FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

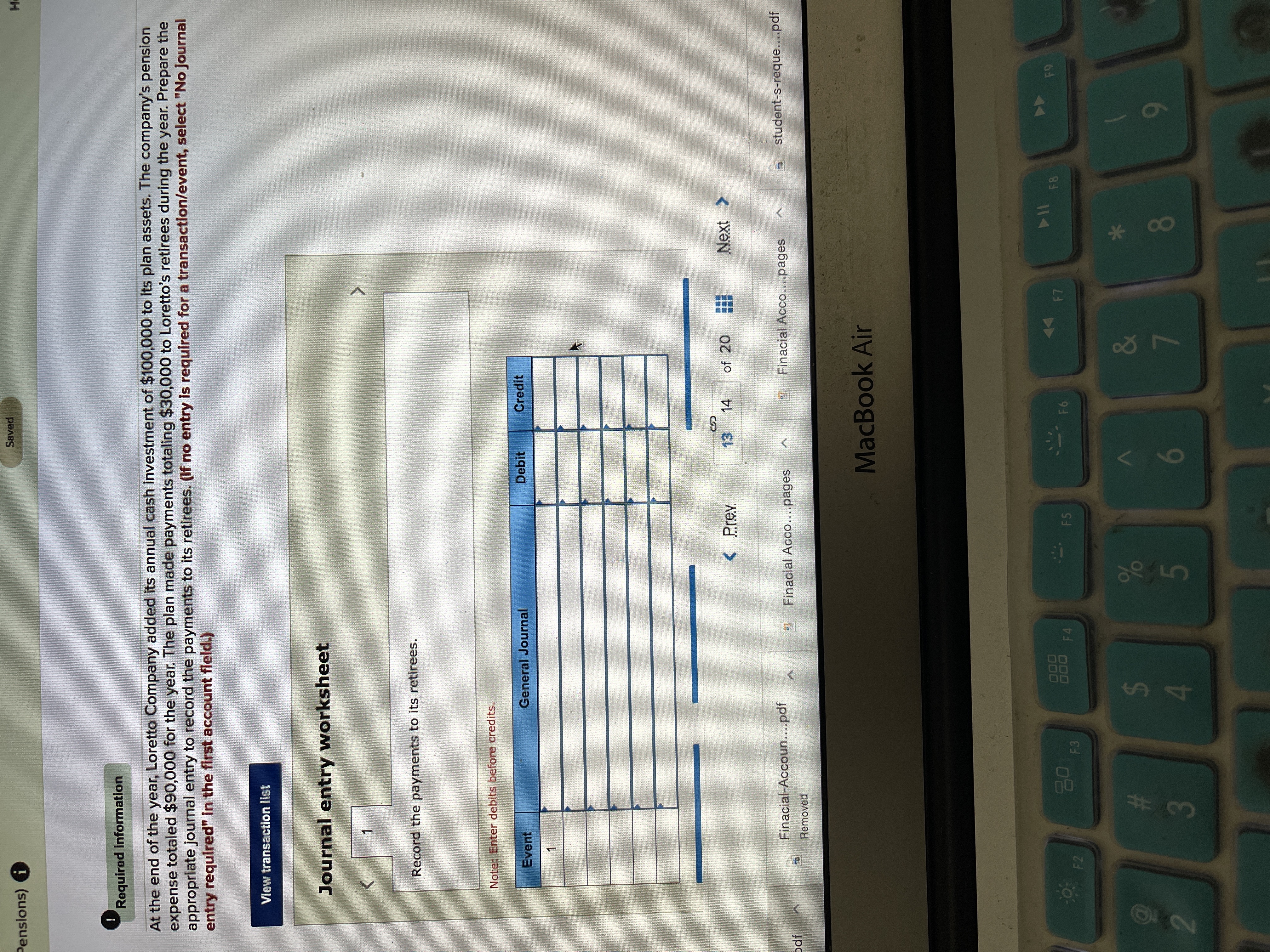

Transcribed Image Text:**Journal Entry Exercise: Pension Payments**

---

**Required Information:**

At the end of the year, Loretto Company added its annual cash investment of $100,000 to its plan assets. The company’s pension expense totaled $90,000 for the year. The plan made payments totaling $30,000 to Loretto's retirees during the year. Prepare the appropriate journal entry to record the payments to its retirees. *(If no entry is required for a transaction/event, select "No Journal entry required" in the first account field.)*

**Instructions:**

1. **View Transaction List**

2. **Journal Entry Worksheet**

- **Task:** Record the payments to its retirees.

- **Note:** Enter debits before credits.

| Event | General Journal | Debit | Credit |

|-------|-----------------|-------|--------|

| 1 | | | |

---

This exercise guides learners through the process of recording pension payments within a financial accounting framework. Completing this task involves understanding how pension-related transactions affect the company’s financial statements.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Lender Company provides postretirement health care benefits to employees who provide at least 10 years of service and reach the age of 65 while in service. On January 1 of the current calendar year, the following plan-related data were available. APBO balance Fair value of plan assets Average remaining service period to retirement Average remaining service period to full eligibility Postretirement Benefit Expense Service cost Interest cost Return on plan assets Amortization of prior service cost Postretirement benefit expense On January 1 of the current year, Lender amends the plan to provide dental benefits. The actuary determines that the cost of making the amendment increases the APBO by $11,000,000. Management chooses to amortize this amount on a straight- line basis. The service cost is $31,000,000. The appropriate interest rate is 10%. ($ in millions) Required: Calculate the postretirement benefit expense for the current year. Note: Enter your answers in millions rounded to 2…arrow_forwardThe following data are for Guava Company's retiree health care plan for the current calendar year. Number of employees covered Years employed as of January 1 Attribution period EPBO, January 1 EPBO, December 31 Interest rate Funding and plan assets Multiple Choice O O What is the service cost to be included in the current year's postretirement benefit expense? (Round your answer to the nearest whole dollar.) $3,200. $3,456. $3,900. 5 4 (each) 20years $3,306. $ 64,000 $69,120 8% Nonearrow_forwardRequired information [The following information applies to the questions displayed below.] Actuary and trustee reports indicate the following changes in the PBO and plan assets of Lakeside Cable during 2024: Prior service cost at January 1, 2024, from plan amendment at the beginning of 2022 (amortization: $6 million per year) Net loss-pensions at January 1, 2024 (previous losses exceeded previous gains) Average remaining service life of the active employee group Actuary's discount rate $ 50 million $60 million 10 years 8% ($ in millions) PBO Beginning of 2024 $ 500 Beginning of 2024 Service cost 66 Interest cost, 8% 40 Return on plan assets, 7.5% (10% expected) Loss (gain) on PBO (4) Cash contributions Less: Retiree benefits (52) Less: Retiree benefits End of 2024 $ 550 End of 2024 Plan Assets $360 27 65 (52) $400 Assume the following actuary and trustee reports indicating changes in the PBO and plan assets of Lakeside Cable during 2025: ($ in millions) Beginning of 2025 PBO $ 550…arrow_forward

- please dont provide answer in image format thank you Assume Towne Centre Art Museum (which has a December 31st year end) received the following contributions in 2020. Prepare journal entries to record these events and any year-end adjusting journal entries resulting from the events. a) Unrestricted pledges of support were received in the amount of $300,000. All of these are due within the year and it is estimated that 7% will ultimately prove to be uncollectable. b) 600 memberships were sold to the public in the amount of $45 each. Membership provides the individual with a monthly magazine and other benefits. The estimated fair value of member benefits is $20. The member year runs from July 1 to June 30. c) A local carpenter donated supplies and labor with values of $25,000 and $30,000 (respectively) to construct a new exhibition area. Fixed assets are classified as unrestricted net assets. d) On April 1,2020 a local businessman made a pledge payable in a future period. The pledge is…arrow_forwardPlease need answer for all with full working please answer all with steps computation explanation formula please answer all Stanley-Morgan Industries adopted a defined benefit pension plan on April 12, 2024. The provisions of the plan were not made retroactive to prior years. A local bank, engaged as trustee for the plan assets, expects plan assets to earn a 10% rate of return. The actual return was also 10% in 2024 and 2025.* A consulting firm, engaged as actuary, recommends 5% as the appropriate discount rate. The service cost is $160,000 for 2024 and $210,000 for 2025. Year-end funding is $170,000 for 2024 and $180,000 for 2025. No assumptions or estimates were revised during 2024. *We assume the estimated return was based on the actual return on similar investments at the inception of the plan and that, since the estimate didn't change, that also was the actual rate in 2025. Required: Calculate each of the following amounts as of both December 31, 2024, and December 31, 2025:…arrow_forwardThe pension worksheet for Carla Vista Industries is shown below. Carla Vista Industries Pension Worksheet General Journal Entries Memo Record Annual Pension Projected Pension Items Expense Cash Asset/ Liability Benefit Obligation Plan Assets Balance, Jan. 1, 2025 $22000 dr $259000 cr $281000 dr (a) Service Cost $63000 dr 63000 cr (b) Interest Cost 34000 dr 34000 CE (c) Actual Return 35000 cr 35000 dr (d) Contributions $49000 cr 49000 dr (e) Benefits ?? dr 22 cr Journal Entry for 2025 $62000 dr $49000 cr 13000 cr Balance, Dec. 31, 2025 $9000. dr 22 $279000 What amount of benefits were paid during 2025? O $63000 O $86000 O $49000 O $62000arrow_forward

- Current Attempt in Progress The actuary for the pension plan of Oriole Company calculated the following net gains and losses: Incurred during the Year (Gain) or Loss 2025 $(675,000) 2026 246,000 2027 973,000arrow_forwardThe following incomplete (columns have missing amounts) pension spreadsheet is for the current year for First Republic Corporation (FRC). ($ in millions)Debit(Credit)PBO Plan Assets Prior Service Cost Net(Gain)/Loss Pension Expense Cash Net Pension (Liability)/Asset Beginning balance (740) 32 (94) Service cost 66 Interest cost 37 Expected return on assets 72 Gain/loss on assets (4) Amortization of: Prior service cost (10) Net gain/loss 5 Loss on PBO (12) Contributions to fund (49) Retiree benefits paid (69) Ending balance 745 (85) What was the net pension asset/liability reported in the balance sheet at the end of the year? Multiple Choice Net pension liability of $41 million. Net pension asset of $58 million. Net pension…arrow_forwardDo not give image formatarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education