Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

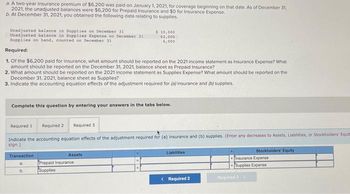

Transcribed Image Text:a. A two-year insurance premium of $6,200 was paid on January 1, 2021, for coverage beginning on that date. As of December 31,

2021, the unadjusted balances were $6,200 for Prepaid Insurance and $0 for Insurance Expense.

b. At December 31, 2021, you obtained the following data relating to supplies.

Unadjusted balance in Supplies on December 31

Unadjusted balance in Supplies Expense on December 31

Supplies on hand, counted on December 31

Required:

$ 10,000

62,000

6,000

1. Of the $6,200 paid for insurance, what amount should be reported on the 2021 income statement as Insurance Expense? What

amount should be reported on the December 31, 2021, balance sheet as Prepaid Insurance?

2. What amount should be reported on the 2021 income statement as Supplies Expense? What amount should be reported on the

December 31, 2021, balance sheet as Supplies?

3. Indicate the accounting equation effects of the adjustment required for (a) insurance and (b) supplies.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3

Indicate the accounting equation effects of the adjustment required for (a) insurance and (b) supplies. (Enter any decreases to Assets, Liabilities, or Stockholders' Equit

sign.)

Transaction

Assets

a.

Prepaid Insurance

b.

Supplies

Liabilities

Stockholders' Equity

Insurance Expense

Supplies Expense

< Required 2

Required 3>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- An examination of Insurance Policies of Standard Company is presented below: Policy Date of Purchase Life of Policy Cost September 1, 2019 4years P25,920 May 1, 2020 2years 18,960 July 31, 2020 1year 9,720 Prepaid Insurance was debited for the cost of each policy at the time of its purchase. Expired insurance was correctly recorded at the end of 2019. What is the balance of Prepaid Insurance at the end of 2020?arrow_forwardA company makes the payment of a one-year insurance premium of $4,584 on March 1, 2019. c. Calculate the amount of prepaid insurance that should be reported on the December 31, 2019, balance sheet with respect to this policy.arrow_forwardA two-year insurance premium of $8,400 was paid on January 1, 2018, for coverage beginning on that date. As of December 31, 2018, the unadjusted balances were $8,400 for Prepaid Insurance and $0 for Insurance Expense.At December 31, 2018, you obtained the following data relating to supplies.Unadjusted balance in Supplies on December 31, 2018 $ 21,000Unadjusted balance in Supplies Expense on December 31, 2018 84,000Supplies on hand, counted on December 31, 2018 14,800how would you form a journal entry for the supplies and the insurancearrow_forward

- Under M. Sabio Company’s accounting system, all insurance premiums paid are debited to prepaid insurance. For interim financial reports, M Sabio makes monthly estimated charges to insurance expenses with credits to prepaid insurance. Additional information for the year ended December 31, 2019 are as follows: Prepaid Insurance at December 31, 2018 P120,500 Charges to insurance expense during 2019( including a year- End adjustment of P10,500) 437,500 Prepaid Insurance at December 31, 2019 110,000 What was the total amount of insurance premiums paid by M. Sabio during 2019? P448,000 P427,000 P327,500 P437,500arrow_forwardRequlred Information [The following information applies to the questions displayed below.] A company makes the payment of a one-year Insurance premlum of $4,248 on March 1, 2019. c. Calculate the amount of prepald Insurance that should be reported on the December 31, 2019, balance sheet with respect to this policy. Prepaid insurancearrow_forwardRates and insurance outstanding at 31 December 2019 was GHC 675. However, at 31 December 2020, rates and insurance was palid in excess of GHC 425. The receipts and payment account showed a payment of GHC 2,300 in respect of rates and insurance. How much should reflect in the income and expenditure account?arrow_forward

- The premium on a three-year insurance policy expiring on December 31, 2022 was paid in total on January 1, 2020. The original payment was initially debited to a prepaid asset account. The appropriate adjusting entry had been recorded on December 31, 2020. The balance in prepaid asset account on December 31, 2020 should be a. The same as it would have been if the original payment had been debited initially to an expense account. b. Zero c. Higher that if the original payment had been debited initially to an expense account. d. The same as the original payment.arrow_forwardA one year insurance premium of $4,400 was paid on October 1, 2021 by the Cool Company, for coverage beginning on that date. As of December 31, 2021, the unadjusted balances were $4,400 for Prepaid Insurance and $0 for Insurance Expense. What amount should be reported on the 2021 Balance Sheet as Prepaid Insurance?arrow_forwardTransactions (a) through (e) took place in Stoney Heights Private Hospital during the year ending December 31, 2019.a. Gross revenues of $5,000,000 were earned for service toMedicare patients.b. Expected contractual adjustments with Medicare, a third-party payor, are $2,500,000; and an allowance for contractual adjustments account is used by Stoney Heights.c. Medicare cleared charges of $5,000,000 with payments of $2,160,000 and total contractual allowances of $2,840,000 ($2,500,000 + $340,000).d. Interim payments received fromMedicare amounted to $250,000.e. The hospital made a lump-sum payment back toMedicare of $100,000.1. Record the transactions in the general journal.2. Calculate the amount of net patient service revenues.3. What is the net cash flow from transactions withMedicare?4. What adjustments must be made at year-end to settle up with Medicare and properly report the net patient service revenues after this settlement?arrow_forward

- please answer correct with full explanation computation formula with steps The premium on a three-year insurance policy expiring on December 31, year 3, was paid in total on January 1, year 1. The original payment was initially debited to a prepaid asset account. The appropriate journal entry has been recorded on December 31, year 1. The balance in the prepaid asset account on December 31, year 1, should be O Zero. O The same as the original payment. O The same as it would have been if the original payment had been debited initially to an expense account. O Higher than if the original payment had been debited initially to an expense account.arrow_forwardUnder Edelbert company’s accounting system, all insurance premiums paid are debited to prepaid insurance. Information for the year ended December 31, 2018 is as follows:Prepaid Insurance on January 1 200,000Charge to insurance expense 880,000Prepaid insurance on December 31 240,000What was the amount of insurance premium paid in 2018?arrow_forwardDo a journal entry to account for insurance expense incurred in the month of December. Date the journal entry for December 31, 2019. If the insurance was paid on december 10 in the amount of $636 and runs through May 31st. How do I record this in Journal entry?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College