FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:%24

%24

%24

00

10. October 27, 2010

120 days

February 24, 2011

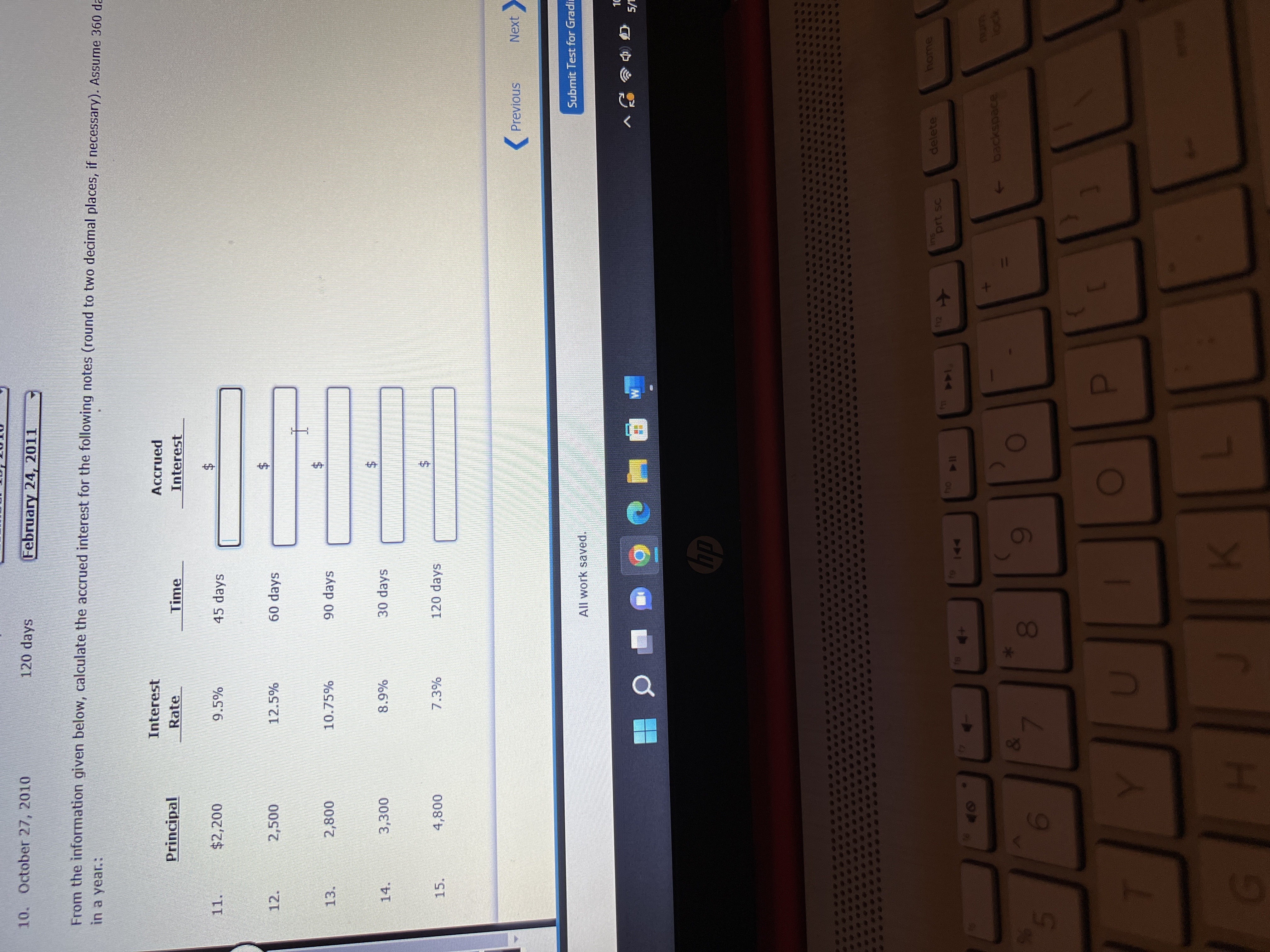

From the information given below, calculate the accrued interest for the following notes (round to two decimal places, if necessary). Assume 360 da

in a year.:

Interest

Accrued

Principal

Rate

Time

Interest

11.

$2,200

9.5%

45 days

12.

2,500

12.5%

60 days

10.75%

90 days

3.

30 days

24

14.

15.

120 days

Previous

Next

Submit Test for Gradi

All work saved.

dp

delete

home

prt sc

144

114 04

backspace

6

5.

D.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 7arrow_forwardCalculating Interest Using 360 days as the denominator, calculate interest for the following notes using the formula I = P x R × T. Round your answers to the nearest cent. Principal Rate Time Interest $4,100 6.00% 30 days 1,000 7.50 60 3,500 8.00 120 950 6.80 95 1,250 7.25 102 2,600 7.00 90arrow_forwardDetermine Due Date and Interest on Notes Determine the due date and the amount of interest due at maturity on the following notes: Date of Note Face Amount Interest Rate Term of Note a. January 10* $40,000 5% 90 days b. March 19 18,000 8. 180 days C. June 5 90,000 7 30 days d. September 8 36,000 3 90 days November 20 27,000 60 days е. *Assume that February has 28 days. Assume 360-days in a year when computing the interest. Note Due Date Interest a. С. d. е. II b.arrow_forward

- Calculating Interest Using 360 days as the denominator, calculate interest for the following notes using the formula I = P x R × T. Round your answers to the nearest cent. Principal Rate Time Interest $5,000 6.00% 30 days 1,000 7.50 60 4,500 8.00 120 %24 950 6.80 95 1,250 7.25 102 2,900 7.00 90 %24 %24arrow_forwardPresented below are data on three promissory notes. Determine the missing amounts. (Round answers for Total Interest to O decimal places, e.g. 825. Round annual interest rate to 0 decimal places, e.g. 15%. Use 360 days for calculation.) (a) (b) (c) Date of Note April 1 July 2 March 7 Terms 60 days 30 days 6 months Maturity Date Principal $780,000 80,400 165,000 Annual Interest Rate 15 % % 16 % $ $ Total Interest $938arrow_forwardExercise 3-19A (Algo) Preparing a trial balance LO 3-3 Required On December 31, Year 2, Morgan Company had the following normal account balances in its general ledger. Use this information to prepare a trial balance. Land Unearned Revenue Dividends Prepaid Rent Cash Salaries Expense Accounts Payable Common Stock Operating Expenses Office Supplies Advertising Expense Retained Earnings, Beginning Service Revenue Accounts Receivable Totals MORGAN COMPANY Trial Balance December 31, Year 2 Account Titles Debit $19,250 19,100 4,600 6,700 60,740 15,500 2,290 21,000 13,600 1,850 2,400 19,990 68,800 6,540 Creditarrow_forward

- Assuming a 360-day year, when a $11,200, 90-day, 5% interest-bearing note payable matures, the total payment will be Oa. $560 Ob. $140 Oc. $11,760 Od. $11,340 0 0 0 0arrow_forwardMaturity Dates of Notes Receivable Determine the maturity date and compute the interest for each of the following notes: (Round to the nearest dollar.)\table[[,\table[[Date of], [Note]], Interest,], [a., August 5, $12,000,9%, 120 days], [b., May 10, 33,600,7%, 90 days ], [c., October 20, 48,000, 12%, 45 days], [d., July 16,9,000, 10%, 60 days], [e., September 15, 19,000,7%,75 days]]arrow_forwardJust as a heads up in the question it mentions ordinary interest, ordinary interest is 360 days instead of the full 365 days a yeararrow_forward

- Interest on note: $1,137.50interest rate: 10%Note dated: 3/17/2024Note due date: 10/13/2024Days in year (ordinary interest) 3601.What is the term of the loan (in days)?2. What is the principal in on the note?arrow_forwardA B E 2 Determine the maturity date and compute interest for each note. 3 Days to be used per year 360 days 4 Note Contract Date Principal Interest Rate Period of Note (Term) 6. 1 1-Mar $10,000 6% 60 days 7 2 15-May 15,000 8% 90 days 8 3 20-Oct 8,000 4% 45 days 9. 10 Required: 11 12 (Use cells A5 to F8 from the given information to complete this question.) 13 14 Note Contract Date Maturity Date Interest Expense 15 16 17 3 18arrow_forwardCompute for the Effective Interest Rate Payment Period = Quarter 1. 10% Compounded Yearly = Blank 1 2. 10% Compounded Semi-annually = Blank 2 3. 10% Compounded Quarterly = Blank 3 4. 10% Compounded Bi-monthly Blank 4 5. 10% Compounded Monthly Blank 5 6. 10% Compounded Continuously Blank 6arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education