Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

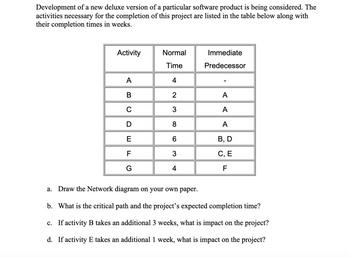

Transcribed Image Text:Development of a new deluxe version of a particular software product is being considered. The

activities necessary for the completion of this project are listed in the table below along with

their completion times in weeks.

Activity

A

B

с

D

E

F

G

Normal

Time

4

2

3

8

6

3

4

Immediate

Predecessor

A

A

A

B, D

C, E

F

a. Draw the Network diagram on your own paper.

b. What is the critical path and the project's expected completion time?

c. If activity B takes an additional 3 weeks, what is impact on the project?

d. If activity E takes an additional 1 week, what is impact on the project?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- 5. A project with nine activities includes only four paths that are shown below along with their lengths. The following table provides the opportunities for crashing activities. Activity Maximum Reduction Crash Cost/Day $600 А B C 1 $300 $50 $400 $500 $400 D 1 E 2 F 1 G 3 Suppose each day of shortening (crashing) the project saves $1200. Determine how many days should the project be crashed, and report the total cost for this crashing and how long the project will take to complete after the crashing. Show all your work. Cost for crashing =, How long is the project after crashing? days Paths Length in days АCD 27 АCFG 28 ВED 25 ВEFG 23arrow_forwardWhat does “nonrecourse” financing mean?arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- Please provide full and authentic solution. Please ensure the working out eases the eyes. Please dont make mistakes. Please double check when done. Greatly Appreciated!!. Please know that it is not 1000 on Project Beta it was 10,000. I was told that Project Alpha had higher IRR and higher net present value. Please confirm if it is true.arrow_forward1.arrow_forwardSuppose that sending an analyst to an executive education program will raise the precision of the analyst’s forecasts as measured by R-square by .01. How might you put a dollar value on this improvement? Provide a numerical example.arrow_forward

- REQUIRED Use the information provided below to answer the following questions: 3.1. Calculate the Payback period for the HMC. 3.2. Calculate the Net Present Value for both the HMC and VMC. 3.3. Calculate the Internal Rate of Return (IRR) for the HMC and VMC. 3.4. Which configuration of the CNC machining centres should SMT purchase, if any? Motivate your answer by referring to the answers obtained in questions 3.3 and 3.4. INFORMATION Southern Manufacturing Tools Limited (SMT) is considering the purchase of a Computer Numerical Control (CNC) machining centre for its operations. Two configurations of the CNC machining centres are available: horizontal CNC machining centre (HMC) and vertical CNC machining centre (VMC). Both the HMC and VMC will require an initial investment of R10 000 000, will have a useful life of 7 years and a residual value of R1 500 000. SMT uses the straight-line method of depreciation. The expected net cash inflows of the VMC are expected to be R2 100 000…arrow_forwardConsider VM * D' * s recent investment in the 3D MRI equipment. While this technology allows the Medical Imagining Center to stay at the forefront of technological developments in the field, it is currently underutilized. How would you propose to treat the new equipment from a costing system standpoint? Let's assume that the operating data of the new 3D MRI machine is the following: Initial Cost = $5, 000, 000 Useful life = 10 years Residual value = 0 Overhead costs (other than depreciation) per year =\$ 250000 Capacity = 2,500 hours / year Current utilization = 500 hours / yeararrow_forwardCan someone set up an excel sheet using the following data and show me the formula side, so I know how to replicate this type of problem later on? I don't understand where we get the values from the solution excel sheet I attached in the images. Thanks in advance!arrow_forward

- Solve the following problem using excel: The program is estimated to require a 10-year commitment to fully achieve the desired result. Analyze the following information using both the Net Present Value (NPV) method and the Internal Rate of Return (IRR) method.(I have already worked and solved this problem, however as it is complex and contains a large number of values to be calculated, I want to be sure that I applied all appropriate concepts correctly.)I have attached the directions and problem in a screenshot.arrow_forwardI need this question completed in 10 minutesarrow_forwardProject's Life Is Longer than the Analysis Period. Explain how?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education