FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Please help I can’t figure out the answer.

Required:

A. Provide Journal Entries

B. Prepare Statement of Stock Holder’s Equity

First Image : In the image, it

shows the list of accounts and The Statement of Stock Holder’s Equity Table (I need answers for the statement of stock holder’s Equity.

Second Image: Journal Entries Table ( I need answers for Journal Entries)

Additional note: Red X marks meant the answers provided were wrong. Green check marks are the correct answers. I need answers for the tables that has wrong (X) answers.

Another note: There is no additional questions on this activity. Required questions A and B are the only ones that needs to be answered. No further questions in this activity. This is not INCOMPLETE, everything is in the pictures (Accounts and questions)

Thanks

Transcribed Image Text:Journal Entries

Statement of Stockholders' Equity

General Journal

Date

Description

Debit

Crrdit

Jan.8

Cash

240000 5

D

Common Stack

60000

Paid-in-Capital in Exces of Par ValuE

180000

IEsued shares of common szock.

Mar.12 Cash

126000

Treasury Stock

103500

Paid-in-Capital from Treasury Stock

Soid shares of treasury stock.

22500

Jun.30 Retained earning

56250 x

Stock Dividend Distributable

15000 x

Paid-in-Capital in Excas of Par Value

56250. *

Deciared stock dividend.

Jul.10

Stock Dividend Distributable

15000 x

Common Stack

15000 x

İssued shares of common ock decared as dividend.

Ort7 Treasury Stock

50000 v

Cash

50000

Purchased shares of common stock for zreasury.

Der. 18 Cash Dividends

76250 x

Đividends Payable

76250 X

Deciared cash aividend

Dec 31 Retained earning

157500 x

Scock Dividends

71250 X

To close the income summary account.

Dec31 Retained earnings

157500 X

Sock dividends

71250 x

Cash Dividends

76250. *

To close the dividend accaunts.

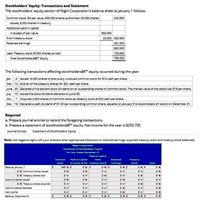

Transcribed Image Text:Stockholders' Equity: Transactions and Statement

The stockholders' equity section of Night Corporation's balance sheet at January 1 follows:

Common stock, $4 par value, 300,000 shares authorized, 60.000 shares

240,000

issued, 6,000 shares in treasury

Additional paid-in capital

In excess of par value

360,000

From treasury stock

22,500 382.500

Retained earnings

261.000

883,500

Less: Treasury stock (6,000 shares) at cost

103,500

Total Stockholders†Equity

780,000

The following transactions affecting stockholders’ equity occurred during the year:

Jan.

8 Issued 15,000 shares of previously unissued common stock for $16 cash per share.

Mar. 12 Sold all of the treasury shares for $21 cash per share.

June 30 Deciared a five percent stock dividend on all outstanding shares of comman stock. The market value of the stock was $19 per share.

July 10 ssued the stock dividend declared on June 30.

7 Acquired 2500 shares of common stock as treasury stock at $20 cash per share.

Dec. 18 Declared a cash dividend of 51.00 per outstanding common share, payable on January 9 to stockholders of record on December 31.

Required

a. Prepare journal entries to record the foregoing transactions.

b. Prepare a statement of stockholders†equity. Net income for the year is $255.750.

Journal Entries

Statement of Stockholders' Equity

Note: Use negative signs with your answers when appropriate (reduction to retained earnings, acquired treasury stock and treasury stock balances).

Night Corporation

Statement of Stockhoiders' Equity

For Year Ended December 31

Paid-in-Capital

Common

Paid-in-Capital

from

Retained

Treasury

Stock

in Excess of Par Treasury Stock

Earnings

Stock

Total

Balance January 1

240 x S

O xS

0 x Common shares issued

0 x Treasury shares soid

Stock Dividends Issued

0 x Treasury shares acquired

Cash Dividends Declared

Net Income

Salance. December 31

0 xS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

a simple

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

a simple

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Requirement General Journal General Ledger Trial Balance Fair Value Adj Transaction Analysis Fin St Impact For each transaction, indicate the change, if any, in total assets and total equity. If equity changes, indicate whether the change was reflected as a component of net income, or directly within the stockholders' equity portion of the balance sheet. Remember that the change in total assets must agree with the change in total equity. Show less Change in Change in equity: Total assets As a component of net income As a direct component of stockholders' equity Total change in equity Apr. 16) Purchased 4,000 shares of Smith Co. stock at $30 per share. $0 $0 $0 Jul. 7) Purchased 2,500 shares of Edmunds Co. stock at $55 per share. 0 0 Jul. 20) Purchased 1,200 shares of Delray Co. stock at $22 per share. 0 0 Aug. 15) Received an $1.00 per share cash dividend on the Smith Co. stock. 0 Aug. 28) Sold 2,400…arrow_forward6arrow_forwardBuild a T-account for each part of the expanded accounting equation. (1) Drag the debit "DR" and credit "CR" labels to the appropriate sides of the T-account. (2) Drag the normal balance label to the correct side of the T- account. (3) Label which side of the t-account increases "+" and decreases "" that account. view drag.and drop keyboard instructions Debit Normal Credit Balance Land Common Stock Dividends Depreciation Expense- Equipmerit Unearnied Revenue Service Revenuearrow_forward

- Which additional account is used when you close Opening Balance Equityarrow_forwardMargot and Orlando are trying to understand when to record journal entries for dividends. Which of the following dates related to dividends require(s) a journal entry? Select all that apply. Date of record Ex-Dividend Date Date of payment Date of declaration Larrow_forwardPlease answer with reason for all why the option is correct and why the other options are incorrect.. Accounting type Question: A Trial Balance shows A. The balance of Profit and Loss Account B. Complete accuracy of accounting done by the accountant C. Arithmetical accuracy of ledger balances D. Balance between assets and liabilities Answer: Option Carrow_forward

- And prepare the equity section of the balance sheet pleasearrow_forwardIdentify the type of account (Asset, Liability, Equity, Revenue, Expense), normal balance (Debit, Credit), financial statement (Balance Sheet, Income Statement), and whether the account is closed at the end of the period (Yes, No) by selecting the letter that best describes those attributes. If an account is a contra or adjunct account, the answer will show the account type in parentheses. Answer items may be used once, more than once, or not at all. Retained Earnings 1. Equity, Credit, Balance Sheet, No 2. Freight-Out Liability, Credit, Balance Sheet, No V Loss on Impairment of Intangible Assets 3. Expense, Debit, Income Statement, Yes 4. Gain on Acquisition of Business (Equity), Debit, Balance Sheet, No 5. Amortization of Copyrights Asset, Debit, Income Statement, Yes Allowance for Doubtful Accounts 6. Expense or Loss, Credit, Income Statement, Yes Land 7. Revenue or Gain, Credit, Income Statement, Yes Federal Income Tax Withheld 8. (Revenue or Gain), Debit, Income Statement, Yes…arrow_forwardplease step by step solution. please introductio of this solution.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education