FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:82

More info

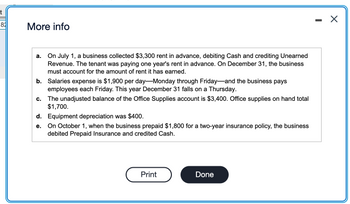

a. On July 1, a business collected $3,300 rent in advance, debiting Cash and crediting Unearned

Revenue. The tenant was paying one year's rent in advance. On December 31, the business

must account for the amount of rent it has earned.

b. Salaries expense is $1,900 per day-Monday through Friday and the business pays

employees each Friday. This year December 31 falls on a Thursday.

C. The unadjusted balance of the Office Supplies account is $3,400. Office supplies on hand total

$1,700.

d. Equipment depreciation was $400.

e.

On October 1, when the business prepaid $1,800 for a two-year insurance policy, the business

debited Prepaid Insurance and credited Cash.

Print

Done

X

Transcribed Image Text:a. On July 1, a business collected $3,300 rent in advance, debiting Cash and crediting Unearned Revenue. The tenant was paying one year's rent in advance. At December 31, the business must account for the amount of rent it has earned.

Date

Accounts and Explanation

Debit

Credit

(a) Dec. 31

Unearned Revenue

Rent Revenue

To accrue rent revenue.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hardevarrow_forwardAllowance Method versus Direct Write-Off Method On March 10, May, Inc., declared a $2,500 account receivable from Anders Company as uncollectible and wrote off the account. On November 18, May received a $800 payment on the account from Anders. Assume that May uses the allowance method of handling credit losses. Prepare the journal entries to record the write-off and the subsequent recovery of Anders’s account. Assume that May uses the direct write-off method of handling credit losses. Prepare the journal entries to record the write-off and the subsequent recovery of Anders’s account. Assume that the payment from Anders arrives on the following February 5, rather than on November 18 of the current year. (1) Prepare the journal entries to record the write-off and subsequent recovery of Anders’s account under the allowance method. (2) Prepare the journal entries to record the write-off and subsequent recovery of Anders’s account under the direct write-off method. a. General…arrow_forwardApplying the matching principle Suppose on January 1, Andrew’s Tavern prepaid rent of $16,800 for the full year. On November 30, how much rent expense should be recorded for the period January 1 through November 30?arrow_forward

- Journal entry worksheet The Krug Company collected $16,200 rent in advance on November 1, debiting Cash and crediting Unearned Rent Revenue. The tenant was paying 12 months’ rent in advance and occupancy began November 1. Note: Enter debits before credits. Transaction General Journal Debit Credit a.arrow_forwardEmployee advances Amounts owed by customers for the sale of services (due in 30 days) Refundable income taxes Interest receivable Accepted a formal instrument of credit for services (due in 18 months) A loan to company president Dishonored a note for principal and interest which will eventually be collected $1,580 3,050 1,120 950 2,220 8,000 1,380 Based on this information, what amount should appear in the "Other Receivables" category? a. $18,300 b. $11,650 C. $13,030 d. $15,250arrow_forwardBrian Burns uses perpetual inventory system and LIFO All credit sales discounts are recorded using the net method – customers receive a 3 percent discount if they pay within 30 days. Purchase discounts are recorded using the net method All depreciation is straight line. Additional Information for Journal Entries Brian Burns records accruals for utilities expense as an adjusting journal entry at the end of each year. They pay utilities once a year on January 31st for the prior year. NOTE: There is no payment for utilities on January 31st of 2022 because January 1 of 2022 is the first day of operations. January 1 Sold 10,000 shares of common stock for $95 per share. Borrowed $2,000,000 at 8 percent with interest payable semi-annually (on July 1 and January 1). Purchased 1,000 units of inventory at $150 a piece on credit from Biggie Smalls Inc. Terms are 2/10; n/60 Paid $480,000 for 2 years of rent in advance…arrow_forward

- Accrued Vacation Pay A business provides its employees with varying amounts of vacation per year, depending on the length of employment. The estimated amount of the current year’s vacation pay is $77,400. Journalize the adjusting entry required on January 31, the end of the first month of the current year, to record the accrued vacation pay. If an amount box does not require an entry, leave it blank. fill in the blank db942400303a02e_2 fill in the blank db942400303a02e_3 fill in the blank db942400303a02e_5 fill in the blank db942400303a02e_6 b. How is the vacation pay reported on the company's balance sheet? When is this amount removed from the company's balance sheet?arrow_forwardComplete the following: (Use Table 7.1) Invoice Date goods are received Terms Last day of discount period Final day bill is due (end of credit period) June 18 1/10, n/30arrow_forwardBrian Burns uses perpetual inventory system and LIFO All credit sales discounts are recorded using the net method – customers receive a 3 percent discount if they pay within 30 days. Purchase discounts are recorded using the net method All depreciation is straight line. Additional Information for Journal Entries Brian Burns records accruals for utilities expense as an adjusting journal entry at the end of each year. They pay utilities once a year on January 31st for the prior year. NOTE: There is no payment for utilities on January 31st of 2022 because January 1 of 2022 is the first day of operations. January 1 Sold 10,000 shares of common stock for $95 per share. Borrowed $2,000,000 at 8 percent with interest payable semi-annually (on July 1 and January 1). Purchased 1,000 units of inventory at $150 a piece on credit from Biggie Smalls Inc. Terms are 2/10; n/60 Paid $480,000 for 2 years of rent in advance…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education