ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

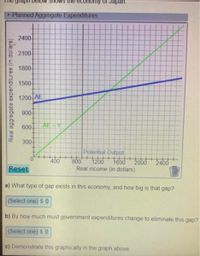

Transcribed Image Text:graph below shows the economy oOT Japan.

Planned Aggregate Expenditures

2400-

2100

1800-

1500

1200 AE

900-

600

AE Y

300-

Potential Output

00 200 tobd 200d 2400

40

Reset

Real income (in dollars)

a) What type of gap exists in this economy, and how big is that gap?

(Select one) $ 0

b) By how much must government expenditures change to eliminate this gap?

(Select one) $ 0

c) Demonstrate this graphically in the graph above.

Real aggregate expenditures (in dollars)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Briefly synthesize (4-6 sentences) the 2020 fiscal policies implemented by the US government as a result of COVID-19.arrow_forwardIncome Expenditures 0 100 100 150 200 200 300 250 Refer to the table above to answer the following: (a) At an income level of $200, how much is autonomous expenditures and how much is induced? (b) Given the expenditures function AE = $4,000 + 0.6Y and income of $1,000, how much is spent and how much is induced?arrow_forward3. Briefly answer each of the following. a) Explain precisely why secondary market impacts should be ignored when prices in the secondary market do not change. b) Why don't large positive multiplier effects on local spending from events such as the Superbowl, or any sizeable local project or event, indicate the project's benefits exceed its costs, even locally? Hint: one important part of the answer has to do with secondary market effects, and you may want to reference question #2.arrow_forward

- Subject :- Economyarrow_forward6) Suppose the economy is closed and is characterized by the following behavioral equations: C=C₁+C₁YD Y₁ = Y-T I=b₁ + b₂Y a. Government spending and taxes are constant. Solve for the equilibrium output. What is the value of the multiplier? How does the relationship between investment and output affect the value of the multiplier as compared to the case when investment was exogenous? For the multiplier to be positive what condition must (c₁ +b₁ ) satisfy? Explain your answers? b. Suppose that the parameter bo, sometimes called business confidence, increases. How will the equilibrium output be affected? Will investment change by more or less than the change in bo? Why? What will happen to national saving?arrow_forward(a) Suppose in a simple Keynesian economy, planned consumption function is given by C=250+0.65(Y-T). Planned investment, government purchases, taxes are $100 million, $100 million and $150 million respectively. What is MPC, MPS and autonomous consumption Derive the saving function. What is the equilibrium level of income? Y= AD=C+I+G If government purchases increase to $150 million, what is the new equilibrium level of income? What level of government purchases is needed to achieve an income of $2000 million? From question e) you get the newly government purchase. Now find out the multiplier value What is the amount of shift in AD curve? [Use the multiplier value from e)] (b) In a self-regulating economy “X”, labor supply is 40 million but labor demand is 10 million. What will happen in goods and service market simultaneously? Explain this situation with relevant graph. Based on your findings in a) is it denoting long run equilibrium? If not, will the economy be able to restore…arrow_forward

- Question 2 Refer to the information provided in Figure 23.9 below to answer the question(s) that follow. Aggregate expenditures ($ millions) 225 200 175 150 45° AE 100 200 300 Aggregate output ($ millions) Figure 23.9 a) Refer to Figure 23.9. Write the equation for the aggregate expenditure function (AE). Show your work. b) Refer to Figure 23.9. What is the equilibrium level of output in this economy? State the equilibrium condition used to determine this. c) Explain the forces that maintain/drive the economy to this equilibrium by considering what will happen at the following two levels of output, $300 million and $100 million. You will need to discuss changes in investment through unplanned inventories and the response of output. d) Refer to Figure 23.9. How will equilibrium aggregate expenditure and equilibrium aggregate output change as a result of a decrease in investment by $20 million? e)The interest rate is an exogenous factor that effects the level of investment in an economy.…arrow_forwardAn economy is described by the following equations: C=150+0.5 YD I=150 G=200 T=? What is the value of Taxes T, so that the equilibrium level of output (Y*) in this economy is equal to 90O? (Show your workings)arrow_forwardHow would I do D?arrow_forward

- Suppose that we are in an economy with international trade, the government, domestic consumption, and investment. The government retains a tax rate of 10%. - Suppose that we observe this economy at two levels of national income (Y) ceteris paribus: (i) Y = 1,000 and (ii) Y = 1,800. The amounts for each of these desired expenditure categories at each of these levels of Y are given by: At Y = 1,000: + Consumption = 1,000 - Government Spending = 550 %3D Investment = 150 %3D Imports = 100 t Exports = 150 At Y = 1,800: 4 Consumption = 1,560 - Government Spending = 550 Investment = 270 e %3D Imports = 180 Exports = 150 Based upon this data, answer the following questions. We will keep referring to four categories - these are Consumption (C), Investment (1), Government Spending (G), and Net Exports (NX). « | 1. Plot both of the Desired Consumption and Desired Savings Functions, with Y on the x-axis and C & S on the y-axis. Label both functions' y-intercepts, and the x-intercept for the…arrow_forwardSuppose the MPC is 34 and the government wants to increase output by $2000. 1. How much should government spending increase? 2. How much should taxes decrease? (You can leave your answer as a fraction) 3. Describe the intuition behind why these two values are different 4. Suppose instead the government wants to decrease output by $ 2000. By how much should they raise taxes?arrow_forwardUsing a graph and words, explain the effect of SRAS and LRAS curves when the President of the United States would give businesses who invested in new plant and equipment an investment tax credit equal to 10 percent of their investment and the marginal tax rate has been reduced to people who make over $50,000 and are permanent. Will you work more or less when marginal tax rates are cut and will businesses invest more in plant and equipment when an investment tax credit has been implemented by the President of the United States? Also explain in your graph what will happen to equilibrium price level and equilibrium real GDP and the unemployment rate when the marginal tax rates are cut and are permanent for people making over $50,000 and the investment tax credit has been implemented by the President of the United States.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education