Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

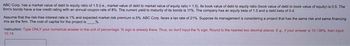

Transcribed Image Text:ABC Corp, has a market value of debt to equity ratio of 1.5 (ie, market value of debt to market value of equity ratio=1.5). Its book value of debt to equity ratio (book value of debt to book value of equity) is 0.5. The

firm's bonds have a low credit rating with an annual coupon rate of 8%. The current yield to maturity of its bonds is 11%. The company has an equity beta of 1.5 and a debt beta of 0.4.

Assume that the risk-free interest rate is 1% and expected market risk premium is 5% ABC Corp, faces a tax rate of 21%. Suppose its management is considering a project that has the same risk and same financing

mix as the firm. The cost of capital for the project is %

Instruction: Type ONLY your numerical answer in the unit of percentage % sign is already there. Thus, so don't input the % sign. Round to the nearest two decimal places. Eg, if your answer is 10.136%, then input

10.14

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- TT Industries is trading for $20 per share and has 25 million shares outstanding. TT Industries has a debt-equity ratio of 0.4 and its debt is zero coupon debt with a ten-year maturity and a yield to maturity of 8%. Which of the following best describes TT's debt using a put option? A) Short $200 million in risk-free debt and Long a put option on the firm's assets with a $200 strike price B) Long $200 million in risk-free debt and Short a put option on the firm's assets with a $700 strike price C) Long $200 million in risk-free debt and Short a put option on the firm's assets with a $200 strike price D) Short $200 million in risk-free debt and Long a put option on the firm's assets with a $700 strike pricearrow_forwardEpson has one bond outstanding with a yield to maturity of 5% and a coupon rate of 8%. The company has no preferred stock. Epson's beta is 1.5, the risk-free rate is 2.2% and the expected market risk premium is 6%. Epson has a target debt/equity ratio of 0.7 and a marginal tax rate of 34%. 1. What is Epson's (pre-tax) cost of debt? 2. What is Epson's cost of equity? 3. What is Epson's capital structure weight for equity, i.e., the fraction of long-term capital provided by equity? 4. What is Epson's weighted average cost of capital?arrow_forwardXYZ Corp. has bonds outstanding with a coupon rate of 2% and a YTM of 5.7%. The risk - free rate of return is 2.2% and the market is returning 10.0%. The stock has a beta of 0.9 and the firm is financed with 45% debt and 55% equity. If the tax rate is 24%, what is XYZ's WACC?arrow_forward

- Ripple Wine Merchants has 10,700 shares of stock outstanding at a price per share of $63. The risk-free rate is 2.8% and the expected market return is 9.8 %. Ripple has a beta of 1.59. The company also has 320 bonds outstanding, with a par value of $1000 per bond. The after-tax cost of debt is 5.89% and the bonds sell for 93.6% of par. What is the firm's WACC if the tax rate is 21%? O Multiple Choice 9.52% 9.44% 9.78% 9.14%arrow_forwardGanado and Equity Risk Premiums. Maria Gonzalez, Ganado's Chief Financial Officer, estimates the risk-free rate to be 3.20%, the company's credit risk premium is 4.50%, the domestic beta is estimated at 1.01, the international beta is estimated at 0.75, and the company's capital structure is now 40% debt. The before-tax cost of debt estimated by observing the current yield on Ganado's outstanding bonds combined with bank debt is 7.90% and the company's effective tax rate is 42%. Calculate both the CAPM and ICAPM weighted average costs of capital for the following equity risk premium estimates. a. 8.70% b. 7.80% c. 6.00% d. 5.10% Warrow_forwardA company just paid $1.23 in dividends per share, and it has a dividend payout of 38%. Considering that the PE ratio is 8 times, determine the price of this company’s individual stocks. d. If the coupon rate of a bond is 3.05% and the yield to maturity is 6.48%, and if a bondholder has a marginal tax rate of 21%, determine their after tax yield in this case.arrow_forward

- A firm's stock has a beta of 1.75, Treasury bills yield 3.8%, and the market portfolio offers an expected return of 9.5%. In addition to equity, the firm finances 26% of its assets with debt that has a yield to maturity of 7.4%. The firm is in the 28% marginal tax bracket. What is the company’s after tax cost of debt?arrow_forwardXYZ Corp. has a debt-to-equity ratio of 0.6 and an equity beta of 1.7. What will be the firm’s equity beta if it changes its target debt-to-equity ratio to 0.75? Assume the firm has risk-free debt.arrow_forwardConsider Rhye, amid-size pharmaceutical company. Rhye’s equity has a book value of $2.8 billion and a market value of $19.4 billion. Rhye’s debt, on the other hand, has a book value of $500 million and a market value of $600 million; the debt’s annual interest rate and yield to maturity are 6% and 5%, respectively. Currently, Rhye has a beta of 1.2 and faces a corporate tax rate of 35%. Also currently, the yield to maturity on 10-year U.S. Treasury Notes is 2.5%. The market risk premium remains around its historical average of 5.5%. so, what is Rhye's debt ratio, equity ratio, and WACC? Help me with this. TQarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education