Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

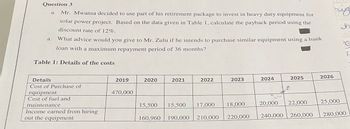

Transcribed Image Text:Question 3

a. Mr. Mwansa decided to use part of his retirement package to invest in heavy duty equipment for

solar power project. Based on the data given in Table 1, calculate the payback period using the

discount rate of 12%.

a.

What advice would you give to Mr. Zulu if he intends to purchase similar equipment using a bank

loan with a maximum repayment period of 36 months?

Table 1: Details of the costs

Details

Cost of Purchase of

equipment

Cost of fuel and

maintenance

Income earned from hiring

out the equipment

2019

470,000

2020

15,500

2021

2022

15,500 17,000

160,960 190,000 210,000

2023

18,000

220,000

2024

20,000

240,000

2025

22,000

260,000

hig

h

2026

25,000

G

S

280,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Deciding between traditional and Roth IRAs. Elijah James is in his early 30s and is thinking about opening an IRA. He can’t decide whether to open a traditional/deductible IRA or a Roth IRA, so he turns to you for help. To support your explanation, you decide to run some comparative numbers on the two types of accounts; for starters, use a 25-year period to show Elijah what contributions of $5,500 per year will amount to (after 25 years) if he can earn, say, 10 percent on his money. Will the type of account he opens have any impact on this amount? Explain. Assuming that Elijah is in the 22 percent tax bracket (and will remain there for the next 25 years), determine the annual and total (over 25 years) tax savings he’ll enjoy from the $5,500-a-year contributions to his IRA. Contrast the (annual and total) tax savings he’d generate from a traditional IRA with those from a Roth IRA. Now, fast-forward 25 years. Given the size of Elijah’s account in 25 years (as computed in part a),…arrow_forwardNot sure what the table factor would bearrow_forwardOwners of a new restaurant have found numerous costs associated with starting their business (see table). They financed the total of these costs with end-of-month payments through a loan from the bank at {E}compounded {F}, amortized over {G} years. 1. What is the size of the monthly payments required to settle this loan? 2. What is the principal balance outstanding on the loan after one year? 3. What is the size of the final payment? 4. Construct a partial amortization schedule for this loan.arrow_forward

- An engineer is considering buying a life insurance policy for his family. He currently owes $65,000 and he would like his family to have an annual available income of $50,000 indefinitely. If the engineer assumes that any money from the insurance policy can be invested in an account paying a guaranteed 5% annual interest, how much life insurance should he buy? $1,000,000 $1,065,000 ● $2,000,000 $2,130,000arrow_forwardYou have entered into an agreement for the purchase of land. The agreement specifies that you will take ownership of the land immediately. You have agreed to pay $50,000 today and another $50,000 in three years. Calculate the total cost of the land today, assuming a discount rate of (a) 5%, (b) 7 %, or (c) 9%. Note: Use tables, Excel, or a financial calculator. Round your answers to 2 decimal places. (FV of $1, PV of $1, FVA of $1, and PVA of $1) a. b. C. Payment Amount $ 50,000 50,000 50,000 Interest Rate 7 5% 7% 9% Answer is complete but not entirely correct. Compounding Annually Annually Annually Period Due 3 years 3 years 3 years $ Total Cost of Land Today 93,121.25 X 90,816.30✔ 88,617.30arrow_forwardSubject:- financearrow_forward

- Billy Dan and Betty Lou were recently married and want to start saving for their dream home. They expect the house they want will cost approximately $255,000. They hope to be able to purchase the house for cash in 7 years. To determine the appropriate discount factor(s) using tables, click here to view Tables I. II. II. or IV in the appendix. Alternatively, if you calculate the discount factor(s) using a formula, round to six (6) decimal places before using the factor in the problem. Required a. How much will Billy Dan and Betty Lou have to invest each year to purchase their dream home at the end of 7 years? Assume an interest rate of 9 percent. b. Billy Dan's parents want to give the couple a substantial wedding gift for the purchase of their future home. How much must Billy Dan's parents give them now if they are to reach the desired amount of $255,000 in 9 years? Assume an interest rate of 9 percent. Complete this question by entering your answers in the tabs below. Required A…arrow_forwardNeed help with the question pleasearrow_forwardSolve by using the sinking fund or amortization formula. Betty Price purchased a new home for $245,000 with a 10% down payment and the remainder amortized over a 15 year period at 9% interest. (a) What amount (in $) did Betty finance? $ (b) What equal monthly payments (in $) are required to amortize this loan over 15 years? (Round your answer to the nearest cent.) $ (c) What equal monthly payments (in $) are required if Betty decides to take a 20 year loan rather than a 15 year loan? (Round your answer to the nearest cent.) $arrow_forward

- Harriet Marcus is concerned about the financing of a home. She saw a small cottage that sells for $75,000. Assuming that she puts 20% down, what will be her monthly payment and the total cost of interest over the cost of the loan for each assumption? (Use the Table 15.1) Note: Do not round intermediate calculations. Round your answers to the nearest cent. a. 25 Years, 5.00% b. 25 Years, 5.50% c. 25 Years, 5.75% d. 25 Years, 6.00% Monthly payment Total cost of interest e. What is the savings in interest cost between 5.00% and 6.00%? Note: Round your answer to the nearest dollar amount. Interest costarrow_forwardTime to accumulate a given sum Personal Finance Problem Manuel Rios wishes to determine how long it will take an initial deposit of $7,000 to double. a. If Manuel earns 8% annual interest on the deposit, how long will it take for him to double his money? b. How long will it take if he earns only 5% annual interest? c. How long will it take if he can earn 10% annual interest? d. Reviewing your findings in parts a, b, and c, indicate what relationship exists between the interest rate and the amount of time it will take Manuel to double his money. a. If Manuel earns 8% annual interest, the amount of time to double his money is years. (Round to two decimal places.) Carrow_forwardYou purchase a plot of land worth $54,000 to create a community garden. To do so, you secure a 10-year loan, charging 5.22% APR, compounded monthly, and requiring monthly payments of $505. (Assume the value of the land is still $54,000. Round each answer to the nearest dollar.) (a) Assuming that you put some money down, what was your original loan amount (in dollars)? X $ (b) What is the outstanding balance (in dollars) on your loan after making 4 years of payments? $ 170255.84 (c) How much equity (in dollars) do you have in the garden after 4 years? $ Xarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education