Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

1- Please solve this question with all steps required. Many thanks.

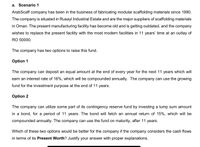

Transcribed Image Text:a. Scenario 1

ArabScaff company has been in the business of fabricating modular scaffolding materials since 1990.

The company is situated in Rusayl Industrial Estate and are the major suppliers of scaffolding materials

in Oman. The present manufacturing facility has become old and is getting outdated, and the company

wishes to replace the present facility with the most modern facilities in 11 years' time at an outlay of

RO 50000.

The company has two options to raise this fund.

Option 1

The company can deposit an equal amount at the end of every year for the next 11 years which will

earn an interest rate of 16%, which will be compounded annually. The company can use the growing

fund for the investment purpose at the end of 11 years.

Option 2

The company can utilize some part of its contingency reserve fund by investing a lump sum amount

in a bond, for a period of 11 years. The bond will fetch an annual return of 15%, which will be

compounded annually. The company can use the fund on maturity, after 11 years.

Which of these two options would be better for the company if the company considers the cash flows

in terms of its Present Worth? Justify your answer with proper explanations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please show and explain all steps to solve this problem.arrow_forwardIn a thoughtful and well-written response, answer the following: If you were thinking about writing a Letter of Last Instruction, what are some specific provisions you might put into the document?arrow_forwardGoodwill messages craft special messages that foster goodwill and convey kindness. One page answerarrow_forward

- 4. Explain Ted's strategy to justify his request and include a list of items Ted might ask for?arrow_forwardCan someone please show me how to do this?arrow_forwardHi, thanks for your help. PLease how to obtain YTM without excel and mathematical calculator. i really need to know how to obtain YTM manually to understand the question. Many thanksarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education