Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

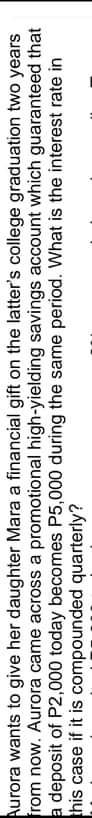

Transcribed Image Text:Aurora wants to give her daughter Mara a financial gift on the latter's college graduation two years

from now. Aurora came across a promotional high-yielding savings account which guaranteed that

a deposit of P2,000 today becomes P5,000 during the same period. What is the interest rate in

this case if it is compounded quarterly?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- If Magda decides to pay her monthly repayments over 25 year period at the interest rate of 10.75 what will be the loan factor?arrow_forwardPoonam wants to invest in an account today tohave S4000 at the end of 8 years. If she caninvest at 4.25% compounded semi-annually,how much does she need to invest?arrow_forwardWithout using Excel and using the formula, Cheryl is setting up a payout annuity and wishes to receive $1200 per month for 20 years. A. How much does she have to deposit if her money earns 8% interest compounded monthly? B. Find the total amount Cheryl will receive from her payout annuity.arrow_forward

- You invest $2000 today at 7% per year. If you leave thisfor your grandchildren by not touching the account for80 years, what is the amount of interest on interestearned for this investment? Please explain how to do this problem in the financial calculator. The most important thing is that I understand how to solve the problem on my ownarrow_forwardplease answerarrow_forwardKaren wants to have $22,559 in her investment account in 5 years. If her bank offers an annual compound interest rate of 1.2% with monthly compounding, how much should she deposit today? Round your answer to the nearest dollar.arrow_forward

- At the time of her grandson's birth, a grandmother deposits $4000 in an account that pays 4% compounded monthly. What will be the value of the account at the child's twenty-first birthday, assuming that no other deposits or withdrawals are made during this period? Click the icon to view some finance formulas. The value of the account will be $ (Round to the nearest dollar as needed.) Formulas In the provided formulas, A is the balance in the account after t years, P is the principal investment, r is the annual interest rate in decimal form, n is the number of compounding periods per year, and Y is the investment's effective annual yield in decimal form. nt A=P(1+1) " P= A (₁.3⁰² Print A=Pet Y Done -1arrow_forwardYou want to make 5 equal deposits into an account paying 7.5 percent so that your child can take out $14,000 per year for college expenses. Your deposits will be at t=1, t=2, t=3, t-4, and t-5. Your child will make withdrawals of $14,000 at t-7, t-8, t-9, and t-10. Assume no inflation of college expenses. How much will you need to deposit each of the next 5 years? t = 0 7 W W 1 8 2 9 DOD W W 3 10 D $14,000 $14,000 $14,000 $14,000 A. $7,483 B. $8,424 C. $7,510 D. $8,073 E. $7,910 4 D 5 Darrow_forwardSuppose that the parents of a young child decide to make annual deposits into a savings account, with the first deposit being made on the child’s fifth birthday and the last deposit being made on the 15th birthday. Then, starting on the child’s 18th birthday, the withdrawals as shown will be made. If the effective annual interest rate is 8% during this period of time, what are the annual deposits in years 5 through 15? Use a uniform gradient amount (G) in your solution. (See shown figure )arrow_forward

- Klipling wants to have $43257 for a down payment on a house ten years from now. She can either deposit one lump sum today or she can wait two years and deposit a lump sum. Assume an annual interest rate of 2.3%. How much additional money must she deposit if she waits for two years rather than making the deposit today? O 757.32 O 774.73 O 1532.05 O 1640.21 O1603.33arrow_forwardYour cousin is currently 12 years old. She will be going to college in 6 years. Your aunt and uncle would like to have $90,000 in a savings account to fund her education at that time. If the account promises to pay a fixed interest rate of 4.2% per year, how much money do they need to put into the account today to ensure that they will have $90,000 in 6 years?arrow_forwardKaren wants to have $22,011 in her investment account in 6 years. If her bank offers an annual compound interest rate of 2% with monthly compounding, how much should she deposit today?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education