FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

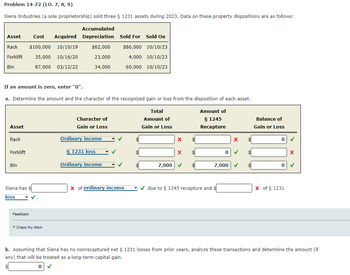

Transcribed Image Text:Problem 14-72 (LO. 7, 8, 9)

Siena Industries (a sole proprietorship) sold three § 1231 assets during 2023. Data on these property dispositions are as follows:

Accumulated

Cost Acquired Depreciation Sold For Sold On

Rack $100,000 10/10/19 $62,000 $86,000 10/10/23

Forklift

35,000 10/16/20

23,000

4,000 10/10/23

Bin

87,000

03/12/22

34,000

60,000 10/10/23

Asset

If an amount is zero, enter "0".

a. Determine the amount and the character of the recognized gain or loss from the disposition of each asset.

Total

Amount of

Amount of

§ 1245

Recapture

Gain or Loss

Asset

Rack

Forklift

Bin

Siena has

loss

Feedback

►Check My Work

Character of

Gain or Loss

Ordinary income

§ 1231 loss

Ordinary income

X of ordinary income

7,000

X

X

due to § 1245 recapture and

X

0 ✓

7,000

Balance of

Gain or Loss

0

0

X of § 1231

X

b. Assuming that Siena has no nonrecaptured net § 1231 losses from prior years, analyze these transactions and determine the amount (if

any) that will be treated as a long-term capital gain.

0 ✓

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Fair value as a method of asset measurement is defined as: Multiple Choice O O the cost of an asset adjusted for the depreciation or amortization accumulated over its lifetime. price that would be received to sell assets in an orderly transaction between market participants on a given date. the net amount of cash into which an asset could be converted in the ordinary course of business. the value of what is given in exchange for the asset at its initial acquisition.arrow_forwardA fixed asset with a cost of $27,381 and accumulated depreciation of $24,642.90 is sold for $4,654.77. What is the amount of the gain or loss on disposal of the fixed asset? a.$1,916.67 loss b.$2,738.10 gain c.$1,916.67 gain d.$2,738.10 lossarrow_forwardCapital expenditures incurred subsequent to purchase of property assets increase total assets. T/Farrow_forward

- Gains and Losses results from realization events such as: a. sales, purchases, exchanges, or other disposition of property. b. sales, exchanges, or other disposition of property. c. Disposition , sales and donations. d. all of the above.arrow_forward_______ 9. Which of the following constitute property for purposes of §351 Money Debt of Transferee evidenced by a security Debt of Transferee NOT evidenced by a security Interest accrued on b & c after the Transferor acquired the debt Only A Only A & B Only A, B, & d All of the abovearrow_forwardE4arrow_forward

- A fixed asset with a cost of $30,192 and accumulated depreciation of $27,172.80 is sold for $5,132.64. What is the amount of the gain or loss on disposal of the fixed asset? a.$2,113.44 loss b.$3,019.20 gain c.$3,019.20 loss d.$2,113.44 gainarrow_forwardWhich one of the following statements regarding the book value of an asset is correct? Multiple Choice О It reflects the original cost of the asset less accumulated depreciation. O It is the original cost at which the asset was purchased. It is the original cost of the asset minus the depreciation expense for that asset during the year. O It is the fair value of the asset if the asset is sold.arrow_forwardNonearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education