ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

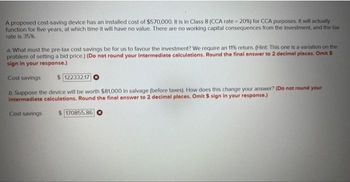

Transcribed Image Text:A proposed cost-saving device has an installed cost of $570,000. It is in Class 8 (CCA rate = 20%) for CCA purposes. It will actually

function for five years, at which time it will have no value. There are no working capital consequences from the investment, and the tax

rate is 35%.

a. What must the pre-tax cost savings be for us to favour the investment? We require an 11% return. (Hint: This one is a variation on the

problem of setting a bid price.) (Do not round your intermediate calculations. Round the final answer to 2 decimal places. Omit $

sign in your response.)

Cost savings

$122332.17

b. Suppose the device will be worth $81,000 in salvage (before taxes). How does this change your answer? (Do not round your

Intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.)

Cost savings

170855.86

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Can someone double check my work-out? Is my workout and solution correct?arrow_forwardsolve plzarrow_forwardA proposed cost-saving device has an installed cost of $610,000. It is in Class 8 (CCA rate = 20%) for CCA purposes. It will actually function for five years, at which time it will have no value. There are no working capital consequences from the Investment, and the tax rate is 35%. a. What must the pre-tax cost savings be for us to favour the Investment? We require an 10% return. (Hint: This one is a variation on the problem of setting a bid price.) (Do not round your intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) Cost savings $ 94,000 b. Suppose the device will be worth $85,000 in salvage (before taxes). How does this change your answer? (Do not round your intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) Cost savings $80,769.23arrow_forward

- Kolby's Korndogs is looking at a new sausage system with an installed cost of $670,000. The asset qualifies for 100 percent bonus depreciation and can be scrapped for $88,000 at the end of the project's 5-year life. The sausage system will save the firm $213,000 per year in pretax operating costs, and the system requires an initial investment in net working capital of $41,000. If the tax rate is 23 percent and the discount rate is 11 percent, what is the NPV of this project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPVarrow_forwardCorrect only pls. Only the highlighted parts. Npv if pretax cost savings are $100000 per year is -121277. 58. Now how to find the last part.arrow_forwardMansukharrow_forward

- A company plans to design and build transport vehicles for the Army. The cost for the design is $10M. The cost for the test prototype is $2M. The cost to produce and test each production vehicle is $0.5M. What is the non-recurring cost? What is the recurring cost per vehicle? What price per vehicle must the company sell the vehicles to the government to make $50K profit per vehicle if the company sold 50 vehicles? 100 vehicles? Why does the price per vehicle go down when production goes up?arrow_forwardSuppose that two certain cars have the following average operating and ownership costs. Average Costs per Mile Ownership Operating $0.24 $0.20 $0.68 $0.25 If you drive 20,000 miles per year, by how much does the total annual expense for Car A exceed that of Car B over nine years? Car A Car B The total annual expense for Car A exceeds that of Car B by $ (Round to the nearest dollar as needed.) over nine years. Total $0.92 $0.45arrow_forward6arrow_forward

- If the profit function for selling smart phone screen magnifier is -4500p2 + 561500p – 11898000, what is the maximum profit that can be expected from selling smart phone screen magnifiers? Question 1 options: $ 0, no profit $ 5,617,681 $ 1,717,764 -$ 8,004,171arrow_forwardthe manager has determined that a potential new product can be sold at a priceof$12.50 each. The cost to produce the product is $7.00, but the equipment necessary for production must be leased for $20,000 per year. What is the break-even point?arrow_forwardA new drill press costs $12,000. It would potentially produce an additional $4,000 of revenue per year and have an operating expense of $1,200. What is the PW of the drill press if the new equipment is expected to last 8 years and i = 10%? Select one: a. $15,534 b. $19,345 c. $14,938 d. $21,735arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education