ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

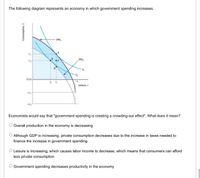

Transcribed Image Text:The following diagram represents an economy in which government spending increases.

PPF,

PPF2

C2

(0,0)

Leisure, I

Economists would say that "government spending is creating a crowding-out effect". What does it mean?

O Overall production in the economy is decreasing

O Although GDP is increasing, private consumption decreases due to the increase in taxes needed to

finance the increase in government spending

Leisure is increasing, which causes labor income to decrease, which means that consumers can afford

less private consumption

O Government spending decreases productivity in the economy

Consumption, C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Instructions: Enter your answers as a whole number. If you are entering any negative numbers be sure to include a negative sign (-) in front of those numbers. (2) Aggregate Expenditures, Output (GDP = DI), Private Closed Economy, Billions (6) Aggregate Expenditures, Open Economy,. (5) Net Exports, (1) Real Domestic (3) Еxports, (4) Imports, Billions Billions Billions Billions Billions $300 $340 $30 $10 350 380 30 10 400 420 30 10 450 460 30 10 500 500 30 10 550 540 30 10 600 580 30 10 650 620 30 10 Net exports = $ billion Equilibrium GDP = $ billion d. What is the multiplier in this example?arrow_forwardUse the figure below to answer the following questions. Aggregate Expenditure (billions of 2012 dollars) 400 360 320 280 240 200 160 120 80 80 40 45° line AE 0 40 80 120 160 200 240 280 320 360 400 Real GDP (billions of 2012 dollars) The economy depicted does not engage in international trade and has no government. Planned aggregate expenditure (AE) is equal to the sum of consumption expenditure (C) and investment (I). Investment is $ billion. If investment increases by $75 billion, then real GDP increases by $ billion.arrow_forwardThe following table shows data for the economy before the decrease in saving. Suppose that the decrease in saving causes consumption to rise from $280 million to $320 million. Assume Say's law holds in this economy. Fill in the data for the economy after the decrease in saving. Before Saving Decrease After Saving Decrease Consumption (C) $280 million $320 million Investment (I) $200 million $ million Government Purchases (G) $250 million $ million Exports (EX) $500 million $500 million Imports (IM) $300 million $300 million As a result of the decrease in saving, total expenditures will .arrow_forward

- 1.1. What is the US GDP for the first quarter and second quarter of 2020? What is the personal consumption expenditures for the first quarter and second quarter of 2020?arrow_forwardA simple economy consists of three industries: agriculture, manifacturing and services. The input-output matrix associated with this economy is A M A 0.1 0.2 0.2 M 0.2 0.2 0.1 S 0.1 0.1 0.3 Find the gross output of goods needed to satisfy a consumer demand for 170 million dollars worth of agricultural products, 150 million dollars worth of manufactured products, and 180 million dollars worth of services. million dollars worth of agricultural products, and million dollars worth of manufactured products. million dollars worth of services.arrow_forwardCa=25+0.75 (Y-T) lg = 50 Xn=10 G = 70 T= 30 (Advanced analysis) The accompanying equations are for a mixed open economy. The letters Y, Calg Xn, G, and T stand for GDP, consumption, gross Investment, net exports, government purchases, and net taxes, respectively. Figures are in billions of dollars. The equilibrium level of GDP for this economy isarrow_forward

- Why is consumption spending insufficient to explain economic growth and rising standards of living?arrow_forwardIn the below table, which decomposes GDP by expenditure for the U.S. and China in 2006. Compute the ratio of saving to GDP for each economy.arrow_forwardTo which city are people from Barbados more likely to migrate?arrow_forward

- Question 2 Diddy spends $1,500 on a new laptop to use in his business in San Francisco. The laptop was built in Canada. Investment spending and net exports both increase by $1500, GDP increases by $3000 Consumption spending increases by $1500, net exports decreases by $1500 Consumption spending and net exports both increase by $1500, GDP increases by $3000 Investment spending and GDP both increase by $1500 Investment spending increases by $1500, net exports decreases by $1500 Consumption spending and GDP both increase by $1500 O Investment spending and net exports both increase by $1500arrow_forwardIn the ruins of an ancient Mesopotamian civilization, Dr. Jones has found what appears to be a partially intact government records about economic activity in the kingdom. From the recovered tablets, he learned that GDP was 12 billion, private consumption was 9.5 billion,transfers to poor were 1.5 billion, private investments were at 2.1 billion, government purchased goods and services in the amount of 1.7 billion and collect 3 million in taxes. Assuming the data are correct, what can you say about(a) net exports, (b) private savings, and (c) public savings. What do the numbers in (a), (b), and (c) mean?arrow_forwardSuppose that we are in an economy with international trade, the government, domestic consumption, and investment. The government retains a tax rate of 10%. - Suppose that we observe this economy at two levels of national income (Y) ceteris paribus: (i) Y = 1,000 and (ii) Y = 1,800. The amounts for each of these desired expenditure categories at each of these levels of Y are given by: At Y = 1,000: + Consumption = 1,000 - Government Spending = 550 %3D Investment = 150 %3D Imports = 100 t Exports = 150 At Y = 1,800: 4 Consumption = 1,560 - Government Spending = 550 Investment = 270 e %3D Imports = 180 Exports = 150 Based upon this data, answer the following questions. We will keep referring to four categories - these are Consumption (C), Investment (1), Government Spending (G), and Net Exports (NX). « | 1. Plot both of the Desired Consumption and Desired Savings Functions, with Y on the x-axis and C & S on the y-axis. Label both functions' y-intercepts, and the x-intercept for the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education