MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

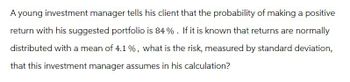

Transcribed Image Text:A young investment manager tells his client that the probability of making a positive

return with his suggested portfolio is 84%. If it is known that returns are normally

distributed with a mean of 4.1%, what is the risk, measured by standard deviation,

that this investment manager assumes in his calculation?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Similar questions

- Suppose that the annual rate of return for a common biotechnology stock is normally distributed with a mean of 4% and a standard deviation of 5%. Find the probability that the one-year return of this stock will be negative. Round your answer to at least four decimal places. Continue cer esc % %24 23 3 @ 5 2 earrow_forwardIf the standard deviation of returns on the market is 10 percent, and the beta of a well- diversified portfolio is 1, calculate the standard deviation of this portfolio. O 10% O 20% 30% O Cannot be determined!arrow_forwardSuppose that we know that 33.8% of the people born in the United States between 1936 and 1951 have BLUE eyes. Three randomly selected Americans are selected and examined for eye color. If you let success correspond to an American having BLUE eyes, calculate the following. Calculate the standard deviation.arrow_forward

- A financial investor builds a portfolio that is worth an expected £35mil. The investor knows that his analysts can build a model to boost the potential return from the portfolio investment. The additional return has a Normal Distribution with mean £3mil and standard deviation £0.5mil. The investor wishes to sell his financial services at a price that guarantees his expected profit will be 5% of the total return from the portfolio. Now assume the financial advisor knows that another advisor will offer a competitive portfolio. Based on historical data, he knows this competitive portfolio’s total return follows a normal distribution with mean £36mil and standard deviation of £2mil and is priced at 5% of total return. Clients will naturally choose the advisor which offers the portfolio with the highest net How does the distribution of profit over the range of financial prices considered in part B) changes, when the competitor is considered?arrow_forwardBusiness Weekly conducted a survey of graduates from 30 top MBA programs. On the basis of the survey, assume the mean annual salary for graduates 10 years after graduation is 181000 dollars. Assume the standard deviation is 37000 dollars. Suppose you take a simple random sample of 57 graduates. Find the probability that a single randomly selected policy has a mean value between 162867.2 and 190801.5 dollars. P(162867.2 < X < 190801.5) = (Enter your answers as numbers accurate to 4 decimal places.) Find the probability that a random sample of size n = 57 has a mean value between 162867.2 and 190801.5 dollars. P(162867.2 < X < 190801.5) = (Enter your answers as numbers acCcurate to 4 decimal places.)arrow_forwardSuppose your manager indicates that for a normally distributed data set you are analyzing, your company wants data points between z=−0.5z=-0.5 and z=0.5z=0.5 standard deviations of the mean (or within 0.5 standard deviations of the mean). What percent of the data points will fall in that range?Answer: percent (Enter a number between 0 and 100, not 0 and 1 and round to 2 decimal places)arrow_forward

- Risk-taking is an important part of investing. In order to make suitable investment decisions on behalf of their customers, portfolio managers give a questionnaire to new customers to measure their desire to take financial risks. The scores on the questionnaire are approximately normally distributed with a mean of 51 and a standard deviation of 16. The customers with scores in the bottom 15% are described as "risk averse." What is the questionnaire score that separates customers who are considered risk averse from those who are not? Carry your intermediate computations to at least 4 decimal places. Round answer to one decimal place.arrow_forwardBusiness Weekly conducted a survey of graduates from 30 top MBA programs. On the basis of the survey, assume the mean annual salary for graduates 10 years after graduation is 167000 dollars. Assume the standard deviation is 34000 dollars. Suppose you take a simple random sample of 89 graduates. Find the probability that a single randomly selected policy has a mean value between 160512.8 and 180695.2 dollars. P(160512.8 Next Question (Enter your answers as numbers accurate to 4 decimalarrow_forward. You make an investment. Assume that annual returns are normally distributed with a mean return of .05 per year and a standard deviation of .20. What is the probability of (a) a positive annual return? (b) What is the probability of an annual return greater than .12? (c) What is the probability of a return of –.06 or less? (d) Suppose there are 250 trading days in a year and the return on any day is independent of the return on any other day. What is the probability of a positive return on any given day?arrow_forward

- Suppose you are working with a data set that is normally distributed, with a mean of 250 and a standard deviation of 46. Determine the value of x from the following information. (d) x is greater than 57% of the valuesarrow_forwardSuppose your manager indicates that for a normally distributed data set you are analyzing, your company wants data points between z=−0.6z=-0.6 and z=0.6z=0.6 standard deviations of the mean (or within 0.6 standard deviations of the mean). What percent of the data points will fall in that range?Answer: percent (Enter a number between 0 and 100, not 0 and 1 and round to 2 decimal places)arrow_forwardPax World Balanced is a highly respected, socially responsible mutual fund of stocks and bonds. Vanguard Balanced Index is another highly regarded fund that represents the entire U.S. stock and bond market (an index fund). The mean and standard deviation of annualized percent returns are shown below. The annualized mean and standard deviation are for a recent 10-years period.†. If x represents return and s represents risk, then explain why the coefficient of variation can be taken to represent risk per unit of return. From this point of view, which fund appears to be better? Explain. A. Since the CV is s/s2 we can say that the CV represents the risk per unit of return; the Pax fund appears to be better because the CV is smaller. B. Since the CV is s/s2 we can say that the CV represents the risk per unit of return; the Vanguard fund appears to be better because the CV is smaller. C. Since the CV is s/x we can say that the CV represents the risk per unit of return; the Pax fund…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman