Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:57

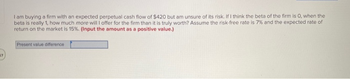

I am buying a firm with an expected perpetual cash flow of $420 but am unsure of its risk. If I think the beta of the firm is O, when the

beta is really 1, how much more will I offer for the firm than it is truly worth? Assume the risk-free rate is 7% and the expected rate of

return on the market is 15%. (Input the amount as a positive value.)

Present value difference

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Southern Imports is an all-equity firm with a beta of 1.23. The firm is considering a new project that entails less risk than its current operations and thus management feels that the firm's beta should be lowered by .18 when assigning a discount rate to this project. The expected return on the market portfolio is 9.4 percent and the risk-free rate is 2.8 percent. What discount rate should be assigned to this project? 9.73% 9.34% 10.32% O 11.46%arrow_forward(Capital Asset Pricing Model) Breckenridge, Inc., has a beta of 0.79. If the expected market return is 10.0 percent and the risk-free rate is 6.0 percent, what is the appropriate expected return of Breckenridge (using the CAPM)? The appropriate expected return of Breckenridge is %. (Round to two decimal places.)arrow_forwardA financial analyst for the ZZZ Corporation uses the Security Market line to estimate the cost of equity, Re. The analyst observes the current risk-free interest rate, Rf, is 3%. The analyst estimates that ZZ has a beta of 2. If the analyst finds that RE is 13%, what does the analyst use as the value of [E(RM) – R¡]? -arrow_forward

- Use the following forecasted financials: (Certain cells were left intentionally blank by asker) You may need to use the CAPM model. Assume beta equals 1.09, the risk-free rate is 1.62%, and the market risk premium is 4.72%. d) Calculate the terminal value and the present value of the terminal value. Assume a long-term growth rate of 3%. e) Calculate Sherwin Williams value per share. The company has 263.3 million shares outstanding.arrow_forwardThe expected return for the investment is ??? The standard deviation is ??? While the expected return for the risk-free assets, Treasury Bills, is ??? The standard deviation is ???arrow_forward2. Consider the model of Moral Hazard where firms choose between investing one unit of output in a less risky or more risky project. The safer project yields with probability and zero otherwise while the risky project yields 2 with probability and zero otherwise i.e. TG = G = TB B = 2. Suppose firms finance their investment by borrowing 1 unit from a the fiinancial market at interest rate R. The financial market is risk neutral and requires an expected rate of return equal to the risk free rate which is assumed to be zero. Will there be an equilibrium with lending to firms from the financial market A. Yes B. No C. Not enough information D. None of A-Carrow_forward

- (Capital Asset Pricing Model) Johnson Manufacturing, Inc., is considering several investments. The rate on Treasury bills is currently 7.5 percent, and the expected return for the market is 10.5 percent. What should be the expected rate of return for each investment (using the CAPM)? Security A B C D Beta 1.62 1.02 0.71 1.34 a. The expected rate of return for security A, which has a beta of 1.62, is%. (Round to two decimal places.)arrow_forwardneed answer in step by steparrow_forwardIn Simpleland, there are only two risky assets in the market, A and B. The information and CAPM estimates of A and B are shown in the following table: A 100 Million 0.09 Market Capitalisation ($) |Variance (o²) Covariance between A and B Expected Return on Market Risk free rate 400 Million 0.01 0.2 20% 10% The manager believes that in the near future, B will outperform A by 5% with uncertainty measured in variance 0.0005. He has also assigned the error of estimating the above CAPM model in terms of variance to be 0.01, i.e. T = 0.01. a) What is the expected return of A and B under CAPM? 2.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education