FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

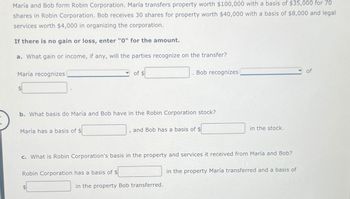

Transcribed Image Text:María and Bob form Robin Corporation. María transfers property worth $100,000 with a basis of $35,000 for 70

shares in Robin Corporation. Bob receives 30 shares for property worth $40,000 with a basis of $8,000 and legal

services worth $4,000 in organizing the corporation.

If there is no gain or loss, enter "0" for the amount.

a. What gain or income, if any, will the parties recognize on the transfer?

María recognizes

María has a basis of $

b. What basis do María and Bob have in the Robin Corporation stock?

of $

1

Robin Corporation has a basis of $

Bob recognizes

and Bob has a basis of $

c. What is Robin Corporation's basis in the property and services it received from María and Bob?

in the property Bob transferred.

in the stock.

in the property María transferred and a basis of

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 54. What are the 4 business structures when filing tax returns: A) Schedule C, Partnership form 1065, S Corporation 1120 s, Corporation 1120 B) Schedule K-1, 1040 Individual tax returns, Corporation 1120 C) 1065, K-1, 1120 and Schedule E 55. When can partnership/S corporation income can be used. Choose best answer : A) Rental income and loss shows profit B) Borrower has accessed the income via cash distributions C) Positive income trendsarrow_forwardDescribe the three hurdles partner John must pass if he wants to deduct a loss from his share in an S corporation. What other loss limitation rule may impact the deductibility of losses from an S corporation?arrow_forwardAll of the following are self-employment income except A) net income of a sole proprietorship. B) dividends received by a corporate shareholder. C) fees received for serving as a director of a corporation. D) distributive share of partnership income from a partnership operating a business.arrow_forward

- A26.arrow_forwardIf a family company was established with both Robbie and Dawnnie each owning the same number of shares, would any dividends paid to the couple be franked or unfranked? Explain. On the basis that Robbie will still receive a salary and does not require any further income, could a dividend be paid only to Dawnnie but not to Robbie?arrow_forwardA-1arrow_forward

- which of the following is not a "relative" under the constructive ownership rules? A. 60 percent owned corporation. B. A sister. C. A partnership in which the taxpayer owns 20 percent. D. A trust of which taxpayer is the sole beneficiary. E. All of the Above are considered Relatives.arrow_forwardDoes James have income, gain or loss on the transaction in which he receives stock in TOBY, INC.? Indicate the amount of any income, gain, or loss. What is James’s basis in TOBY, INC. stock? Does Jenna have income, gain, or loss on the transaction in which she receives stock in TOBY, INC.? Indicate the amount of any income, gain, or loss.arrow_forwardRobert and Charles are trying to decide what form of business to form for their new company. They ask you the following question: Which of the following transactions would be considered by the IRS to be a taxable sale of assets? Changing the form of business from: a partnership to an LLC. a corporation to an LLC. All of the above. an LLC to a corporation.arrow_forward

- Discuss planning opportunities with organizing a corporation. Instructions Original Post Prompt: Sarah incorporates her small business but does not transfer the machinery and equipment the business uses to the corporation. Subsequently, the machinery and equipment are leased to the corporation for an annual rent. What tax reasons might Sarah have for not transferring the machinery and equipment to the corporation when the business was incorporated?arrow_forwardIn order to be eligible to exclude gain on the sale of a principal residence, the taxpayer must meet which of the following tests? ○ Ownership test ○ Use test and ownership test Business use test ○ Use testarrow_forwardHi can someone help me with this please?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education