MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

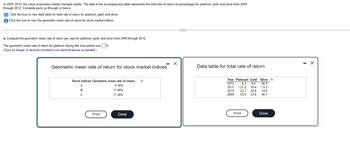

Transcribed Image Text:In 2009-2012, the value of precious metals changed rapidly. The data in the accompanying table represents the total rate of return (in percentage) for platinum, gold, and silver from 2009

through 2012. Complete parts (a) through (c) below.

Click the icon to view data table for total rate of return for platinum, gold, and silver.

Click the icon to view the geometric mean rate of return for stock market indices.

a. Compute the geometric mean rate of return per year for platinum, gold, and silver from 2009 through 2012.

The geometric mean rate of return for platinum during this time period was %.

(Type an integer or decimal rounded to two decimal places as needed.)

Geometric mean rate of return for stock market indices

Stock indices Geometric mean rate of return

9.38%

11.89%

17.36%

A

B

C

Print

Done

D

Data table for total rate of return

56.8

Year Platinum Gold Silver

2012 6.4 0.6

2011 - 21.2 10.4 -9.3

2010 22.1 29.8 14.4

2009

53.5 23.8 46.7

Print

Done

- X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 10 images

Knowledge Booster

Similar questions

- Sears Holdings Corporation (SHLD) is one of the largest mall-based retailers in the United States. The following year-end data were taken from a recent Sears balance sheet (in millions): December 31 Year 2 Year 1 Current assets $6,045 $5,863 Current liabilities 5,438 5,595 a. Compute the working capital and the current ratio as of December 31, Year 1 and Year 2. (Round your answers to two decimal places.) Year 2 Year 1 Working capital $ fill in the blank 1 $ fill in the blank 2 Current Ratio fill in the blank 3 fill in the blank 4 b. If a company has a current ratio less than 1 and a working capital decline, what does it indicate?arrow_forwardThe following data are taken from recent financial statements of Nike, Inc. (NKE) (in millions): Year 2 Year 1 Revenues (sales) $32,376 $30,601 Operating income 4,502 4,175 a. Determine the amount of change (in millions) and percent of change in operating income from Year 1 to Year 2. Round to one decimal place. Operating income $fill in the blank 1 fill in the blank 2% b. Determine the percentage relationship between operating income and sales for Year 2 and Year 1. Round to one decimal place. Year 1 fill in the blank Year 2 fill in the blankarrow_forwardmni.2arrow_forward

- Question 14 Compute 15% of 90arrow_forwardMonthly Sales 6267.19 7058.06 7119.5 7147.18 7198.52 7298.09 7325.7 7335.68 7355.97 7481.05 7490.23 7530.08 7616.09 7682.69 7684.14 7704.12 7704.98 7779.28 7798.23 7815.15 7844.16 7890.21 7977.6 7993.16 8021.03 8028.37 8068.86 8082.42 8096.17 8119.25 8129.21 8190.68 8255.28 8282.44 8376.31 8392.4 8400.95 8451.16 8456.66 8505.35 8539.25 8543.65 8573.05 8641.78 8667.48 8751.08 8777.97 8800.08 8888.65 8907.03 9096.87 9241.74 9411.68 9450.73 9484.62 9514.57 9521.4 9524.91 9733.44 10123.24 Given the company’s performance record and based on the empirical rule of normal distribution (also known as the 68%-95%-99.7% rule), what would be the lower bound of the range of sales values that contains 68% of the monthly sales? What would be the upper bound of the range of sales values that contains 68% of the monthly sales?arrow_forwardNjarrow_forward

- The table below represents the monthly unemployment rates in the US from January of 2005 through May of 2016. Year Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2005 5.3% 5.4% 5.2% 5.2% 5.1% 5.0% 5.0% 4.9% 5.0% 5.0% 5.0% 4.9% 2006 4.7% 4.8% 4.7% 4.7% 4.6% 4.6% 4.7% 4.7% 4.5% 4.4% 4.5% 4.4% 2007 4.6% 4.5% 4.4% 4.5% 4.4% 4.6% 4.7% 4.6% 4.7% 4.7% 4.7% 5.0% 2008 5.0% 4.9% 5.1% 5.0% 5.4% 5.6% 5.8% 6.1% 6.1% 6.5% 6.8% 7.3% 2009 7.8% 8.3% 8.7% 9.0% 9.4% 9.5% 9.5% 9.6% 9.8% 10.0% 9.9% 9.9% 2010 9.7% 9.8% 9.9% 9.9% 9.6% 9.4% 9.5% 9.5% 9.5% 9.5% 9.8% 9.4% 2011 9.1% 9.0% 9.0% 9.1% 9.0% 9.1% 9.0% 9.0% 9.0% 8.8% 8.6% 8.5% 2012 8.2% 8.3% 8.2% 8.2% 8.2% 8.2% 8.2% 8.1% 7.8% 7.8% 7.8% 7.9% 2013 7.9% 7.7% 7.5% 7.5% 7.5% 7.5% 7.3% 7.2%…arrow_forwardFrom the data in the table it shows the 2019 daily return data for the S&P 500 Index (stocks) and the US 30 year Bond (bonds). How do I test the hypothesis that mean daily return on stocks exceeds the mean daily return on bonds? Please show the steps. S&P500 dailt returns data: Date Price Daily Return 2019-12-31 3230.78 0.294602% 2019-12-30 3221.29 -0.578082% 2019-12-27 3240.02 0.003398% 2019-12-26 3239.91 0.512817% 2019-12-24 3223.38 -0.019545% 2019-12-23 3224.01 0.086614% 2019-12-20 3221.22 0.494478% 2019-12-19 3205.37 0.445929% 2019-12-18 3191.14 -0.043230% 2019-12-17 3192.52 0.033529% US 30 Year Bond Date Price Daily Return 31-Dec-19 2.389 2.32% 30-Dec-19 2.335 0.78% 29-Dec-19 2.317 -0.03% 27-Dec-19 2.318 -0.16% 26-Dec-19 2.321 -0.71% 25-Dec-19 2.338 0.15% 24-Dec-19 2.334 -0.83% 23-Dec-19 2.354 0.31% 22-Dec-19 2.346 0.12% 20-Dec-19 2.344 -0.43%arrow_forwardQuarterly Glass Container Demand Year 1990 1991 1992 First Qtr. 17,446. 17,748. 17,595. Second Qtr. 17,785. 19,360. 18,338. Third Qtr. 18,971. Fourth Qtr. 19140. 17,802. 19,413. 18,315. 18,083. Question: Quarterly sales (in thousands of units) of a product over the last two years have been 26, 29, 30, 27, 28, 32, 33, and 30. Plot the data and forecast for the next period using Winter's Seasonal Model. Now, assume sales for the ninth quarter turned out to be 32. Update your parameter estimates and forecast sales for period 10.arrow_forward

- Below are the CPIS for three different European countries from 2016 to 2019: Country CPI in 2016 CPI in 2017 CPI in 2018 CPI in 2019 United Kingdom 99.4 101.5 104.2 106.3 France 99 100.6 101.7 103.1 Germany 99.1 100.8 102 103.3 (a) Which country / countries experienced inflation from 2016 to 2019? (b) Calculate the percentage changes in CPIS from 2018 to 2019 for each country. (c) If the prices of a country, it was the cheapest in 2019? roduct wer the same in these three countries in 2018, in whicharrow_forwardThe following data were taken from Miller Company's balance sheet: Dec. 31, Year 2 Dec. 31, Year 1 Total liabilities $150,000 $105,000 Total stockholders' equity 75,000 60,000 a. Compute the ratio of liabilities to stockholders' equity. Round your answers to one decimal place. Liabilities toStockholders' Equity 12/31/Year 2: fill in the blank 1 12/31/Year 1: fill in the blank 2 b. Has the creditors' risk increased or decreased from December 31, Year 1, to December 31, Year 2?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman