ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

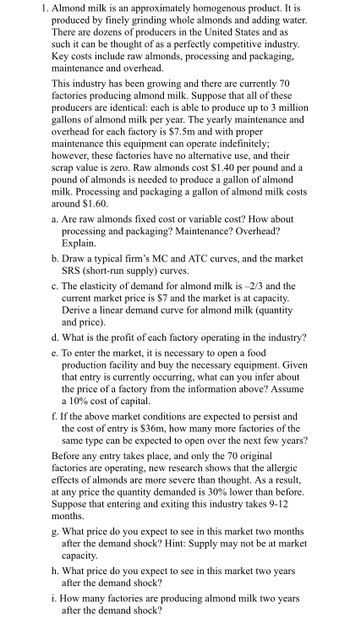

Transcribed Image Text:1. Almond milk is an approximately homogenous product. It is

produced by finely grinding whole almonds and adding water.

There are dozens of producers in the United States and as

such it can be thought of as a perfectly competitive industry.

Key costs include raw almonds, processing and packaging,

maintenance and overhead.

This industry has been growing and there are currently 70

factories producing almond milk. Suppose that all of these

producers are identical: each is able to produce up to 3 million

gallons of almond milk per year. The yearly maintenance and

overhead for each factory is $7.5m and with proper

maintenance this equipment can operate indefinitely;

however, these factories have no alternative use, and their

scrap value is zero. Raw almonds cost $1.40 per pound and a

pound of almonds is needed to produce a gallon of almond

milk. Processing and packaging a gallon of almond milk costs

around $1.60.

a. Are raw almonds fixed cost or variable cost? How about

processing and packaging? Maintenance? Overhead?

Explain.

b. Draw a typical firm's MC and ATC curves, and the market

SRS (short-run supply) curves.

c. The elasticity of demand for almond milk is -2/3 and the

current market price is $7 and the market is at capacity.

Derive a linear demand curve for almond milk (quantity

and price).

d. What is the profit of each factory operating in the industry?

e. To enter the market, it is necessary to open a food

production facility and buy the necessary equipment. Given

that entry is currently occurring, what can you infer about

the price of a factory from the information above? Assume

a 10% cost of capital.

f. If the above market conditions are expected to persist and

the cost of entry is $36m, how many more factories of the

same type can be expected to open over the next few years?

Before any entry takes place, and only the 70 original

factories are operating, new research shows that the allergic

effects of almonds are more severe than thought. As a result,

at any price the quantity demanded is 30% lower than before.

Suppose that entering and exiting this industry takes 9-12

months.

g. What price do you expect to see in this market two months

after the demand shock? Hint: Supply may not be at market

capacity.

h. What price do you expect to see in this market two years

after the demand shock?

i. How many factories are producing almond milk two years

after the demand shock?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Give every questions answer and take likearrow_forwardSuppose there is a 10% increase in the price of apples. In the immediate short run this elicits a 1% increase in the quantity of apples supplied. Calculate the elasticity of supply. Is this elasticity of supply elastic or inelastic? Why do you think this is? Now assume that over a ten year period a 10% increase in the price of apples leads to a 15% increase in the quantity of apples supplied. Calculate this elasticity of supply. Is it elastic or inelastic? Explain the difference in your two measures of elasticity.arrow_forwardBack to Assignment Keep the Highest 1/2 4. Elastic, inelastic, and unit-elastic demand The following graph shows the demand for a good. Attempts 1 ❖ PRICE (Dollars per unit) 350 225 175 50 0 Region Between W and X Between X and Y Between Y and Z 1 QUANTITY (Units) True False W Demand For each of the regions listed in the following table, use the midpoint method to identify if the demand for this good is elastic, (approximately) unit elastic, or inelastic. Elastic Inelastic Unit Elastic ? True or False: The slope of the demand curve is not equal to the value of the price elasticity of demand.arrow_forward

- A farmer produced 8400 tons of grapes and each ton sales for $200. Grapes are found to be a perfect cure for Corona Virus. As a result, the price of grapes went from $200 per ton to $10,000 per ton. How many tons will the farmer sale? Using your knowledge of price elasticity of supply, draw a graph illustrating this sale. What will happen in the market for grapes in one year if the price hold steady at $10, 000. Draw a graph showing this.arrow_forwardExplain how each of the factors would or would not affect the price elasticity of demand for a good or service that your company (or a company for which you have an interest) produces?Help your classmates expand or re-focus on what they have observed.arrow_forwardIf Starbucks’s data analytics department estimates the income elasticity of demand for its coffee to be 2.5, how will the prospect of an economic boom (expected to increase consumers’ incomes by 5 percent over the next year) impact the quantity of coffee Starbucks expects to sell?Instruction: Enter your response rounded to two decimal places. It will change by _____ percent.arrow_forward

- _6. A product's price changes from $2 to $6 and its quantity demanded changes from 10 to 4 units. This is an example of price: A) B) C) D) inelastic demand. elastic demand. unitarily elastic demand. inelastic supply. Show your work here Formula Calculation Answerarrow_forwardBlue Co. makes a processor that requires a metal that can only be found in a single mine in Peru. Do you expect the price elasticity of supply for this processor to be elastic or inelastic? Explain in 1-4 sentences.arrow_forwarda. Define income elasticity of demand and cross-price elasticity of demand. b. If a firm determines that the income elasticity of demand for its good is negative (EY < 0), what can be said about this good? c. On the island of Econopia, the cross-price elasticity of demand between holilacs and bajwins is negative (EXY <0). What is the relationship between these goods?arrow_forward

- Price of tin and silicone decrease affecting the market for iPhones A)Decrease in supply B)Decrease in demand C)Increase in supply D)Increase in demandarrow_forwardThe following table contains a monthly demand and supply schedule for large, single- topping, carry-out pizza Pizza Price (per pack) Quantity demanded for pizza (per pack) Quantity supplied for pizza (per pack) Quantity demanded for good Y $21 6000 7900 6000 $19 7000 7200 8000 $17 8000 6500 10000 (A) Calculate the price elasticity Of demand (PED) for good X when price fall from S 19 to $ 17. (B) Suppose you are the sellers of pizza based on the value of PED obtained In your answer for Question(A), would you or would you not raise the price of pizza? Why? (C)What S the cross elasbcity of demand (CED) of Good Y when price of carry-out pizza fall from $19 to S17? How is pizza and the Good Y related?arrow_forwardWhat is the total revenue in a market with the following demand and supply curves? QD=478-6P and QS=128+8Parrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education