 G2 Depreciation Expense Date PR Debit 76,000 Account Number 603 Credit May 31 Income Summary 62 Balance 8,400 May 31 G2…arrow_forwardplease help with the question that is attached as a picture. thanksarrow_forwardHelp me pleasearrow_forward

- %24 Saved Help Quiz: Accounting for Current Liabi.. A i Required information ORobert Doly/Getty Images Knowledge Check 01 A potential legal claim which is probable and the amount can be reasonably estimated should be: O recorded in the financial statements as a contingent liability. O disclosed in the notes while the lawsuit is outstanding. O disclosed in the notes when the lawsuit is settled. O is a potential liability that has arisen because of a past event or transaction. .w. ...... F3 F4 F5 F7 F8 F10 DDI 23 3 9. 6.arrow_forwardStudents Home M Federal Financial Aid Program X Students Home Ch. 7 Hmwk: Invoices, Trade &X A Ch. 7 Hmwk Invoices, Trade & X A webassign.net/web/Student/Assignment-Responses/last?dep3D27277752 Apps M Gmail DYouTube Maps ... ... EReading list 7. [-/1 Points] DETAILS BRECMBC9 7.I1.010. MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER Calculate the net price factor (as a %) and net price (in $) by using the complement method. Round your answer to the nearest cent. List Price Trade Discount Rate Net Price Factor Net Price $3,499.00 35% $4 Need Help? Read It 8. [-/1 Points] DETAILS BRECMBC9 7.J1.014. MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER Calculate the trade discount (in $) and trade discount rate (as a %). Round your answer to the nearest tenth of a percent. List Price Trade Discount Rate Trade Discount Net Price $4,500.00 $3,515.00 Need Help? 11:28 PM 71°F (岁 10/9/2021 P Type here to searcharrow_forwardPlease read through the questions parts 2 and 3 is asking for journal entry. The rest are fill ins.arrow_forward

- Optional. P Search vout References Mailings Review View Help Aav Aoミ、E、、三E4T AaBbCcDc AaBbCcDc AaBbC AaBbCcl AaB ン、A、三 三三加、、田 I Normal 1 No Spac. Heading 1 Heading 2 Title Paragraph Styles 4. Jeff, age 50, is thinking of purchasing a S100,000 permanent life insurance policy to fund a gift to his local hospital. He was recently treated there after an automobile accident. He does not expect the policy to be surrendered for a number of years and is concerned that inflation might erode the value of his gift. Which of the following products would best suit Jeff's needs? (A) A whole life participating policy with dividends used to reduce the annual premium. (B) A term to 100 life insurance policy. (C) A whole life participating policy with a paid-up additions dividend option. (D) A whole life non-participating policy.arrow_forwardAccounting Questionarrow_forward3. Record the following transactions in Tally Prime Date Amount (in RO) 2021 Opening Balances : Buildings A/C Furniture A/C Jan 1 40,000 25,000 Cash A/C Bank A/C Al Kamil Steel Product Company A/C ( Dr. Balance) 10,000 12,500 10,000 7,500 Bank overdraft Capital A/C Brought additional capital into the business ? Jan 2 30,0`00 Deposited into bank Purchased goods and paid by cheque Purchased goods from Taghleef Industrial Company and got 5% trade discount Cash Sales Jan 31 20,000 Feb 1 5,000 Feb 2 15,000 Mar 1 10,000 Goods returned to Taghleef Industrial Company Purchased Equipment from Oman National Engineering Company Withdrew from bank for office use Mar 2 1,000 Mar 31 20,000 Apr 1 2,000 Apr 2 Sold goods to National Industries 15,000 Мay 1 May 2 Мay 31 June 1 Paid Wages and Salaries 3,000 Goods returned by National Industries Paid carriage inwards 1,500 1,500 Received Commission 2,000 June 2 Received from National Industries 8,000 Paid to Taghleef Industrial Company July 1 July 2…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education