Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

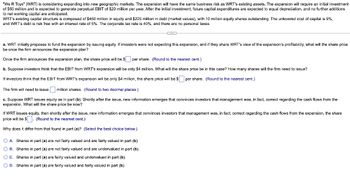

Transcribed Image Text:"We R Toys" (WRT) is considering expanding into new geographic markets. The expansion will have the same business risk as WRT's existing assets. The expansion will require an initial investment

of $50 million and is expected to generate perpetual EBIT of $20 million per year. After the initial investment, future capital expenditures are expected to equal depreciation, and no further additions

to net working capital are anticipated.

WRT's existing capital structure is composed of $450 million in equity and $225 million in debt (market values), with 10 million equity shares outstanding. The unlevered cost of capital is 9%,

and WRT's debt is risk free with an interest rate of 5%. The corporate tax rate is 40%, and there are no personal taxes.

a. WRT initially proposes to fund the expansion by issuing equity. If investors were not expecting this expansion, and if they share WRT's view of the expansion's profitability, what will the share price

be once the firm announces the expansion plan?

Once the firm announces the expansion plan, the share price will be $

per share. (Round to the nearest cent.)

b. Suppose investors think that the EBIT from WRT's expansion will be only $4 million. What will the share price be in this case? How many shares will the firm need to issue?

If investors think that the EBIT from WRT's expansion will be only $4 million, the share price will be $ per share. (Round to the nearest cent.)

The firm will need to issue million shares. (Round to two decimal places.)

c. Suppose WRT issues equity as in part (b). Shortly after the issue, new information emerges that convinces investors that management was, in fact, correct regarding the cash flows from the

expansion. What will the share price be now?

If WRT issues equity, then shortly after the issue, new information emerges that convinces investors that management was, in fact, correct regarding the cash flows from the expansion, the share

price will be $. (Round to the nearest cent.)

Why does it differ from that found in part (a)? (Select the best choice below.)

A. Shares in part (a) are not fairly valued and are fairly valued in part (b).

OB. Shares in part (a) are not fairly valued and are undervalued in part (b).

OC. Shares in part (a) are fairly valued and undervalued in part (b).

O D. Shares in part (a) are fairly valued and fairly valued in part (b).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Salalah Oil,has a cost of equity capital equal to 22.8 percent. If the risk-free rate of return is 10 percent and the expected return on the market is 18 percent, then what is the firm's beta. Select one: a. None of these b. 1.20 c. 1.25 d. 1.60arrow_forwardConsider a two-date binomial model. A company has both debt and equity in its capital structure. The value of the company is 100 at Date 0. At Date 1, it is equally like that the value of the company increases by 20% or decreases by 10%. The total promised amount to the debtholders is 100 at Date 1. The riskfree interest rate is 10%. a. What are the possible payoffs to the equityholders at date 1? What kind of financial product has the same payoffs? Please describe the detailed characteristics of the financial product. b. What are the possible payoffs to the bondholders at date 1? Are they riskfree? What kind of financial product/portfolio has the same payoffs? Please describe the detailed characteristics of the financial product/portfolio.arrow_forward1. Arizona Rock, an all-equity firm, currently has a beta of 1.25. The risk-free rate, kRF, is 7 percent and kM is 14 percent. Suppose the firm sells 10 percent of its assets with beta equal to 1.25 and purchases the same proportion of new assets with a beta of 1.1. What will be the firm’s new overall required rate of return, and what rate of return must the new assets produce in order to leave the stock price unchanged? a. 15.645%; 15.645% b. 15.750%; 15.645% c. 14.750%; 15.750% d. 15.645%; 14.700% e. 15.750%; 14.700% 2. Dry Seal plans to issue bonds to expand operations. The bonds will have a par value of P1,000, a 10-year maturity, and a coupon interest rate of 9%, paid semiannually. Current market conditions are such that the bonds will be sold to net P937.79. What is the yield-to-maturity of these bonds? a. 10% b. 9% c. 11% d. 8% 3. You have just purchased a 15-year, P1,000 par value bond. The coupon rate on this bond is nine percent (9%) annually, with…arrow_forward

- 2) Zang Industries has hired the investment banking firm of Eric, Schwartz, & Mann (ESM) to help it go public. Zang and ESM agree that Zang's current value of equity is $56 million. Zang currently has 5 million shares outstanding and will issue 2 million new shares. ESM charges a 6% spread. What is the correctly valued offer price? Do not round intermediate calculations. Round your answer to the nearest cent. $ ___________ How much cash will Zang raise net of the spread (use the rounded offer price)? Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answer to the nearest dollar. $___________arrow_forwarddevarrow_forward2. During the discussion of the potential IPO and East Coast Yachts’ future, Dan states that hefeels the company should raise $60 million. However, Larissa points out that if the company needsmore cash soon, a secondary offering close to the IPO would be potentially problematic. Instead,she suggests that the company should raise $90 million in the IPO. How can we calculate theoptimal size of the IPO? What are the advantages and disadvantages of increasing the size of theIPO to $90 million?arrow_forward

- 57 I am buying a firm with an expected perpetual cash flow of $420 but am unsure of its risk. If I think the beta of the firm is O, when the beta is really 1, how much more will I offer for the firm than it is truly worth? Assume the risk-free rate is 7% and the expected rate of return on the market is 15%. (Input the amount as a positive value.) Present value differencearrow_forwardThe Tennis Shoe Company has concluded that additional equity financing will be needed to expand operations and that the needed funds will be best obtained through a rights offering. It has correctly determined that as a result of the rights offering, the share price will fall from $56 to $54.30 ($56 is the rights-on price; $54.30 is the ex-rights price, also known as the when-issued price). The company is seeking $17.5 million in additional funds with a per-share subscription price equal to $41. How many shares are there currently, before the offering? (Assume that the increment to the market value of the equity equals the gross proceeds from the offering.) (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)arrow_forwardThis question is related to Chapter 18 of Berk & Demarzo "Capital Budgeting and Valuation with Leverage". How do the calculations of the firm value using the APV method differ between the following assumptions? The growth rate of the EBIT and the debt-equity ratio will be constant The growth rate of the EBIT and the interest coverage ratio will be constant. The firm selects the optimal interest coverage ratio and maintains this ratio constant forever (corporate taxes are the only imperfection) Are the values that result different or equal?arrow_forward

- Hello Can you assist with problem 3b. Then assist with question 5. Question 3b is needed to answer question 5arrow_forwardThe value of a firm's future cash flows is estimated at 230M. The continuously compounded risk-free rate is 3%. The duration of firm's debt is 11 years. The face value of the firm's debt is 280M. The volatility of firm cash flows is 0.22. The firm pays no dividends. Use the notion of equity as a call option on the value of the firm. Let the firm now accept a project that has an NPV of -10M and increases the volatility of the firm to 0.30. What is the new value of the firm's equity?arrow_forwardSuppose a U.S. investor wishes to invest in a British firm currently selling for £40 per share. The investor has $10,000 to invest, and the current exchange rate is $2/£. a. How many shares can the investor purchase? Number of shares = b. Fill in the table below for rates of return after one year in each of the nine scenarios (three possible prices per share in pounds times three possible exchange rates). (Leave no cells blank - be certain to enter "0" wherever required. Negative values should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places.) Price per Share (£) Pound-Denominated Return (%) Dollar-Denominated Return (%)for Year-End Exchange Rate $1.80/£ $2/£ $2.20/£ £35 % % % % % % £40 % % % % % % £45 % % % % % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education