Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Question

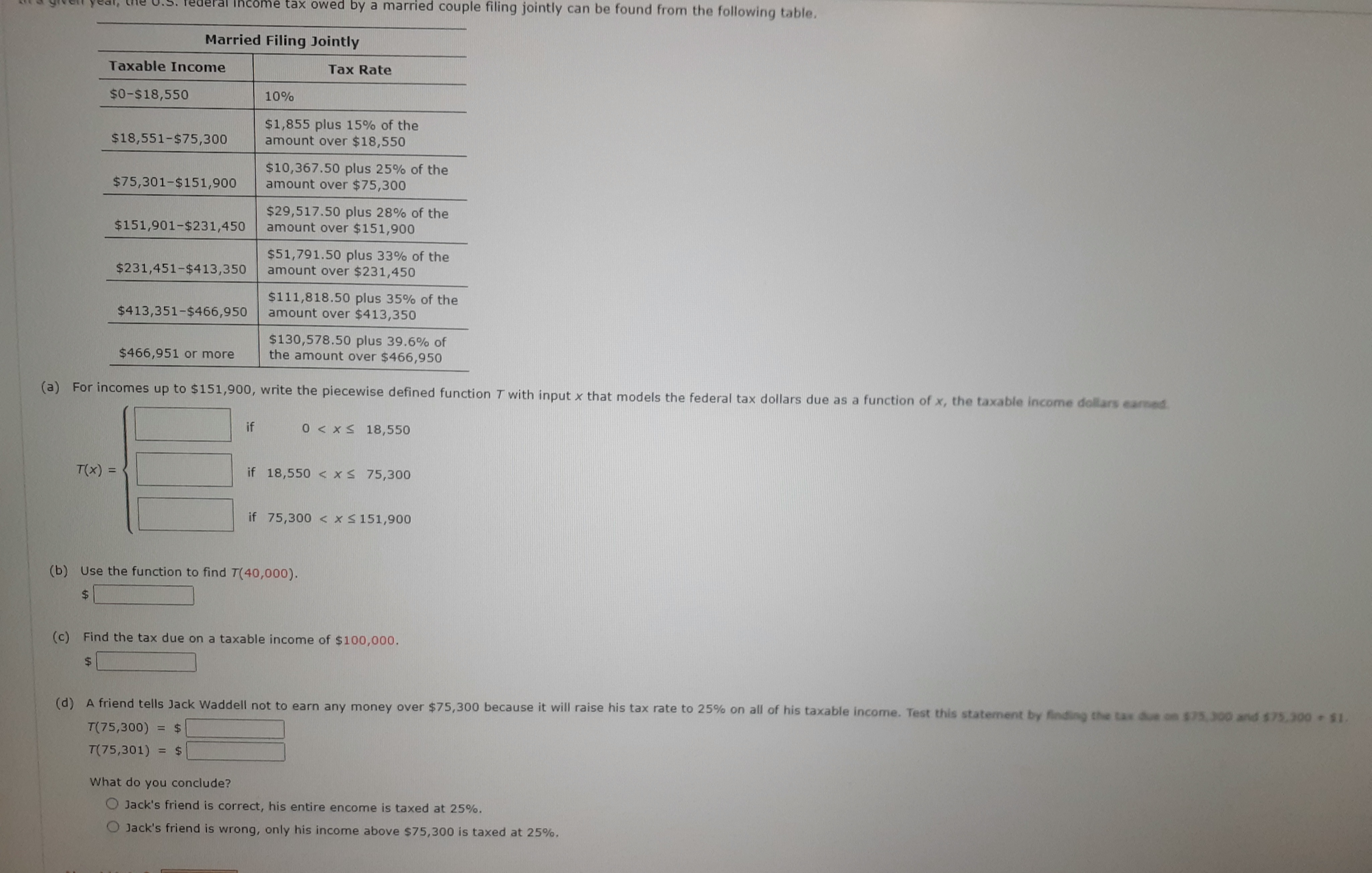

Transcribed Image Text:Federal Income tax owed by a married couple filing jointly can be found from the following table.

Married Filing Jointly

Taxable Income

$0-$18,550

$18,551-$75,300

$75,301-$151,900

$151,901-$231,450

T(x) =

$231,451-$413,350

$413,351-$466,950

$466,951 or more

10%

if

Tax Rate

$1,855 plus 15% of the

amount over $18,550

$10,367.50 plus 25% of the

amount over $75,300

$29,517.50 plus 28% of the

amount over $151,900

$51,791.50 plus 33% of the

amount over $231,450

$111,818.50 plus 35% of the

amount over $413,350

(a) For incomes up to $151,900, write the piecewise defined function T with input x that models the federal tax dollars due as a function of x, the taxable income dollars earned

$130,578.50 plus 39.6% of

the amount over $466,950

0 < x≤ 18,550

if 18,550 < x≤ 75,300

(b) Use the function to find T(40,000).

$

if 75,300 < x≤ 151,900

(c) Find the tax due on a taxable income of $100,000.

$

(d) A friend tells Jack Waddell not to earn any money over $75,300 because it will raise his tax rate to 25% on all of his taxable income. Test this statement by finding the tax due on $75,300 and $75,300 - $1.

T(75,300) = $

T(75,301) = $

What do you conclude?

Jack's friend is correct, his entire encome is taxed at 25%.

Jack's friend is wrong, only his income above $75,300 is taxed at 25%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- A phone company charges $25 a month for unlimited talk, text, and 2GB of data, and $5 for every gigabyte of data above 2GB. Write an expression for the monthly phone charge, P, in dollars, as a function of the number of gigabytes of data, d, used that month. For 0 P(d) : = P(d) =arrow_forwardConstruct a piecewise tax function where the tax is 5 % on the first $15,000 of income, then 12 % on any income over $15,000.arrow_forwardThe total cost C for a manufacturer during a given time period is a function of the number N of items produced during that period. To determine a formula for the total cost, we need to know the manufacturer's fixed costs (covering things such as plant maintenance and insurance), as well as the cost for each unit produced, which is called the variable cost. To find the total cost, we multiply the variable cost by the number of items produced during that period and then add the fixed costs.Suppose that a manufacturer of widgets has fixed costs of $9000 per month and that the variable cost is $14 per widget (so it costs $14 to produce 1 widget). (a) Use a formula to express the total cost C of this manufacturer in a month as a function of the number of widgets produced in a month. (Use N as the number of widgets produced in a month.)C = (b) Express using functional notation the total cost if there are 225 widgets produced in a month.C( )Calculate the total cost if there are 225…arrow_forward

- A salesperson makes a base salary of $50, 000 a year plus 4% commission on all sales up to (and including) $275, 000 If they exceed $275, 000 in sales for a calendar year, the salesperson's commission jumps to 8% for all their remaining sales over $275, 000 . The salesperson's total salary S for a given year is based on their total sales X . Write the piecewise-defined function S(x). hint: do not forget to include the base salary of $50, 000 when finding the pieces of the function if x 275, 000 .04x+50000 S(x) = { .08x+20000 The submission, .08x+20000, is incorrect.arrow_forwardConsider the monthly rent (Rent in $) of a home in Ann Arbor, Michigan, as a function of the number of bedrooms (Beds), the number of bathrooms (Baths), and square footage (Sqft). Rent Beds Baths Sqft 645 1 1 500 675 1 1 648 760 1 1 700 800 1 1 903 820 1 1 817 850 2 1 920 855 1 1 900 859 1 1 886 900 1 1.5 1000 905 2 1 920 905 2 1 876 929 2 1 920 960 2 1 975 975 2 2 1100 990 1 1.5 940 995 2 1 1000 1029 2 2 1299 1039 2 2 1164 1049 2 2 1180 1050 2 2 1162 1084 2 2 1163 1100 2 1 1020 1100 2 2 1150 1185 2 2 1225 1245 3 2 1368 1275 2 2 1400 1275 3 2 1350 1400 3 1 1185 1450 2 2 1200 1500 3 2 1412 1518 3 3 1700 1600 3 1 1440 1635 3 3 1460 1635 3 3 1460 1650 3 1.5 1170 1750 3 1.5 1944 1950 4 2.5 2265 1975 3 4 1700 2200 5 4 4319 2400 3 2.5 2700 a. Estimate: Rent = β0 + β1Beds + β2Baths + β3Sqft + ε. (Round your answers to 2 decimal places.) Rent =. ? + ? bed +. ? bath+ ? sqftarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,