FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Ming Chen began a professional practice on June 1 and plans to prepare financial statements at the end of each month. During June, Ming Chen (the owner) completed these transactions.

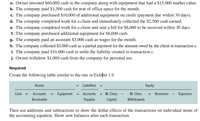

Transcribed Image Text:a. Owner invested $60,000 cash in the company along with equipment that had a $15,000 market value.

b. The company paid $1,500 cash for rent of office space for the month.

c. The company purchased $10,000 of additional equipment on credit (payment due within 30 days).

d. The company completed work for a client and immediately collected the $2,500 cash earned.

e. The company completed work for a client and sent a bill for $8,000 to be received within 30 days.

f. The company purchased additional equipment for $6,000 cash.

g. The company paid an assistant $3,000 cash as wages for the month.

h. The company collected $5,000 cash as a partial payment for the amount owed by the client in transaction e.

i. The company paid $10,000 cash to settle the liability created in transaction c.

j. Owner withdrew $1,000 cash from the company for personal use.

Required

Create the following table similar to the one in Exhibit 1.9.

Assets

Liabilities +

Equity

Cash + Accounts + Equipment = Accounts + M. Chen, -

Capital

M. Chen, + Revenues

Expenses

Receivable

Payable

Withdrawals

Then use additions and subtractions to show the dollar effects of the transactions on individual items of

the accounting equation. Show new balances after each transaction.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Latan is an employee of Giant Computers where the job responsibilities include selling computers and software to customers. Latan is married filing jointly with two dependents under 17. The annual salary is $49,200 and receives a 3 percent commission on all sales. During the semimonthly pay period ending September 30, Latan sold $21,200 of computers and software. Required: Complete the payroll register for the September 30 pay period with a pay date of October 5. P/R End Date: Check Date: Latan Totals Name 9/30/2022 10/5/2022 Filing Status Dependents Hourly Rate or Period Wage Company Name: Number of Regular Hours Number of Overtime Hours Giant Computers Commissions $ 0 Regular Earnings $ 0 Overtime Earnings Gross Earnings $arrow_forwardDennis receives $11,100 during the current tax year from Blanca for some office space in Anaheim, California. The rent covers eight months, from August 1 of the current year to March 31 of the following year. The amount also includes a security deposit of $1,500. How much should Dennis report as rental income in the current tax year? a. $1,200. b. $6,000. c. $9,600. d. $11,100.arrow_forwardCan I do a general journal entry on this scenario, if so how do i do it? Master Flow’s first employee, Emma Stone starts at the Company. She will be responsible for Warehouse Management. She will be paid $20 / Hour. Emma works 30 Hours / Pay Period (every two weeks). The pay period ends on 12-31-20. Emma’s Federal Tax Withholding is $50, based on her W4, and all other standard payroll taxes apply at their appropriate rates. She does not receive benefits and does not have any contributions of any type withheld from her pay.arrow_forward

- On March 8, Manuel borrowed $720.00 from his uncle at 4.3% per annum calculated on the daily balance. He gave his uncle six cheques for $110.00 dated the 8th of each of the next six months starting April 8 and a cheque dated October 8 for the remaining balance to cover payment of interest and repayment of principal. Construct a complete repayment schedule for the loan including totals for Amount Paid, Interest Paid, and Principal Repaid. Complete the repayment schedule below. (Round to the nearest cent as needed.) Balance Before Payment Amount Paid Balance After Payment Payment Number O Mar. 8 Interest Paid Principal Repaid $720.00 1 Apr. 8 $720.00 $110.00 2 May 8 $110.00 3 June 8 $110.00 4 July 8 $110.00 5 Aug. 8 $110.00 6 Sept. 8 $110.00 7 Oct. 8 $0.00 Totals:arrow_forwardThrough November, Cameron has received gross income of $120,000. For December, Cameron is considering whether to accept one more work engagement for the year. Engagement 1 will generate $7,000 of revenue at a cost to Cameron of $3,000, which is deductible for AGI. In contrast, engagement 2 will generate $5,000 of qualified business income (QBI), which is eligible for the 20 percent QBI deduction. Cameron files as a single taxpayer. Calculate Cameron's taxable income assuming he chooses engagement 1 and assuming he chooses engagement 2. Assume he has no itemized deductions. Description Engagement 1 Engagement 2 (1) Gross income before new work engagement $ 120,000 $ 120,000 (2) Income from engagement 7,000 5,000 (3) Additional for AGI deduction (3,000) (4) Adjusted gross income $ 124,000 $ 125,000 (5) Greater of itemized deductions or standard deduction (6) Deduction for QBI (1,000) Taxable incomearrow_forwardThrough November, Cameron has received gross income of $120,000. For December, Cameron is considering whether to accept one more work engagement for the year. Engagement 1 will generate $7,000 of revenue at a cost to Cameron of $3,000, which is deductible for AGI. In contrast, engagement 2 will generate $5,000 of qualified business income (QBI), which is eligible for the 20 percent QBI deduction. Cameron files as a single taxpayer, and he did not contribute to charity during the year. Calculate Cameron's taxable income assuming he chooses engagement 1 and assuming he chooses engagement 2. Assume he has no itemized deductions.arrow_forward

- Subject: acountingarrow_forwardThrough November, Cameron has received gross income of $131,000. For December, Cameron is considering whether to accept one more work engagement for the year. Engagement 1 will generate $9,860 of revenue at a cost to Cameron of $4,100, which is deductible for AGI. In contrast, engagement 2 will generate $7,200 of qualified business income (QBI), which is eligible for the 20 percent QBI deduction. Cameron files as a single taxpayer. Calculate Cameron's taxable income assuming he chooses engagement 1 and assuming he chooses engagement 2. Assume he has no itemized deductions. Description (1) Gross income before new work engagement (2) Income from engagement (3) Additional for AGI deduction (4) Adjusted gross income (6) Deduction for QBI Taxable income Engagement 1 Engagement 2arrow_forwardAudrey Martin and Beth James are partners in the Country Gift Shop, which employs the individuals listed below. Paychecks are distributed every Friday to all employees. Based on the information given, compute the amounts listed below for a weekly payroll period. Name and Position Zena Vertin, Office Nicole Norge, Sales Bob Mert, Delivery Audrey Martin, Partner Beth James, Partner Employer's QASDI Tax Employer's Hi Tax S Salary $ 700 per week 2,980 per month 650 per week 950 per week 950 per week Totals 5 OASDI Taxable Earnings OASDI Tax HI Taxable Earnings HI Taxarrow_forward

- Iman purchased an electric lawn mower, an edger, and an extension cord from her neighborhood yard and garden store. Immediately thereafter, the store emailed her a bill for these items. The bill stated that payment was due within 30 days. The bill is called a(n): Multiple Choice ledger statement. warranty. indenture. receipt. invoice.arrow_forwardIn 20--, the annual salaries paid to each of the officers of Perez, Inc., follow. The officers are paid semimonthly on the 15th and the last day of the month. Compute the FICA taxes to be withheld from each officer's pay on (a) November 15 and (b) December 31. If an amount is zero, enter "0". Enter all earnings and taxes to two decimal places. a. Name and Title Perez, Paul, President Donald, Donna, VP Finance Funke, Jack, VP Sales Weis, Al, VP Mfg. Lang, Hope, VP Personnel Lee, Amy, VP Secretary b. Name and Title Perez, Paul, President Donald, Donna, VP Finance Funke, Jack, VP Sales Weis, Al, VP Mfg. Annual Salary $186,000 162,000 76,800 92,400 78,000 52,800 Annual Salary $186,000 162,000 76,800 92,400 OASDI Taxable Earnings $ 17,300 X OASDI Taxable Earnings $ $ November 15 OASDI Tax $ OASDI Tax $ $ December 31 HI Taxable Earnings HI Taxable Earnings $ HI Tax HI Taxarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education