Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

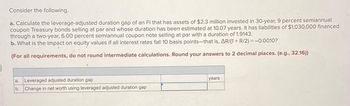

Transcribed Image Text:Consider the following.

a. Calculate the leverage-adjusted duration gap of an FI that has assets of $2.3 million invested in 30-year, 9 percent semiannual

coupon Treasury bonds selling at par and whose duration has been estimated at 10.07 years. It has liabilities of $1,030,000 financed

through a two-year, 6.00 percent semiannual coupon note selling at par with a duration of 1.9143.

b. What is the impact on equity values if all interest rates fall 10 basis points-that is, AR/(1+ R/2) = -0.0010?

(For all requirements, do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16))

a. Leveraged adjusted duration gap

b. Change in net worth using leveraged adjusted duration gap

years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- please only answer part Darrow_forwardAssume you make the following investments: A $10,000 investment in a 10-year T-bond that yields 6.00%, and a $20,000 investment in a 10-year corporate bond with an BBB rating and a yield of 8.30%. Based on this information, and the knowledge that the difference in liquidity risk premiums between the two bonds is 0.50%, what is your estimate of the corporate bond's default risk premium? A.) 2.30%? B.) 3.06%? C.) 1.80%? D.) 2.52%?arrow_forwardPrepare a duration table for a zero-coupon bond using the following assumptions: a. $100,000 par value b. 10-year maturity c. Discount Rate of 12%arrow_forward

- ● Calculate and interpret the Macaulay and modified durations of a a) 3-year 10% semi-annual bond (Bond C) when the required yield is 10%, and a b) 3-year zero-coupon bond (Bond D) when the required yield is 10% 16arrow_forwardConsider a CDO with a total notional of $500 million, consisting of three tranches: Senior (75%), Mezzanine (15%), and Equity (10%). The underlying portfolio has a total expected loss of 6%. a. Calculate the expected losses for each tranche, assuming they follow the standard tranche subordination rules. b. If the actual realized losses are 30%, determine the losses allocated to each tranche. c. Plot a graph that shows how the payoff of the holders to the Mezzanine tranche owners varies with the value of the assets in the mortgage pool at the time of maturity. d. Represent this payoff as a combination of payoffs of options and risk-free debt for Mezzanine tranche. e. Suppose the CDO manager decides to create a fourth tranche, called the Super- Senior tranche, which has the highest priority in the cash flow waterfall. If the Super-Senior tranche is sized at 50% of the total notional, recalculate the expected losses for all tranches. (hint: Super- Senior tranche is created out of Senior…arrow_forwardA firm has liabilities of $98 in one year, $100 in two years, and $107 in three years. The firm exactly matches its liabilities by purchasing the following zero or annual coupon bonds redeemable at par: Bond Maturity Par Value Coupon Rate Effective Yield A 1 year 100 5% 3% B 2 years 100 0% 4% C 3 years 100 4% 5% Find the number of units of Bond A that must be purchased to match the liabilities exactly. (A) 0.894 (B) 0.897 (C) 0.913 (D) 0.933 (E) 0.959arrow_forward

- What is the yield to maturity of a corporate semiannual coupon payments bond with 13 years to maturity, a coupon rate = 8% and market price = $1,250? A) 6.0% B) 5.3% C) 4.7% D) 4.2%arrow_forwardKm for the following Individual or component costs of capital) Your firm is considering a new investment proposal and would like to calculate its weighted average cost of capital. To help in this compute the cost of capital for the a. A bond that has a $1,000 par value (face value) and a contract or coupon interest rate of 11.4 percent mat is paud semiannually. The bond is currently selling for a price of $1,121 and will mature in 10 years The firm's tax rate is 34 percent b. If the firm's bonds are not frequently traded, how would you go about determining a cost of debt for this company? A new common stock issue that paid a $174 dividend last year. The par value of the stock is $15, and the firm's dividends per share have grown at a rate of 81 percent per year. This growth rate is expected to continue into the foreseeable tuture The pnce of this stock is now $27 12 d. A preferred stock paying a 10.7 percent dividend on a $126 par value The preferred shares are currently selling for…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education