FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

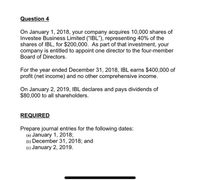

Transcribed Image Text:Question 4

On January 1, 2018, your company acquires 10,000 shares of

Investee Business Limited ("IBL"), representing 40% of the

shares of IBL, for $200,000. As part of that investment, your

company is entitled to appoint one director to the four-member

Board of Directors.

For the year ended December 31, 2018, IBL earns $400,000 of

profit (net income) and no other comprehensive income.

On January 2, 2019, IBL declares and pays dividends of

$80,000 to all shareholders.

REQUIRED

Prepare journal entries for the following dates:

(a) January 1, 2018;

(b) December 31, 2018; and

(c) January 2, 2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 7arrow_forwardProblem 11. On May 5, 2019, MacDougal Corp. exchanged 2,000 shares of its P25 par value ordinary treasury shares for a patent owned by Masset Co. The treasury shares were acquired in 2018 for P45,000. At May 5, 2019, MacDougal's ordinary shares was quoted at P38 per share, and the patent had a carrying value of P68,000 on Masset's books. MacDougal should record the patent at what amount?arrow_forwardSituation 1Waterway Cosmetics acquired 10% of the 189,000 shares of common stock of Martinez Fashion at a total cost of $12 per share on March 18, 2020. On June 30, Martinez declared and paid $77,300 cash dividend to all stockholders. On December 31, Martinez reported net income of $122,300 for the year. At December 31, the market price of Martinez Fashion was $13 per share.Situation 2Wildhorse, Inc. obtained significant influence over Seles Corporation by buying 30% of Seles’s 32,100 outstanding shares of common stock at a total cost of $9 per share on January 1, 2020. On June 15, Seles declared and paid cash dividends of $32,700 to all stockholders. On December 31, Seles reported a net income of $78,800 for the year.Prepare all necessary journal entries in 2020 for both situations.arrow_forward

- Item 1 Item Details When the financial controller was providing details on the employee share schemes at Knappa, it was identified that share options granted to the production staff on 1 July 2022 were not accounted for in the year ended 30 June 2023 financial statements. On 1 July 2022, 1,000 share options were granted to each of Knappa's 30 production employees, on the condition that the employees remain with the company for the next two years and that the share price increases from $26.50 per share on 1 July 2022 to $35 per share on 30 June 2024. If the share price target at 30 June 2024 is achieved, the share options can be exercised at any time over the subsequent 12 months (ie up to 30 June 2025). The fair value of each share option at the grant date was $5.60. You have obtained the following information: Year Number of employees who departed during the year No of employees expected to depart in future years 30.06.2023¹ 30.06.2024 1. This information was obtained at 30 June 2023;…arrow_forwardSituation 1 Pharoah Tables acquired 15% of the 4,800,000 shares of common stock of Robot Sofas at a total cost of $7.80 per share on April 1, 2025. On August 8, Robot Sofas declared and paid a $267,000 cash dividend. On December 31, Robot Sofas market price was $8.30 per share and the company reported net income of $625,000 for the year. Situation 2 On January 1, 2025, Coronado Company purchased 40% of Santos Corporation 525,000 outstanding shares of common stock at a total cost of $14 per share. On October 25, Santos declared and paid a cash dividend of $0.40 per share. On December 31, Santos reported a net income of $928,000 for the year and the market price of its common stock was $15 per share. Prepare all necessary journal entries in 2025 for both situations. (Credit account titles are automatically Indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries…arrow_forwardDogarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education