Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Financial accounting

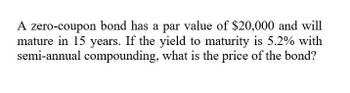

Transcribed Image Text:A zero-coupon bond has a par value of $20,000 and will

mature in 15 years. If the yield to maturity is 5.2% with

semi-annual compounding, what is the price of the bond?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose a 10-year, 10% semiannual coupon bond with a par value of 1,000 is currently selling for 1,135.90, producing a nominal yield to maturity of 8%. However, the bond can be called after 5 years for a price of 1,050. (1) What is the bonds nominal yield to call (YTC)? (2) If you bought this bond, do you think you would be more likely to earn the YTM or the YTC? Why?arrow_forwardYou are looking at a 18-year zero-coupon bond that has a yield to maturity of 5.0% . What is the value of the bond? Assume semi-annual compounding. learrow_forwardWhat is the price of a bond with a coupon rate of 5.20% and semi-annual payments, if the yield-to-maturity is 10.20% and the bond matures in 20 years? Assume a par value of $1,000.arrow_forward

- You find a zero coupon bond with a par value of $10,000 and 13 years to maturity. If the yield to maturity on this bond is 4.7 percent, what is the price of the bond? Assume semi annual compounding periods.arrow_forwardWhat is the yield-to-maturity of a bond with a coupon rate of 9.0%, par value of $2000, 7 years until maturity, and a value of $987.33 if coupons are paid annually with the next one due in one year?arrow_forwardYou find a zero coupon bond with a par value of $10,000 and 19 years to maturity. If the yield to maturity on this bond is 5.7 percent, what is the dollar price of the bond? Assume semiannual compounding periodsarrow_forward

- What is the semi-annual coupon bond's nominal yield to maturity (YTM), if the years to maturity is 15 years, and sells for 119% with coupons rate of 10%? Assume the par value of the bond is $1,000.arrow_forwardYou find a zero coupon bond with a par value of $10,000 and 20 years to maturity. The yield to maturity on this bond is 4.2 percent. Assume semiannual compounding periods. What is the price of the bond?arrow_forwardA 6.75 percent coupon bond with 20 years left to maturity is priced to offer a 6.0 percent yield to maturity. You believe that in one year, the yield to maturity will be 6.6 percent. (Assume interest payments are semiannual.) What would be the total return of the bond in dollars? What would be the total return of the bond in percent?arrow_forward

- What is the duration of a two-year bond that pays an annual coupon of 9 percent and has a current yield to maturity of 16 percent? Use $1,000 as the face value.arrow_forwardYou are purchasing a 10-year, zero–coupon bond. The yield to maturity is 8.69 percent and the face value is $1,000. What is the current market price? Assume semiannual compoundingarrow_forwardsuppose a 30 year, pay coupon of 4% is priced to yield 5%. par = 1000. the bond pays its coupon annually. calculate the instrinsic value of the bond. decide whether the bond is at premium or discount? please show the calculation using excelarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT