FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:ESPAÑOL

INGLÉS

FRANCÉS

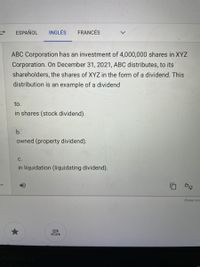

ABC Corporation has an investment of 4,000,000 shares in XYZ

Corporation. On December 31, 2021, ABC distributes, to its

shareholders, the shares of XYZ in the form of a dividend. This

distribution is an example of a dividend

to.

in shares (stock dividend).

b.

owned (property dividend).

C.

in liquidation (liquidating dividend).

Enviar cor

MacBook

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Blossom Corporation was organized on January 1, 2026 with the authorization of 1330000 shares of common stock with a par value of $6 per share. In 2026, the corporation had the following capital transactions: January 5 issued 665000 shares @ $10 per share July 28 purchased 79000 shares @ $12 per share December 31 sold the 79000 shares held in treasury @ $20 per share Blossom used the cost method to record the purchase and the reissuance of the treasury shares. What is the total amount of additional paid-in capital as of December 31, 2026? $3292000. $-0- $2041000. $2660000.arrow_forward(Give the exaplanation of formula and concept.do not provide plagarised content otherwise i dislike)arrow_forwardThe following information is available about Ayayai Corp.'s investments at December 31, 2023. This is the first year Ayayai has purchased securities for investment purposes. Securities 2,500 shares of Petra Corporation common shares 900 shares of Dugald Inc. preferred shares Ayayai follows IFRS. (a) Cost Account Titles and Explanation $25,000 18,000 $43,000 Fair Value $30,000 16,000 $46,000 Prepare the adjusting entry for December 31, 2023, assuming the investments are acquired for trading purposes and accounted for using the FV-NI model with no separate reporting of dividends and other types of FV-NI investment income and losses. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Debit Creditarrow_forward

- ABC Corporation has an investment of 4,000,000 shares in XYZ Corporation. On December 31, 2021, ABC distributes, to its shareholders, the shares of XYZ in the form of a dividend. This distribution is an example of a dividend: a. in stock (stock dividend). b. owned (property dividend). c. in liquidation (liquidating dividend).arrow_forwardBrave Industries owned investment securities with a book value of $20 million on August 12. At that time, Brave's board of directors declared a property dividend consisting of these securities. The fair value of the securities was as follows: Declaration --- August 12 Date of record --- September 1 Distribution date --- September 20 By how much is total stockholder' equity reduced by the property dividend? $31 million $30 million $27 million $20 million $28 million 30 million 31 millionarrow_forward(Give the exaplanation of formula and concept.do not provide plagarised content otherwise i dislike) Isle Royale Inc. bought 22,500 shares of the voting common stock of Lake Clark Company in January 2023. In December, Lake Clark Company announced $202,900 net income for 2023 and declared and paid a cash dividend of $8.00 per share on all 202,000 shares of its outstanding common stock. Calculate Isle Royale Inc.'s dividend revenue from Lake Clark Company in December 2023.○ $180,000○ $22,600○ $0○ $1,616,000arrow_forward

- On January 1, 2020, Swifty Corporation purchased 37% of the common stock outstanding of Cullumber Corporation for $610000. During 2020, Cullumber Corporation reported net income of $180000 and paid cash dividends of $120000. The balance of the Stock Investments-Cullumber account on the books of Swifty Corporation at December 31, 2020 is $610000. O $565600. O $632200. O $676600. eTextbook and Media Save for Later Attempts: 0 of 2 used Submit Answer 2$ & 7 8 9 4. y f h b n m altarrow_forwardThe securities owned by Jane Company were held as a long-term investment. During the currentyear, the following transactions occurred:Jan. 1 Purchased 15,000 shares of ABC Company at P70 per share.May 1 Purchased 8,000 shares of XYZ Corporation for P660,000.Apr 1 Received a cash dividend of P6 per share from ABC Company.July 1 Received a share for a share dividend from XYZ Corporation.Aug 1 Purchased 10,000 shares of GHI Enterprises at P75 each.Oct 1 Received a cash dividend of P6 per share from ABC Company.Oct 31 XYZ Corporation offered shareholders rights to subscribe to one new share for every tenrights tendered at P25. At the time of issuance, the market value of the right is P4. Sharerights are not accounted for separately.Nov 15 Exercised the XYZ Corporation’s share rights.Dec. 1 Sold 10,000 shares of XYZ Corporation at P35 per share. Use the FIFO approach indetermining the cost of the shares sold.Dec. 31 The fair values of the portfolio is as follows:ABC Company – P73 per…arrow_forwardPlease help mearrow_forward

- es On March 31, 2024, Chow Brothers, Incorporated, bought 6% of KT Manufacturing's capital stock for $54.8 million. KT's net income for the year ended December 31, 2024, was $81.6 million. The fair value of the shares held by Chow was $38.2 million at December 31, 2024. KT did not declare or pay a dividend during 2024. Required: 1. Prepare all appropriate journal entries related to the investment during 2024. 2. Assume that Chow sold the stock on January 20, 2025, for $31.6 million. Prepare the journal entries to record the sale. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare all appropriate journal entries related to the investment during 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5), View transaction list Journal entry worksheet 1 2 3 Record the entry for…arrow_forward(Give the exaplanation of formula and concept.do not provide plagarised content otherwise i dislike) Isle Royale Inc. bought 22,500 shares of the voting common stock of Lake Clark Company in January 2023. In December, Lake Clark Company announced $202,900 net income for 2023 and declared and paid a cash dividend of $8.00 per share on all 202,000 shares of its outstanding common stock. Calculate Isle Royale Inc.'s dividend revenue from Lake Clark Company in December 2023.○ $180,000○ $22,600○ $0○ $1,616,000arrow_forward(Give the exaplanation of formula and concept.do not provide plagarised content otherwise i dislike) Isle Royale Inc. bought 22,500 shares of the voting common stock of Lake Clark Company in January 2023. In December, Lake Clark Company announced $202,900 net income for 2023 and declared and paid a cash dividend of $8.00 per share on all 202,000 shares of its outstanding common stock. Calculate Isle Royale Inc.'s dividend revenue from Lake Clark Company in December 2023.○ $180,000○ $22,600○ $0○ $1,616,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education