FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

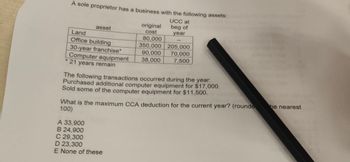

Transcribed Image Text:A sole proprietor has a business with the following assets:

UCC at

beg of

year

asset

Land

Office building

30-year franchise*

Computer equipment

* 21 years remain

original

cost

80,000

350,000 205,000

90,000

70,000

38,000 7,500

The following transactions occurred during the year:

Purchased additional computer equipment for $17,000.

Sold some of the computer equipment for $11,500.

What is the maximum CCA deduction for the current year? (rounde

100)

A 33,900

B 24,900

C 29,300

D 23,300

E None of these

he nearest

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardNonearrow_forwardAsanco Corporation acquired and placed in service the following assets during the year: Asset Date Acquired Cost Basis Building 12/4 $350,000 Computer Equipment 3/2 $40,000 Furniture 4/15 $38,000 Assume that Asanco does not elect §179 expensing and elects not to use bonus depreciation. Answer the following questions. What is Asanco’s first year cost recovery for each asset? Use the format below. Asset Acquisition Date Quarter Recovery Period Original Basis Rate Depreciation Expense What is Asanco’s year 3 cost recovery for each asset if it sells all of these assets on January 10th of year 3? Use the format below. Asset Original Basis Recovery Period Rate Portion of Year Depreciation Expensearrow_forward

- What accounting entry would you do 50:50 joint operation was commenced between two participants. Mary Company contributed cash of $90 000, and Strickland Company contributed a Building with a fair value of $90 000 and a carrying amount of $75 000. Using the line-by-line method of accounting, Strickland Company would record? DR Building in JO $75 000 CR Building $75 000 DR Building in JO $945000 CR Building $37 500 CR Gain on sale of building $7 500 DR Investment in joint operation $45 000 CR Building $37 500 CR Gain on sale of building $7 500 DR Cash in JO $45 000 DR Building in JO…arrow_forwardA1 Wholesale Jewelry Company acquires land for $240,000 cash. Additional costs are as follows: Removal of shed $2,000 Filling and grading 6,000 Proceeds from sale of salvage 1,280 materials Broker commission 4,520 Paving of parking lot 40,000 Closing costs 3,400 A1 will record the acquisition cost of the land at A) $255,920. B) $240,000. C) $254,640. D) $257,200.arrow_forwarda. What is Poplock's year 1 depreciation deduction for each asset? Asset Computer equipment Dog-grooming furniture Pickup truck Commercial building Land (one acre) Total (9 $ (9) (9 $ $ Depreciation Deduction 1,840 1,600 2,000 5,440arrow_forward

- ssarrow_forwardShannon Company acquired land for $56,000 cash. Additional costs are as follow: Title and attorney's fee $300 Insurance of one year $1,500 Broker commission $1,130 Accrued Property taxes $560 Shannon will record the acquisition cost of the land as a. $56,000 b. $57,500 c. $59,490 d. $57,990arrow_forward! Required information [The following information applies to the questions displayed below.] Burbank Corporation (calendar year-end) acquired the following property this year: (Use MACRS Table 1, Table 2 and Exhibit 10-10.) Asset Used copier New computer equipment Furniture New delivery truck Luxury auto Placed in Service November Basis 12 $ 7,800 June 6 14,000 July 15 October 28 January 31 32,000 19,000 70,000 $ 142,800 Total Burbank acquired the copier in a tax-deferred transaction when the shareholder contributed the copier to the business in exchange for stock. (Round your answer to the nearest whole dollar amount.) b. Assuming Burbank would like to maximize its cost recovery deductions by claiming bonus and §179 expense, which assets should Burbank immediately expense? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education