FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

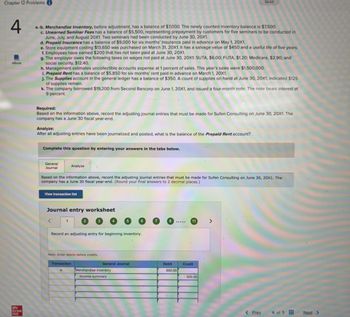

Transcribed Image Text:Chapter 12 Problemsi

4

eBook

Mc

Graw

Hill

a.-b. Merchandise Inventory, before adjustment, has a balance of $7,000. The newly counted inventory balance is $7,500.

c. Unearned Seminar Fees has a balance of $5,500, representing prepayment by customers for five seminars to be conducted in

June, July, and August 20X1. Two seminars had been conducted by June 30, 20X1.

d. Prepaid Insurance has a balance of $9,000 for six months' insurance paid in advance on May 1, 20X1.

e. Store equipment costing $13,650 was purchased on March 31, 20X1. It has a salvage value of $450 and a useful life of five years.

f. Employees have earned $200 that has not been paid at June 30, 20X1.

g. The employer owes the following taxes on wages not paid at June 30, 20X1: SUTA, $6.00; FUTA, $1.20; Medicare, $2.90; and

social security, $12.40.

h. Management estimates uncollectible accounts expense at 1 percent of sales. This year's sales were $1,500,000.

i. Prepaid Rent has a balance of $5,850 for six months' rent paid in advance on March 1, 20X1.

j. The Supplies account in the general ledger has a balance of $350. A count of supplies on hand at June 30, 20X1, indicated $125

of supplies remain.

k. The company borrowed $19,200 from Second Bancorp on June 1, 20X1, and issued a four-month note. The note bears interest at

9 percent.

Required:

Based on the information above, record the adjusting journal entries that must be made for Sufen Consulting on June 30, 20X1. The

company has a June 30 fiscal year-end.

Analyze:

After all adjusting entries have been journalized and posted, what is the balance of the Prepaid Rent account?

Complete this question by entering your answers in the tabs below.

General

Journal

Based on the information above, record the adjusting journal entries that must be made for Sufen Consulting on June 30, 20X1. The

company has a June 30 fiscal year-end. (Round your final answers to 2 decimal places.)

View transaction list

Analyze

Journal entry worksheet

<

1

Record an adjusting entry for beginning inventory.

Note: Enter debits before credits.

a.

Transaction

General Journal

Merchandise inventory

Income summary

Debit

500.00

11

Saved

Credit

500.00

>

< Prev

4 of 5

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help mearrow_forwardYou sold $8,000 of inventory for $10,000 on terms 2/10,n/30. If your customer pays the bill on day five, which of the following are true statements relating to just the day five transaction? Remember that the larger number in a transaction will be the revenue and the smaller one will be the cost of goods sold. A. You will debit cash for $10,000 B. You will credit inventory for $200 C. You will debit discounts for $200 D. You will debit cash for $9,800 E. You will label this transaction as paid bill F. You will label this transaction as a cash entry Select all that apply.arrow_forwardCash Hard #1arrow_forward

- Record journal entries for the following purchase transactions of Flower Company. Oct. 13 Purchased 81 bushels of flowers with cash for $1,300. Oct. 20 Purchased 220 bushels of flowers for $30 per bushel on credit. Terms of the purchase are 5/10, n/30, invoice dated October 20. Oct. 30 Paid account in full from the October 20 purchase. If an amount box does not require an entry, leave it blank. Assume the perpetual inventory system is used. Oct. 13 Oct. 20 Oct. 30 Accounts Receivable Accounts Payable Cost of Goods Sold Cash Sales Returns and Allowances II III II IIarrow_forward12. Boston Dollar Store uses the gross method to record purchase discounts and uses a perpetual inventory system. Boston engaged in the following transactions during April:April 12 - Purchased $15,000 in merchandise subject to terms of 2/10, n/30. The goods were shipped f.o.b. shipping point.April 13 - Received a billing from Orange Freight Lines for $300 for the April 12 purchase.April 15 - Returned $1,000 of merchandise from the April 12 purchase.April 20 - Paid balances due from April 12 purchase.Required:Prepare journal entries to record the above transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forwardA company reported the following balances in some selected accounts: Inventory, 1 March $4,000, Transportation-in $200, Inventory, 31 March $6,000, Purchases $16,000, Purchase Returns and Allowances $500, Purchase discounts $700, Sales $35,000, Sales discounts $1,500. The Cost of Goods Sold for the period is: Group of answer choices $13,000 $16,000 $12,600 $13,400arrow_forward

- Complete all requiremnts in picarrow_forwardTeal Mountain, Inc. uses a perpetual inventory system. Its beginning inventory consists of 200 units that cost $ 220 each. During August, the company purchased 255 units at $ 220 each, returned 4 units for credit, and sold 375 units at $ 340 each. Journalize the August transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.)arrow_forwardTariq Fisher Company uses a perpetual inventory system. On January 1, its inventory account had a beginning balance of Rs 450,000. Tariq engaged in the following transactions during the year:Prepare all necessary transaction as General Entries and answer given below option. Purchased merchandise inventory for Rs 500,000. Generated net sales of Rs 600,000. Recorded inventory shrinkage of Rs 10,000 after taking a physical inventory at year-end. Reported gross profit for the year of Rs 180,000 in its income statement. At what amount was Cost of Goods Sold reported in the company’s year-end income statement? At what amount was Merchandise Inventory reported in the company’s year-end balance sheet? Immediately prior to recording inventory shrinkage at the end of the year, what was the balance of the Cost of Goods Sold account? What was the balance of the Merchandise Inventory account? d- Calculate the Gross profit margin ratioarrow_forward

- 10) The company recorded cash sales for an additional 12) 20 pairs of shoes for $65 each on the 24th of the month. 11) On the last day of the month, the company estimated sales returns for their sales. They estimate that 2% of sales will be returned. (Hint: use total sales from above) Prepare the appropriate journal entries for each transaction under a perpetual inventory system.arrow_forwardAssume that on September 1, Office Depot had an inventory that included a variety of calculators. The company uses a perpetual inventory system. During September, these transactions occurred. Sept. 6 Purchased calculators from Dragoo Co. at a total cost of $1,600, on account, terms n/30 FOB shipping point. 9 Paid freight of $50 on calculators purchased from Dragoo Co. 10 Returned calculators to Dragoo Co. for $66 credit because they did not meet specifications. 12 Sold calculators costing $520 for $690 to Fryer Book Store, on account, terms n/30. 14 20 Granted credit of $45 to Fryer Book Store for the return of one calculator that was not ordered. The calculator cost $34. Sold calculators costing $570 for $760 to Heasley Card Shop, on account, terms n/30. Journalize the September transactions for Office Depot. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education