FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

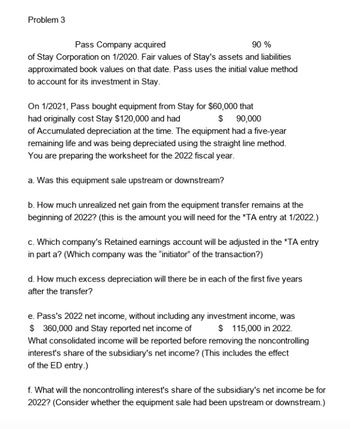

Transcribed Image Text:Problem 3

Pass Company acquired

90 %

of Stay Corporation on 1/2020. Fair values of Stay's assets and liabilities

approximated book values on that date. Pass uses the initial value method

to account for its investment in Stay.

On 1/2021, Pass bought equipment from Stay for $60,000 that

had originally cost Stay $120,000 and had

$ 90,000

of Accumulated depreciation at the time. The equipment had a five-year

remaining life and was being depreciated using the straight line method.

You are preparing the worksheet for the 2022 fiscal year.

a. Was this equipment sale upstream or downstream?

b. How much unrealized net gain from the equipment transfer remains at the

beginning of 2022? (this is the amount you will need for the *TA entry at 1/2022.)

c. Which company's Retained earnings account will be adjusted in the *TA entry

in part a? (Which company was the "initiator" of the transaction?)

d. How much excess depreciation will there be in each of the first five years

after the transfer?

e. Pass's 2022 net income, without including any investment income, was

$360,000 and Stay reported net income of $ 115,000 in 2022

What consolidated income will be reported before removing the noncontrolling

interest's share of the subsidiary's net income? (This includes the effect

of the ED entry.)

f. What will the noncontrolling interest's share of the subsidiary's net income be for

2022? (Consider whether the equipment sale had been upstream or downstream.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question 4: Following balances have been extracted from the ledger of Titan Plc at 31 December 2020 Dr Cr. 3. Land and Building (Note 1) Valuation (1/1/2020) Accumulated depreciation (1/1/2020) Plant and equipment (Note 1) Valuation (1/1/2020) Accumulated depreciation at (1/1/2020): Revaluation surplus (31/12/2020) (Note 1) Retained earnings (31/12/2020) 500,000 80,000 175,000 70,000 209,000 256,450 Note 1 Titan Plc measures its PPE under the revaluation model. On 1 January 2020, the company's land and buildings were valued at £450,000 (Land value £100,000) and its plant and equipment were at £85,000. The valuation has not been reflected in the balances above. On 1 January 2020, the remaining useful lives of the buildings and plant and equipment were reassessed at 20 years and four years respectively. There were no unrecorded acquisitions to or disposals of PPE in the year ended 31 December 2020. The revaluation surplus at 31 December 2020, included £200,000 in respect of land and…arrow_forwardWhat is the adjusting journal entry on December 31, 2019? Debit Unrealized Holding Gain/Loss (P&L), P200,000; Credit Retained Earnings, P200,000 Debit Financial Asset FVPL, P500,000; Credit Retained Earnings, P500,000 Debit Retained Earnings, P100,000; Credit Financial Asset FVPL, P100,000 Debit Retained Earnings, P300,000; Credit Unrealized Gain (P&L), P300,000 Debit Retained Earnings, P200,000; Credit Unrealized Holding Gain/Loss (P&L), P200,000 None of the choicesarrow_forwardView previous attempt On December 31, 2019, Akron, Inc., purchased 5 percent of Zip Company's common shares on the open market in exchange for $16,200. On December 31, 2020, Akron, Inc., acquires an additional 25 percent of Zip Company's outstanding common stock for $96,750. During the next two years, the following information is available for Zip Company: Common Stock Fair Value 2019 2020 2021 Income Dividends Declared $69,000 $7,100 89,000 14,700 (12/31) $324,000 387,000 477,000 Check my work At December 31, 2020, Zip reports a net book value of $289,000. Akron attributed any excess of its 30 percent share of Zip's fair over book value to its share of Zip's franchise agreements. The franchise agreements had a remaining life of 10 years at December 31, 2020, a. Assume Akron applies the equity method to its Investment in Zip account 1. What amount of equity income should Akron report for 2021? 2. On Akron's December 31, 2021, balance sheet, what amount is reported for the Investment in…arrow_forward

- Need assistance with (a) (4) through (7)arrow_forwardQUESTION 3 REQUIRED Use the information given below to prepare the Statement of Comprehensive Income of Micron Limited for the year ended 28 February 2022. INFORMATION The following information was provided by Micron Limited for the financial year ended 28 February 2022: MICRON LIMITED PRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2022 Balance sheet accounts section Ordinary share capital Retained earnings Land and buildings at cost Equipment at cost Vehicles at cost Accumulated depreciation on equipment Accumulated depreciation on vehicles Trading inventory Debtors control Provision for bad debts Bank overdraft Creditors control Loan: Hip Bank (18 % p.a.) South African Revenue Services: Company tax Nominal accounts section Sales Cost of sales Sales returns Advertising Stationery Bad debts Discount allowed Discount received Electricity and water Telephone Interest on overdraft Directors' fees Audit fees Insurance Salaries Bank charges Rent income Municipal rates Debit (R) 4 800 000 2…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education