FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

a. Compute the following ratios for Crazy Eddie during the period 1984-1987. See

Gross profit ratio

Inventory Turnover

Day’s sales in inventory

Day’s sales in accounts receivable

Accounts Payable Turnover Ratio

Long-Term Debt to Assets Ratio

b. Identify and briefly explain the red flags in Crazy Eddie's financial statements which suggested that the firm posed a higher-than-normal level of audit risk.

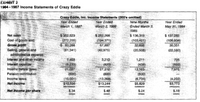

Transcribed Image Text:EXHIBIT 2

1984 -1987 Income Statements of Crazy Eddie

Crazy Eddie, Inc. Income Statements (000's omitted)

Year Ended

March 2, 1986

Year Ended

March 1, 1987

Nine Months

Ended March 3,

Year Ended

May 31, 1984

1985

Net sales

Cost of goods sold

Gross profit

$352,523

(272,255)

$ 262,268

(194,371)

$ 136,319

(103,421)

32,898

$ 137,285

(106,934)

30,351

$80,268

67,897

Selling, general and

administrative expense

Interest and other income

Interest expense

Income befare taxes

Pension contribution

Income taxes

Net Income

(61,341)

(42,975)

(20,508)

(22,560)

7.403

3,210

1,211

(438)

13,163

706.

(5,233)

21.097

(500)

(10,001)

$10,596

(522)

7,975

(820)

27,312

(800)

(600)

(6,734)

(13,268)

$13,244

(4,202)

$3,773

$5,829

Net Income per share

$.34

$.48

$.24

$.18

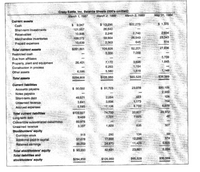

Transcribed Image Text:Crazy Eddie, Inc. Balance Sheets (000's omitted)

March 1, 1987

March 2, 1986

March 3, 1985

May 31, 1984

Current assets

$ 9,347

$ 13,296

$22,273

1,375

Cash

Short-term investments

121,957

26,840

Receivables

10,846

2,246

2,740

2,604

26,543

23,343

109,072

10,639

Merchandise inventories

59,864

Prepaid expenses

2,363

645

514

$261,861

104,609

52,201

27,836

Total current assets

3,356

7,058

Restricted cash

5,739

Due from affiliates

7,172

3,696

1,845

Property, plant and equipment

Construction in process

26,401

6,253

1,154

Other assets

6,596

5,560

1,419

1,149

Total assets

$294,858

$126,950

$65,528

$36,569

Current llabilities

$20,106

2,900

$ 50,022

$ 51,723

23,078

Accounts payable

Notes payable

Short-term debt

49,571

2,254

423

124

Unearned tevenue

3,641

3,696

1,173

764

Accrued expenses

5,593

17,126

8,733

6,078

33,407

7,625

Total current liabilitles

$108,827

74,799

29,972

7,701

Long-term debt

Convertible subordihated debentures

Unearned revenue

8,459

80,975

3,337

1,829

635

327

Stockholders' equity

Common stock

313

280

134

50

'574

12,298

11,429

17.668

Additional paid-in capital

Retained earnings

57,678

35,269

24,673

5,600

Total stockholders' equity

$ 93,260

42,621

23,861

6,224

Total llabilities and

stockholders' equity

$294,858

$126,950

$65,528

$36.569

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In the normal course of performing their responsibilities, auditors often conduct audits or reviewsof the following:1. The computer operations of a large corporation to evaluate whether the internal controlsare likely to prevent misstatements in accounting and operating data.2. Financial statements for use by stockholders when there is an internal audit staff.3. A bond indenture agreement to make sure a company is following all requirements of thecontract.4. Internal controls at a casino to ensure the casino is in compliance with federal and stateregulations.5. Computer operations of a corporation to evaluate whether the computer center is beingoperated as efficiently as possible.6. Annual statements for the use of management.7. Operations of the IRS to determine whether the internal revenue agents are using theirtime efficiently in conducting audits.8. Statements for bankers and other creditors when the client is too small to have an auditstaff.9. Financial statements of a branch of…arrow_forwardWe discussed a number of assertions about account balances, classes of transactions, and disclosures contained in financial statements. These assertions include existence and occurrence, rights and obligations, completeness, cutoff, valuation and disclosure. When we gather audit evidence, we gather evidence to support financial statement assertions. Required: Describe how each of these assertions relates to Accounts Receivable. Conor & Evan, CPAs are the auditors for Mojito, Inc. In the course of the audit, Conor & Evan select a sample of Mojito’s customers from the Accounts Receivable subsidiary ledger and send letters to them asking for confirmation of the Accounts Receivable balances owed to Mojito, Inc. Describe which of the assertions will be supported by the evidence obtained from the confirmations sent to Mojito’s customers. Explain how the evidence supports the assertion and, if it does not support the assertion, why notarrow_forwardThe following is a statement in financial from president and CEO of Samba Bank on behalf of directors to Shareholders: “As a result of strong liquidity position and its strategic direction, your bank’s medium to long term credit rating maintained as A (single A) whereas its short term rating remained as A-1 (A-One) as issued by JCR-VIS Credit rating Agency. These long and short term ratings, respectively, denote the low credit risk due to the adequate credit quality with reasonable protection…..” Required: Explain in detail that how samba bank would have been able to achieve such high credit quality.arrow_forward

- An auditor's analytical procedures have revealed that the accounts receivable of a client have doubled since the end of the prior year. However, the allowance for doubtful accounts, as a percentage of accounts receivable remained about the same. Which of the following client explanations most likely would satisfy the auditor? a. Credit standards were liberalized in the current year. b. Twice as many accounts receivable were written off in the prior year as compared to this year. c. A greater percentage of accounts were currently listed in the "more than 90 days overdue" category than in the prior year. d. The client opened a second retail outlet in the current year and its credit sales approximately equaled the older, established outlet.arrow_forwardThe financial records of the Movitz Company show that R. Dennis owes $4,100 on an account receivable. An independent audit is being carried out, and the auditors send a positive confirmation to R. Dennis. What is the most likely reason as to why a positive confirmation rather than a negative confirmation was used here?a. Control risk was particularly low for accounts receivable.b. Inherent risk was particularly high for accounts receivable.c. Dennis’s account was not yet due.d. Dennis’s account was not with a related party.arrow_forwardThe auditors for Golden Gate Company have a gut feeling that liabilities may be unrecorded. Their initial suspicions stem from a radical decline in accrued liabilities from last year. Golden Gate’s records are all computerized. Required Devise a plan to search the data files to perform a substantive test for identifying unrecorded liabilities.arrow_forward

- 12. The audit of revenue and receivables is of significant audit risk because Select one:a. The understatement of revenue results in a corresponding overstatement of net incomeb. Understatement of revenue has been a factor in many instances of fraudulent financial reportingc. Overstatement of revenue has been a factor in many instances of fraudulent financial reporting,d. The overstatement of revenue results in a corresponding understatement of net incomearrow_forwardWhich of the following are audit procedures? a) Inspecting non-current/fixed assets b) An item of inventory/stock that is present at the inventory/stock count c) A bank statement d) Counting cash balance of the firm e) A paper showing reconciliation of debtors control account with debtor sub-ledger f) A sales invoice g) Inquiry on fraud or theft happened during the year Only b) , c) , e) and f) Only a) , d) and g) Only a) , b) and d) Only a) , b) ,d) and g)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education