FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Cash Hard #1

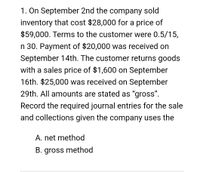

Transcribed Image Text:1. On September 2nd the company sold

inventory that cost $28,000 for a price of

$59,000. Terms to the customer were 0.5/15,

n 30. Payment of $20,000 was received on

September 14th. The customer returns goods

with a sales price of $1,600 on September

16th. $25,000 was received on September

29th. All amounts are stated as "gross".

Record the required journal entries for the sale

and collections given the company uses the

A. net method

B. gross method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 00 X + Create 24 Find text or tools Q ℗ 4 Question 4 The following cash book receipts can be found in the books of Bushveld Traders for April 2024: X 2024 Al Assistant (Marks:15) Doc No Day e DR510 1 Jock Bush Α B/S 04 8 00 Jedi Dealers Internet sales A Details Fol. Analysis of Receipts (R) Bank (R) Debtors Control (R) Output VAT (R) Sales Sundries (R) Amount Fol. Details 82 080 00 82 080 00 82 080 00 Capital 75 753 00 9 880 83 65 872 17 B C B/S 04 15 Blah Bank: Interest 906 30 on deposit D E FL G DS327 21 Stuart Smith cash 17 907 12 17 907 12 sales H DS328 24 Commercial 8 406 36 8 406 36 B/S 04 DS329 27 DR511 30 26 Tenant: Bill Tong Norma Edwards J K L 6 947 35 6.947 35 B Belton cash sales 84 303 00 84 303 00 10 996 04 73 306 96 Steve Brown ? M N 352 431 01 O 154 750 54 ? Abbreviations in the Document Number column: DR, B/S, and DS, indicate Duplicate Receipts, Bank Statement and Duplicate Cash Slips respectively. Required: ments Fill in the missing amounts/details for the letters A…arrow_forwardChap 11. Q.3arrow_forwardCurrent Attempt in Progress Suppose the following items were taken from the December 31, 2025, assets section of the Boeing Company balance sheet. (All dollars are in millions.) F2 w S Inventory Notes receivable-due after December 31, 2026 Notes receivable-due before December 31, 2026 Accumulated depreciation-buildings Current Assets Patents #3 80 F3 E D $ 4 Prepare the assets section of a classified balance sheet. (List the Current Assets in order of liquidity. Enter amounts in millions.) F4 R F % 5 F5 T $15,840 4,950 G 340 12,930 December 31, 2025 6 Patents Buildings BOEING COMPANY Partial Balance Sheet Cash F6 Accounts receivable Debt investments (short-term) (in millions) Y MacBook Air Assets & 7 H 8 Ad F7 U CV B N # * 00 8 J 11,980 DII F8 $11,980 1 21,620 ( 9 M 7,800 5,580 1.580 DD K ) 0 4 F10 L < Parrow_forward

- X CengageNOWv2 | Online teachin X + .cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress Use the information provided for Harding Company to answer the question that follow. Harding Company Accounts payable $32,558 Accounts receivable 60,589 Accrued liabilities 6,279 Cash 21,662 Intangible assets 44,020 Inventory 81,454 Long-term investments 97,693 79,992 Long-term liabilities Notes payable (short-term) 27,484 699,362 Property, plant, and equipment 2,375 Prepaid expenses 37,009 Temporary investments Based on the data for Harding Company, what is the quick ratio (rounded to one decimal place)? Oa. 15.7 Ob. 0.9 Oc. 1.8 Od. 3.1 L $ H % 5 6 a & 7 8arrow_forwardLeader L.. O Commercial Captur... ups The inc ome su mmary account is also called the clearing account the zero-out account the imprest account the adjustments account 0000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education