Algebra and Trigonometry (6th Edition)

6th Edition

ISBN: 9780134463216

Author: Robert F. Blitzer

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Question

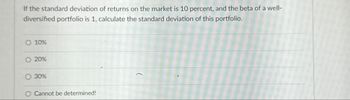

Transcribed Image Text:If the standard deviation of returns on the market is 10 percent, and the beta of a well-

diversified portfolio is 1, calculate the standard deviation of this portfolio.

O 10%

O 20%

30%

O Cannot be determined!

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Pax World Balanced is a highly respected, socially responsible mutual fund of stocks and bonds. Vanguard Balanced Index is another highly regarded fund that represents the entire U.S. stock and bond market (an index fund). The mean and standard deviation of annualized percent returns are shown below. The annualized mean and standard deviation are for a recent 10-years period.†. If x represents return and s represents risk, then explain why the coefficient of variation can be taken to represent risk per unit of return. From this point of view, which fund appears to be better? Explain. A. Since the CV is s/s2 we can say that the CV represents the risk per unit of return; the Pax fund appears to be better because the CV is smaller. B. Since the CV is s/s2 we can say that the CV represents the risk per unit of return; the Vanguard fund appears to be better because the CV is smaller. C. Since the CV is s/x we can say that the CV represents the risk per unit of return; the Pax fund…arrow_forwardSuppose that an accounting firm does a study to determine the time needed to complete one person's tax forms. It randomly surveys 200 people. The sample mean is 22.3 hours. There is a known population standard deviation of 7.0 hours. The population distribution is assumed to be normal. Find the following. (Enter exact numbers as integers, fractions, or decimals.) (i) x = (ii) ? = (iii) n =arrow_forwardSuppose that the borrowing rate that your client faces is 9%. Assume that the equity market index has an expected return of 13% and standard deviation of 25%, that rf = 5%. Your fund manages a risky portfolio, with the following details: E(rp) = 11%, p = 15%. What is the largest percentage fee that a client currently lending (y 1)? (Negative values should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 1 decimal place.) y 1arrow_forward

- Andrew plans to retire in 40 years. He plans to invest part of his retirement funds in stocks, so he seeks out information on past returns. He learns that over the entire 20th century, the real (that is, adjusted for inflation) annual returns on U.S. common stocks had mean 8.7% and standard deviation 20.2%. The distribution of annual returns on common stocks is roughly symmetric, so the mean return over even a moderate number of years is close to Normal. What is the probability (assuming that past pattern of variation continues) that the mean annual return on common stocks over the next 40 years will exceed 10%? What is the probability that the mean return will be less than 5%?arrow_forwardI have problem in the question number #2, but the answer is with the result of question number #1arrow_forwardSuppose the returns of a particular group of mutual funds are normally distributed with a mean of 9.5% and a standard deviation of 5.1%. If the manager of a particular fund wants to be sure that his fund is NOT in the bottom 25% of funds with the lowest return, what return must his fund have? (please round your answer to 2 decimal places)arrow_forward

- A certain brokerage house wants to estimate the mean daily return on a certain stock. A random sample of 12 days yields the following return percentages.−1.81, 1.54, 1.52, −2.58, −2.3, 0.97, 0.93, −1.06, 1.04, 0.2, −0.63, −2.75 Send data to calculator If we assume that the returns are normally distributed, find a 90% confidence interval for the mean daily return on this stock. Then find the lower limit and upper limit of the 90% confidence interval. Carry your intermediate computations to at least three decimal places. Round your answers to one decimal place. (If necessary, consult a list of formulas.) Lower limit: ? Upper limit: ?arrow_forwardIf the expected return on the market is 8% and the risk for your rate is 4%. What is the expected return for a stock with a beta equal to 2.00? arrow_forward5. The changes in the values of two investment portfolios are modelled as Normal distributions. From day to day, the first investment portfolio changes in value with mean 2.6% and standard deviation 1.8%. From day to day, the second investment portfolio changes in value with mean 2.2% and standard deviation 2.5%. An investor is hoping for growth of at least 4%. Which portfolio is most likely to give growth of 4%?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Algebra and Trigonometry (6th Edition)AlgebraISBN:9780134463216Author:Robert F. BlitzerPublisher:PEARSON

Algebra and Trigonometry (6th Edition)AlgebraISBN:9780134463216Author:Robert F. BlitzerPublisher:PEARSON Contemporary Abstract AlgebraAlgebraISBN:9781305657960Author:Joseph GallianPublisher:Cengage Learning

Contemporary Abstract AlgebraAlgebraISBN:9781305657960Author:Joseph GallianPublisher:Cengage Learning Linear Algebra: A Modern IntroductionAlgebraISBN:9781285463247Author:David PoolePublisher:Cengage Learning

Linear Algebra: A Modern IntroductionAlgebraISBN:9781285463247Author:David PoolePublisher:Cengage Learning Algebra And Trigonometry (11th Edition)AlgebraISBN:9780135163078Author:Michael SullivanPublisher:PEARSON

Algebra And Trigonometry (11th Edition)AlgebraISBN:9780135163078Author:Michael SullivanPublisher:PEARSON Introduction to Linear Algebra, Fifth EditionAlgebraISBN:9780980232776Author:Gilbert StrangPublisher:Wellesley-Cambridge Press

Introduction to Linear Algebra, Fifth EditionAlgebraISBN:9780980232776Author:Gilbert StrangPublisher:Wellesley-Cambridge Press College Algebra (Collegiate Math)AlgebraISBN:9780077836344Author:Julie Miller, Donna GerkenPublisher:McGraw-Hill Education

College Algebra (Collegiate Math)AlgebraISBN:9780077836344Author:Julie Miller, Donna GerkenPublisher:McGraw-Hill Education

Algebra and Trigonometry (6th Edition)

Algebra

ISBN:9780134463216

Author:Robert F. Blitzer

Publisher:PEARSON

Contemporary Abstract Algebra

Algebra

ISBN:9781305657960

Author:Joseph Gallian

Publisher:Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:9781285463247

Author:David Poole

Publisher:Cengage Learning

Algebra And Trigonometry (11th Edition)

Algebra

ISBN:9780135163078

Author:Michael Sullivan

Publisher:PEARSON

Introduction to Linear Algebra, Fifth Edition

Algebra

ISBN:9780980232776

Author:Gilbert Strang

Publisher:Wellesley-Cambridge Press

College Algebra (Collegiate Math)

Algebra

ISBN:9780077836344

Author:Julie Miller, Donna Gerken

Publisher:McGraw-Hill Education