Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

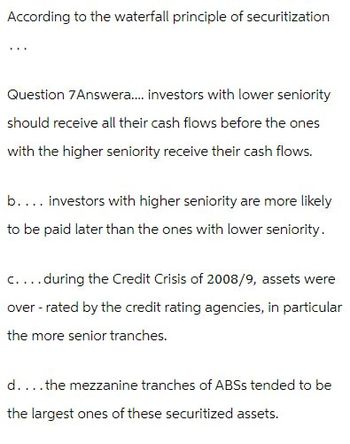

Transcribed Image Text:According to the waterfall principle of securitization

Question 7Answera.... investors with lower seniority

should receive all their cash flows before the ones

with the higher seniority receive their cash flows.

b.... investors with higher seniority are more likely

to be paid later than the ones with lower seniority.

c....during the Credit Crisis of 2008/9, assets were

over-rated by the credit rating agencies, in particular

the more senior tranches.

d....the mezzanine tranches of ABSS tended to be

the largest ones of these securitized assets.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is shadow banking and how does it differ from traditional retail banking? What kind of threat does shadow banking pose to the financial system? Discuss the role of shadow banking in the financial crisis of 2007-2008.arrow_forward“Inside the company fixed income managers bought bonds but they did not keep them for very long at all. Instead, they were constantly buying, exchanging and selling the bonds in their portfolios” Explain why the behavior described in the above quote may happen in terms of interest-rate risk immunization and downgrade risk. Do not discuss speculation or arbitrage as causes of this behavior as these will not gain any credit in this examination.arrow_forwardQuickBank has decided to lower the interest rate it charges on business loans in order to attract more business. It has succeeded in boosting the number of loan applications, but it finds that many of the applicants turn out to be very poor credit risks. This illustrates the problem known as adverse selection moral hazard the principal-agent porblem diversificationarrow_forward

- 1) If borrowers with the most risky investment projects seek bank loans in higher proportion to those borrowers with the safest investment projects, banks are said to face the problem of A) adverse credit risk. B) adverse selection. C) moral hazard. D) lemon lenders.arrow_forwardAll of the following may be considered causes of the “dark side” of credit except: Group of answer choices B. Operational issues that affect credit assessments can have a systematic effect on the whole consumer portfolio. D. Historical data tends to be consistent and can lead to accurate forecasts. A. Tendency of consumers to default is a product of changing legal and social systems. C. Sharp changes in the economic environment, such as a deep recession.arrow_forwardYou recently found out that when the market is in recession, ALL assets seem to suffer from some degree of liquidity problems as there are less trades than usual, and thus it is hard to sell an asset without losing some of its fair value. So, you concluded that at least some portion of liquidity risk must be systematic in nature and therefore it must be compensated by the market. To verify this, you cut the market portfolio in half by the illiquidity measure developed by Amihud (2002) [So that you have one relatively liquid portfolio and one relatively illiquid portfolio. Assume that this measure is reliable.] and calculated the market liquidity risk premium as follows: Market liquidity risk premium = Expected return on the illiquid portfolio - Expected return on the liquid portfolio = [E(RIL) - E(RL)] Then you formed 5 portfolios from the entire market based on liquidity (Amihud measure) and estimate the factor loading β (called liquidity beta) of each portfolio using [RIL - RL] as…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education