Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

provide answer of this General accounting question

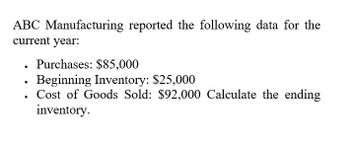

Transcribed Image Text:ABC Manufacturing reported the following data for the

current year:

•

•

Purchases: $85,000

Beginning Inventory: $25,000

Cost of Goods Sold: $92,000 Calculate the ending

inventory.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, Pope Enterprises inventory was 625,000. Pope made 950,000 of net purchases during the year. On its year-end income statement, Pope reported cost of goods sold of 1,025,000. Calculate Popes December 31 ending inventory.arrow_forwardThe following selected information is taken from the financial statements of Arnn Company for its most recent year of operations: During the year, Arnn had net sales of 2.45 million. The cost of goods sold was 1.3 million. Required: Note: Round all answers to two decimal places. 1. Compute the current ratio. 2. Compute the quick or acid-test ratio. 3. Compute the accounts receivable turnover ratio. 4. Compute the accounts receivable turnover in days. 5. Compute the inventory turnover ratio. 6. Compute the inventory turnover in days.arrow_forwardFinancial accountingarrow_forward

- The cost of goods sold for a company for the year was $1,900,000. Merchandise inventory at the beginning of the year was $125,000 and merchandise inventory at the end of the year was $133,000. The merchandise inventory turnover for the year was O a. 65.5. O b. 14.7. Oc. 0.1. Od. 33.8.arrow_forwardGP ℅ FOR THIS PERIOD?arrow_forwardNeed answer the general accounting questionarrow_forward

- GREEN Enterprises reported the following information for the current year: Inventory, January 1 - P2,300,000; Purchases - 27,105,000; Purchase returns and allowances - 520,000; Sales returns and allowances - P692,000; Inventory, December 31 - 2,470,000. Gross profit rate on net sales is 20%. What is the amount of gross sales for the current year?arrow_forwardThe following data were extracted from the income statement of Keever Inc.: Current Year Previous YearSales $18,500,000 $20,000,000Beginning inventories 940,000 860,000Cost of goods sold 9,270,000 10,800,000Ending inventories 1,120,000 940,000a. Determine for each year (1) the inventory turnover and (2) the number of days’ sales in inventory. Round to the nearest dollar and one decimal place.b. What conclusions can be drawn from these data concerning the inventories?arrow_forward(FIFO, LIFO and Average-Cost Determination) John Adams Company’s record of transactions for the month of April was as follows. PurchasesSalesApril 1 (balance on hand) 4813 21 29600 @ $6.00 1,500 @ 6.08 800 @ 6.40 1,200 @ 6.50 700 @ 6.60 500 @ 6.795,300 April 3 911 23 27500 @ $10.00 1,400 @ 10.00 600 @ 11.00 1,200 @ 11.00 900 @ 12.004,600nstructions a. Assuming that periodic inventory records are kept in units only, compute the inventory at April 30 using (1) LIFO and (2) average-cost.b. Assuming that perpetual inventory records are kept in dollars, determine the inventory using (1) FIFO and (2) LIFO.c. Compute cost of goods sold assuming periodic inventory procedures and inventory priced at FIFO. d. In an inflationary period, which inventory method—FIFO, LIFO, average-cost—will show the high-est net income?arrow_forward

- Need help give answerarrow_forwardRequired information ($ thousands) Net sales Cost of goods sold Current Year $ 885,182 396,513 Current Year: Prior Year: Determine the Prior Year and Current Year trend percents for net sales using the Prior Year as the base year. (Enter the answers in thousands of dollars.) Prior Year $ 456,779 137,643 Numerator: Trend Percent for Net Sales: Denominator: Trend Percent 0% 0%arrow_forwardHelparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning