FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

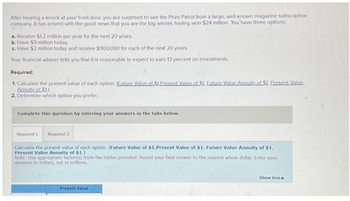

Transcribed Image Text:After hearing a knock at your front door, you are surprised to see the Prize Patrol from a large, well-known magazine subscription

company. It has arrived with the good news that you are the big winner, having won $24 million. You have three options:

a. Receive $1.2 million per year for the next 20 years.

b. Have $9 million today.

c. Have $3 million today and receive $900,000 for each of the next 20 years.

Your financial adviser tells you that it is reasonable to expect to earn 13 percent on investments.

Required:

1. Calculate the present value of each option. (Euture Value of $1.Present Value of $1. Euture Value Annuity of $1. Present Value

Annuity of $1.)

2. Determine which option you prefer.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Calculate the present value of each option. (Future Value of $1,Present Value of $1, Future Value Annuity of $1,

Present Value Annuity of $1.)

Note: Use appropriate factor(s) from the tables provided. Round your final answer to the nearest whole dollar, Enter your

answers in dollars, not in millions.

Present Value

Show less A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Similar questions

- Ralph has an investment worth $264,289.32. The investment will make a special payment of X to Ralph in 2 years from today. The investment also will make regular, fixed annual payments of $67,000.00 to Ralph with the first of these payments made to Ralph in 1 year from today and the last of these annual payments made to Ralph in 5 years from today. The expected return for the investment is 11 percent per year. What is X, the amount of the special payment that will be made to Ralph in 2 years? O $16,664.22 (plus or minus 10 dollars) O $20,531.99 (plus or minus 10 dollars) O $12,184.74 (plus or minus 10 dollars) O $74,370.00 (plus or minus 10 dollars) O none of the answers are within 10 dollars of the correct answerarrow_forward6. An investor is considering an investment that will pay $2,150 at the end of each year for the next 10 years. He expects to earn an annual return of 18 percent on his investment. How much should he pay today for the investment? How much should he pay if the investment returns are paid at the beginning of each year?arrow_forwardYou are considering a 10 year investment plan in which your target is $150,000. There are two options available for you: Option 1: Putting exactly an equal amount of money into an investment fund at the end of each year for 10 years with the rate of return of 8%, annually compounding. Option 2: Putting your initial investment of $50,000 in an asset that will pay you 9% rate of return, compounding quarterly for the first 6 years. The rate of return, compounding annually for the last 4 years (the period from year 7 to the end of year 10) has not been defined yet. Required: Compute the effective annual interest rate (EAR) in the first 6 years in Option 2? Compute the annually compounding rate of return you should target for your asset in the following 4 years to get $150, 000 at the end of year ten in Option 2?arrow_forward

- Joe Pierce has been offered the opportunity of investing $178,556.90 now. The investment will earn 8% per year and at the end of its life will return $500,000 to Joe. How many years must Joe wait to receive the $500,000?arrow_forwardYou are going to retire in 40 years and currently have $100,000. What average annual return would you have to earn on your investment to have $1 million by the time you retire?arrow_forwardTanya is considering an investment that will require an initial payment of 400,000 and additional payments of 100,000 and 50,000 at the end of years one and two, respectively. It is expected that revenue from this investment will be 150,000 per year for five years, beginning one year from the initial investment.Assuming an annual effective rate of 10%, calculate the net present value of this investment.arrow_forward

- JAX, Inc. has been offered the opportunity of investing $128,729 now. The investment will earn 8% per year and at the end of its life will return $600,000 to JAX.. How many years must JAX wait to receive the $600,000?arrow_forwardBill is considering investing $450 at the end of each month in a fixed incone instrument. He will receive $27,000 at the end of four years. If interest is compounded monthly, what is the effective annual rate of return on the investment. A. 22.3% B. 15.1 % C. 11.6 % D. 11.1 % E. 13.6 %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education