CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

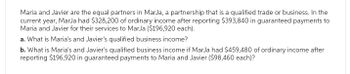

Transcribed Image Text:Maria and Javier are the equal partners in MarJa, a partnership that is a qualified trade or business. In the

current year, Marja had $328,200 of ordinary income after reporting $393,840 in guaranteed payments to

Maria and Javier for their services to MarJa ($196,920 each).

a. What is Maria's and Javier's qualified business income?

b. What is Maria's and Javier's qualified business income if MarJa had $459,480 of ordinary income after

reporting $196,920 in guaranteed payments to Maria and Javier ($98,460 each)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Maria and Javier are the equal partners in MarJa, a partnership that is a qualfied trade or business. In the current year, MarJa had $280,200 of ordinary income after reporting $336,240 in guaranteed payments to Maria and Javier for their services to MarJa ($168,120 each). a. What is Maria's and Javier's qualified business income?$ b. What is Maria's and Javier's qualified business income if MarJa had $392,280 of ordinary income after reporting $168,120 in guaranteed payments to Maria and Javier ($84,060 each)?$arrow_forwardMaria and Javier are the equal partners in MarJa, a partnership that is a qualifying trade or business. In the current year, MarJa had $350,000 of ordinary income after reporting $500,000 in guaranteed payments to Maria and Javier for their services to MarJa ($250,000 each). a. What is Maria's and Javier's qualified business income? b- What's Maria's and Javier's qualified business income if Marja had $550,000 of ordinary income after reporting $300,000 in guaranteed payments to Maria and Javier ($150,000 each)?arrow_forwardCarrie and Callie form a partnership in which Carrie contributes $85,000 in assets and agrees to devote half time to the partnership. Callie contributed $50,000 in assets and agrees to devote full time to the partnership. If no additional information is available, how will Carrie and Callie share in the division of income? In the ratio of:arrow_forward

- In their partnership agreement, John, Roy, and Kim, have an income/loss distribution ratio of 4:2:1. How much would each of the three partners receive from an income of $168,000? John will get: $_____________; Roy: $ ____________; and Kin will receive:$ __________arrow_forwardTanner and Teresa share income and losses in a 2:1 ratio (2/3 to Tanner and 1/3 to Teresa) after allowing for salaries of $42,000 to Tanner and $60,000 to Teresa. Net income of the partnership is $132,000. How should income be divided for Tanner and Teresa? Oa. Tanner, 558,000, Teresa, $74,000 Ob. Tanner, $75,000; Teresa, $57,000 Oc. Tanner, $57,000, Teresa, $75,000 Od. Tunner, $62,000, Teresa, $70,000arrow_forwardsarrow_forward

- Peter and Paul are partners in a partnership. Their share of the partnership profits and losses are 60% and 40% respectively. Peter is a resident and Paul is a non-resident. In this income year, the partnership derived the following income: interest income from an Australian Bank Account: $30,000 interest income from an overseas bank account: $18,000 Calculate the net income of the partnership and explain how that amount will be allocated and assessed in the hands of Peter and Paul.arrow_forwardNancy Freeley has been operating an apartment-locator service as a sole proprietorship. She and Melissa Marcellus have decided to form a partnership. Freeley's contribution consists of Cash, $6,000; Accounts Receivable, $12,000; Furniture, $13,000; Building (net), $53,000; and Notes Payable, $17,000. To determine Freeley's equity in the partnership, she and Marcellus hire an independent appraiser. The appraiser values all the assets and liabilities at their book value, except the building, which has a current market value of $100,000. Also, there are additional Accounts Payable of $3,000 that Freeley will contribute. Marcellus will contribute cash equal to Freeley's equity in the partnership. Requirements 1. Journalize the entry on the partnership books to record Freeley's contribution. 2. Journalize the entry on the partnership books to record Marcellus's contribution.arrow_forwardSolange and Louis enter into a partnership agreement. Solange contributes $65,000 in capital. Louis contributes $95,000 in capital. The agreement stipulates that profits and losses will be shared in the ratio of their respective capital account balances. The net income for the year is $32,000. Which of the following amounts should be credited to Louis’s capital account? $19,000 $32,000 $16,000 $13,000arrow_forward

- Abby and Bailey are partners who share income in the ratio of 2:1 and have capital balances of $67,800 and $30,100, respectively. With the consent of Bailey, Sandra buys one-half of Abby's interest for $44,000. For what amount will Abby's capital account be debited to record admission of Sandra to the partnership?arrow_forwardAnswer the following three questions. Paul and Roger are partners who share income in the ratio of 3:2 (3/5 to Paul and 2/5 to Roger). Their capital balances are $90,000 and $130,000, respectively. The partnership generated net income of $50,000 for the year. What is Paul’s capital balance after closing the revenue and expense accounts to the capital accounts? a.$108,000 b.$115,000 c.$180,000 d.$120,000 Jackson and Campbell have capital balances of $100,000 and $300,000, respectively. Jackson devotes full time and Campbell devotes one-half time to the business. Determine the division of $150,000 of net income in the ratio of capital balances. a.$75,000 and $75,000 b.$37,500 and $112,500 c.$100,000 and $50,000 d.$50,000 and $100,000 Douglas pays Selena $42,600 for her 27% interest in a partnership with net assets of $126,700. Following this transaction, Douglas's capital account should have a credit balance of a.$126,700 b.$11,502 c.$42,600 d.$34,209arrow_forwardGreg and Harriet are partners in GH partnership. Greg originally contributed $50,000 while Harriet contributed $150,000. Greg works full-time while Harriet works part-time. During the year, GH Partnership earned $120,000 in net income. Determine how much of this $120,000 would be allocated to each partner under each of the following profit/loss sharing agreements. a. There is no agreement. Greg Harriet b. In the ratio of original capital investments. Greg Harriet c. In the ratio of time devoted to the business. Greg Harriet d. 10% of original capital investments and the remainder equally. Greg Harriet e. 10% of original capital investments, a salary allowance of $30,000 for Greg, and the remainder equally. Greg Harrietarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you