FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

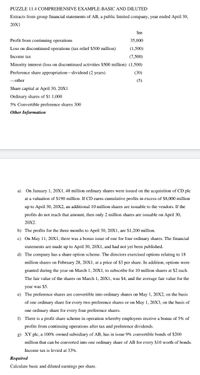

Transcribed Image Text:PUZZLE 11.4 COMPREHENSIVE EXAMPLE-BASIC AND DILUTED

Extracts from group financial statements of AB, a public limited company, year ended April 30,

20X1

$m

Profit from continuing operations

35,000

Loss on discontinued operations (tax relief $500 million)

(1,500)

Income tax

(7,500)

Minority interest (loss on discontinued activities $500 million) (1,500)

Preference share appropriation-dividend (2 years)

(30)

-other

(5)

Share capital at April 30, 20X1

Ordinary shares of $1 1,000

5% Convertible preference shares 300

Other Information

a) On January 1, 20X1, 48 million ordinary shares were issued on the acquisition of CD plc

at a valuation of $190 million. If CD earns cumulative profits in excess of $8,000 million

up to April 30, 20X2, an additional 10 million shares are issuable to the vendors. If the

profits do not reach that amount, then only 2 million shares are issuable on April 30,

20X2.

b) The profits for the three months to April 30, 20X1, are $1,200 million.

c) On May 11, 20X1, there was a bonus issue of one for four ordinary shares. The financial

statements are made up to April 30, 20X1, and had not yet been published.

d) The company has a share option scheme. The directors exercised options relating to 18

million shares on February 28, 20X1, at a price of $3 per share. In addition, options were

granted during the year on March 1, 20X1, to subscribe for 10 million shares at $2 each.

The fair value of the shares on March 1, 20X1, was $4, and the average fair value for the

year was $5.

e) The preference shares are convertible into ordinary shares on May 1, 20X2, on the basis

of one ordinary share for every two preference shares or on May 1, 20X3, on the basis of

one ordinary share for every four preference shares.

f) There is a profit share scheme in operation whereby employees receive a bonus of 5% of

profits from continuing operations after tax and preference dividends.

g) XY plc, a 100% owned subsidiary of AB, has in issue 9% convertible bonds of $200

million that can be converted into one ordinary share of AB for every $10 worth of bonds.

Income tax is levied at 33%.

Required

Calculate basic and diluted earnings per share.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Income Statement and Earnings per Share for Discontinued Operations Apex Inc. reports the following for a recent year: Income from continuing operations before income tax expense $1,000,000 Loss from discontinued operations $240,000* Weighted average number of shares outstanding 20,000 Applicable tax rate 40% *Net of any tax effect. Question Content Area a. Prepare a partial income statement for Apex Inc., beginning with income from continuing operations before income tax expense.arrow_forwardReview 17-9 Parent Corp. owns 40% of Sub Corp. In the current year, Parent has gross income of $43,000 and allowable deductions of $30,000 before considering any dividends received deduction (DRD). Included in the $43,000 gross income is $8,000 of dividends from Sub. What is the maximum DRD available to Parent? a. $4,000 b. $5,200 c. $8,000 d. $8,450arrow_forwardQuestion 4 Company P’s net profit for Year 1 is 4 600 000. capital structure of P comprising 3 000 000 ordinary shares and 500 000 equity-classified preference shares in issue throughout Year 1. Each preference share provides for a cumulative discretionary dividend each year of R1.20; and preference shares have no further rights to participate in dividends with ordinary shares. There are no tax effects on payment of preference dividends.Calculate the basic EPSarrow_forward

- 6arrow_forwardSee Attached 5.27 with Dividened Reduction Tablearrow_forwardProblem 4 (Allocation of Cash Dividends to Preference and Ordinary Shareholders) The Company has the same capital structure (except for retained earnings) for the past five year, see details below: 6% Preference Share Capital, 80,000 shares issued and outstanding, P 50 par P4,000,000 Ordinary Share Capital, 200,000 shares issued and outstanding, P 30 par 6,000,000 Retained Earnings 5,000,000 No dividends were paid prior to 2020 for two years. On December 10, 2020, the Company declared P 1,500,000 as cash dividends to shareholders of record of December 21, 2020, payable on January 5, 2021. Requirements: Prepare all the necessary journal entries to record the dividend transactions. Allocate the dividends between ordinary shareholders and preference shareholders if: Case A. Preference share capital is NON-CUMULATIVE and…arrow_forward

- Problem 4 (Allocation of Cash Dividends to Preference and Ordinary Shareholders) The Company has the same capital structure (except for retained earnings) for the past five year, see details below: 6% Preference Share Capital, 80,000 shares issued and outstanding, P 50 par P4,000,000 Ordinary Share Capital, 200,000 shares issued and outstanding, P 30 par 6,000,000 Retained Earnings 5,000,000 No dividends were paid prior to 2020 for two years. On December 10, 2020, the Company declared P 1,500,000 as cash dividends to shareholders of record of December 21, 2020, payable on January 5, 2021. Requirements: Prepare all the necessary journal entries to record the dividend transactions. Allocate the dividends between ordinary shareholders and preference shareholders if: Case A. Preference share capital is NON-CUMULATIVE and…arrow_forwardonly typed solutionarrow_forwardPlease do not give solution in image format thankuarrow_forward

- Requires all partsarrow_forwardBecker CPA Review 17-10 Parent Corp. owns 15% of Sub Corp. Parent has gross income of $43,000 and allowable deductions of $40,000 before considering any dividends received deduction (DRD). Included in the $43,000 gross income is $8,000 in dividends from Sub. What is the maximum DRD available to Parent? a.$1,500 b.$1,950 c.$4,000 d.$8,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education