FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

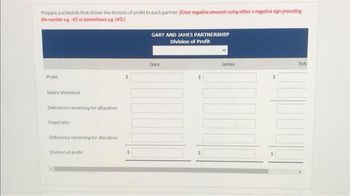

Transcribed Image Text:Prepare a schedule that shows the division of profit to each partner. (Enter negative amounts using either a negative sign preceding

the number eg.-45 or parentheses e.g. (45))

Profit

Salary allowance

Deficiency remaining for allocation

Fixed ratio

Deficiency remaining for allocation

Division of profit

$

GARY AND JAMES PARTNERSHIP

Division of Profit

Gary

$

$

James

Toti

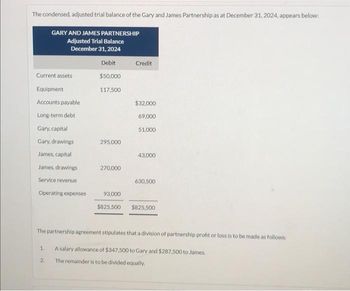

Transcribed Image Text:The condensed, adjusted trial balance of the Gary and James Partnership as at December 31, 2024, appears below:

Current assets

Equipment

Accounts payable

Long-term debt

GARY AND JAMES PARTNERSHIP

Adjusted Trial Balance

December 31, 2024

Gary, capital

Gary, drawings

James, capital

James, drawings

Service revenue

Operating expenses

1.

2.

Debit

$50,000

117,500

295,000

270,000

93,000

$825,500

Credit

$32,000

69,000

51,000

43,000

630,500

The partnership agreement stipulates that a division of partnership profit or loss is to be made as follows:

A salary allowance of $347,500 to Gary and $287,500 to James.

The remainder is to be divided equally.

$825,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] The partnership agreement of the G&P general partnership states that Gary will receive a guaranteed payment of $13,000, and that Gary and Prudence will share the remaining profits or losses in a 45/55 ratio. For year 1, the G&P partnership reports the following results: Sales revenue Gain on sale of land (§1231) Cost of goods sold Depreciation-MACRS Employee wages Cash charitable contributions Municipal bond interest Other expenses $ 70,000 8,000 (38,000) (9,000) (14,000) (3,000) 2,000 (2,000) Note: Negative amounts should be indicated by a minus sign. c. What do you believe Gary's share of self-employment income (loss) to be reported on his year 1 Schedule K-1 should be, assuming G&P is an LLC and Gary spends 2,000 hours per year working there full time? Self-employment income (loss)arrow_forwardEntries for Allocation of Net Income Danny Spurlock and Tracy Wilson decided to form a partnership on July 1, 20-1. Spurlock invested $100,000 and Wilson invested $25,000. For the fiscal year ended June 30, 20-2, a net income of $79,000 was earned. Determine the amount of net income that Spurlock and Wilson would receive under each of the following independent assumptions: Income to be allocated $fill in the blank 1 Spurlock Wilson Total 1. There is no agreement concerning the distribution of net income. $fill in the blank 2 $fill in the blank 3 $fill in the blank 4 2. Each partner is to receive 10% interest on their original investment. The remaining net income is to be divided equally. $fill in the blank 5 $fill in the blank 6 $fill in the blank 7 3. Spurlock and Wilson are to receive a salary allowance of $33,000 and $24,000, respectively.The remaining net income is to be divided equally. $fill in the blank 8 $fill in the blank 9 $fill in the blank 10 4. Each…arrow_forwardAssume the partnership income-sharing agreement calls for income to be divided with a salary of $41,000 to Coburn and $36,000 to Webb, interest of 10% on beginning capital, and the remainder divided 50%-50%. Prepare the journal entry to record the allocation of net income. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Income Summary Coburn, Capital Webb, Capital Debit 68000 Credit 33850 32150arrow_forward

- Question 2 Brown, Blue, and Black are in partnership sharing profit and losses in the ratio 2:1:2. The balance sheet for the partnership as of April 15, 2019, was as follows: $ Non-current assets Land Buildings Equipment Current assets Inventory Accounts receivable Cash Total assets Capital account Brown Blue Black Non-current liabilities Mortgage on building Current liabilities Accounts payable Total liabilities 360,000 1,260,000 234,000 108,000 45,000 36,000 315,000 108,000 450,000 1,080,000 90,000 $ 1,854,000 Required: Prepare the following ledger accounts for the dissolution of the partnership: a) Realization account b) Bank account c) Partner's capital account 189,000 2,043,000 873,000 1,080,000 90,000 2,043,000 The partners agreed to dissolve the partnership on April 15, 2019 on the following conditions: Sold the inventory for $72,000, collected $48,000 on accounts receivable and wrote off the remaining accounts, sold equipment for $192,000 and building and land for $1,200,000,…arrow_forwardFinancial Statements for Partnership The ledger of Camila Ramirez and Ping Xue, attorneys-at-law, contains the following accounts and balances after adjustments have been recorded on December 31, 20Y2: Ramirez and Xue Trial Balance December 31, 20Y2 Debit Balances Credit Balances Cash 50,400 Accounts Receivable 48,000 Supplies 1,800 Land 120,000 Building 132,000 Accumulated Depreciation—Building 75,000 Office Equipment 55,200 Accumulated Depreciation—Office Equipment 23,300 Accounts Payable 35,800 Salaries Payable 3,800 Camila Ramirez, Capital 120,000 Camila Ramirez, Drawing 54,000 Ping Xue, Capital 72,000 Ping Xue, Drawing 78,000 Professional Fees 436,800 Salary Expense 175,200 Depreciation Expense—Building 17,400 Heating and Lighting Expense 8,600 Depreciation Expense—Office Equipment 5,400 Property Tax Expense 10,800 Supplies Expense 6,200…arrow_forwardCoburn (beginning capital, $60,000) and Webb (beginning capital $86,000) are partners. During 2022, the partnership earned net income of $74,000, and Coburn made drawings of $20,000 while Webb made drawings of $22,000.arrow_forward

- The ledger of Tyler Lambert and Jayla Yost, attorneys-at-law, contains the following accounts and balances after adjustments have been recorded on December 31, 20Y3: Lambert and Yost Trial Balance December 31, 20Y3 Debit Balances Credit Balances Cash 34,000 Accounts Receivable 47,800 Supplies 2,000 Land 120,000 Building Accumulated Depreciation-Building Office Equipment Accumulated Depreciation-Office Equipment Accounts Payable Salaries Payable Tyler Lambert, Capital Tyler Lambert, Drawing Jayla Yost, Capital Jayla Yost, Drawing 157,500 67,200 63,600 21,700 27,900 5,100 135,000 50,000 88,000 60,000 Professional Fees 395,300 Salary Expense Depreciation Expense-Building 154,500 15,700 Property Tax Expense 12,000 Heating and Lighting Expense Supplies Expense Depreciation Expense-Office Equipment Miscellaneous Expense 8,500 6,000 5,000 3,600 740,200 740,200 The balance in Yost's capital account includes an additional investment of $10,000 made on April 10, 2OY3. (Continued)arrow_forwardNeed help with parts C through Farrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education