Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Stock Valuation. Why does the value of a share of stock depend on dividends? Based on the dividend growth model, what are the two components of the total return on a share of stock? A substantial percentage of the companies listed on the NYSE and the NASDAQ don’t pay dividends, but investors are nonetheless willing to buy shares in them. If the value of a share of stock depends on dividends, how is this possible?

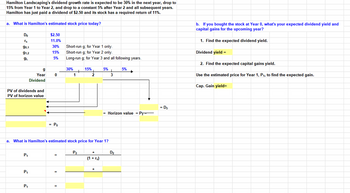

Transcribed Image Text:Hamilton Landscaping's dividend growth rate is expected to be 30% in the next year, drop to

15% from Year 1 to Year 2, and drop to a constant 5% after Year 2 and all subsequent years.

Hamilton has just paid a dividend of $2.50 and its stock has a required return of 11%.

a. What is Hamilton's estimated stock price today?

Do

Ts

90,1

91,2

gL

PV of dividends and

PV of horizon value

P₁

g

Year

Dividend

P₁

P₁

$2.50

11.0%

30%

Short-run g; for Year 1 only.

15% Short-run g; for Year 2 only.

5%

0

= Po

=

Long-run g; for Year 3 and all following years.

=

30%

1

a. What is Hamilton's estimated stock price for Year 1?

15%

P₂

+

(1 + rs)

5%

+

=

3

5%

Horizon value = P₂

D₂

+

= D3

b. If you bought the stock at Year 0, what's your expected dividend yield and

capital gains for the upcoming year?

1. Find the expected dividend yield.

Dividend yield =

2. Find the expected capital gains yield.

Use the estimated price for Year 1, P₁, to find the expected gain.

Cap. Gain yield=

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Similar questions

- АВС XYZ Discount rate (r) Historical growth rate of 0.015+2*0.085=0.185 0.015+1.5*0.085=0.142 (58/30)^(1/30)-1=0.022 Not available. Cannot dividends compute without dividends Sustainable growth rate Fundamental value using dividend growth model with the historical growth rate Fundamental value using the 467*(1+0.185)/(0.185-0.045) dividend growth model with =3953 the sustainable growth rate Fundamental value using residual income growth 0.15*(1-0.7)=0.045 467*(1+0.185)/(0.185-0.022) 0.2*(1-0)=0.2 Not available. Cannot =3395 compute without dividends Not available. Cannot compute without dividends 80*(1+0.022)-(550*0.022)/(0. 185-0.022)=427.36 Not available. Cannot compute without dividends model with the historical growth rate Fundamental value using the 80*(1+0.045)-(550*0.045)/(0. residual income growth 12*(1+0.2)-(100*0.2)/(0.142- 0.2)=96.5 185-0.045)=420.35 model with the sustainable growth ratearrow_forwardWhen a company participates in a stock buyback program, it means that the company is buying shares of its own stock and taking them off the market. With this simple definition in mind, how would a company's stock buyback program affect its Earnings per Share?arrow_forwardDiscuss the Modigliani and Miller theory. What did Modigliani and Miller assume about taxes and brokerage costs when they developed their dividend irrelevance theory? Discuss the bird - in - hand theory of dividends. How did the bird - in - hand theory get its name? What have been the results of the empirical tests of the dividend theories?arrow_forward

- Ultimately what determines the value of a share of common stock? Which would be more appropriate for evaluating your company's stock price, a constant or non-constant growth model, and why?arrow_forwardAccording to the Gordon dividend model, which of the following variables would not affect a stock's price? the firm's expected growth rate in dividends the number of shares outstanding the shareholder's required return next year's expected dividendarrow_forwardAnswer this question based on the dividend growth model. If you expect the required rate of return to increase across the board on all equity securities, then you should also expect: A decrease in all stock values. All stock values to remain constant. An increase in all stock values. An increase or a decrease in all stock values. None of the above.arrow_forward

- Question: I have a question about the stock market. I've never understood and always puzzled about something extremely basic and fundamental about how the stock market works. According to my understanding, a firm issues a certain number of shares, and the value of those shares is determined by supply and demand. However, it appears that I, and anybody else, can purchase or sell any number of shares at the present stock price at any time. So, what is the mechanism that influences the price of a stock? If I check at the stock price of business X and find that it is selling for $100 a share, I, like anyone else, can pick whether to buy one share for $100 or one million shares for $100. So, what causes the stock price of firm X to rise or fall to $100.01 per share or $99.99 per share? The stock price does not appear to move up unless all available shares have been purchased, nor does it appear to move down unless there are persons prepared to sell shares for less than the market asking…arrow_forwardFlexsteel is giving out a large stock dividend. This would: A. Results in a transfer of retained earnings to the common stock account B. Reduces the par value per share by the percentage of the additional shares issued. C. Is accounted for in exactly the same manner as a stock split D. Results in a transfer of retained earnings to common stock and additional paid in capitalarrow_forwardWhich of the following is not a typical question that must be answered with regard to a private company that is owned by a large number of shareholders? Question 46 options: How and when does the company get money from the sale of its stock? What rate of return does the company promise to pay when it sells stock? What is the dividend yield on preferred shares of companies that hold this stock? Who makes decisions in a company owned by a large number of shareholders?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education