FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please answer in good accounting form. Thankyou

7. Compute for the taxable income

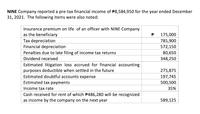

Transcribed Image Text:NINE Company reported a pre-tax financial income of P8,584,950 for the year ended December

31, 2021. The following items were also noted:

Insurance premium on life of an officer with NINE Company

as the beneficiary

Tax depreciation

Financial depreciation

175,000

785,900

572,150

Penalties due to late filing of income tax returns

80,650

Dividend received

348,250

Estimated litigation loss accrued for financial accounting

purposes deductible when settled in the future

Estimated doubtful accounts expense

275,875

197,745

Estimated tax payments

Income tax rate

Cash received for rent of which P486,280 will be recognized

as income by the company on the next year

500,500

35%

589,125

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following items IS included in gross income? O Municipal bond interest O Unemployment compensation received Scholarship for tuition and books O Inherited propertyarrow_forwardTrue or false: Income tax expense may be disclosed either on the income statement or in the notes to the financial statements.arrow_forwardSanan. If a servicemember receives reimbursement for moving expenses, how much will the amount be reported to them? Using Form DD 214. On a separate Form W-2 with code P in box 12. The amount is not reported as it is not taxable income. Using Form DD 2058.arrow_forward

- 4. Deductible education expenses include all of the following except: A. Tuition. B. Books. C. Travel. D. Room and board.arrow_forwardWhich of the following are deducted from gross taxable income todetermine net taxable income? a - Severance payments b - Registered Retirement Savings Plan contributions c - Health carepremiums d - Charitable donationsarrow_forwardIn T1 General Tax Form, Total Income is reported on Line??arrow_forward

- Question 6: Which of the following is not a voluntary deduction from gross earnings? Answer: A. O Union dues B. O State disability insurance C. O Payroll deduction IRA D. Cafeteria planarrow_forward1.Explain the intake process to completing a tax return. using the form 13614-c, w2's, form 1099-R, Form SSA-1099, form 1099-c, Form W-2G, Form 1098-T Just explain for to process this thing all together.arrow_forwardPersonal expenses are deductions: a. for AGI b. always deductible. c. Deductions from AGI d. non of the above.arrow_forward

- Which of the following statements are correct? i. A VAT invoice should be pre-numbered and must show the: - Words “Tax Invoice” (shown prominently) ii. A VAT invoice should display the total amount of the consideration and the VAT. iii. A VAT invoice should display the name and address of the registered taxpayer to whom the taxable supply is made. iv. A VAT invoice should display the date of the taxable supply. a. All of the above b. i, ii and iv c. i only d. i, and iiiarrow_forwardHow to calcuate the taxes on the income statement under operating expense. Please provide an example. Using numbers from an income statement.arrow_forwardA22arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education