ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

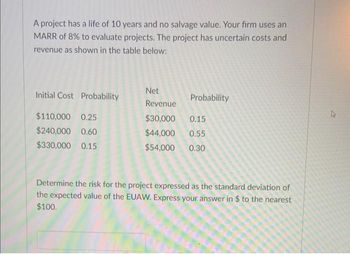

Transcribed Image Text:A project has a life of 10 years and no salvage value. Your firm uses an

MARR of 8% to evaluate projects. The project has uncertain costs and

revenue as shown in the table below:

Net

Initial Cost Probability

Probability

Revenue

$110,000 0.25

$30,000 0.15

$240,000 0.60

$44,000

0.55

$330,000 0.15

$54,000

0.30

Determine the risk for the project expressed as the standard deviation of

the expected value of the EUAW. Express your answer in $ to the nearest

$100.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Solve neatly with proper explanationarrow_forwardNo excelarrow_forward1) The sensitivity graph of a project is presented below: 70 60 Present Worth ('000 $) 50 40 30 SV 20 10 MARR -20% -15% -10% -5% C) FC D) VC E) O&M Base Deviation What is the most sensitive input of the project? A) MARR B) SV O&M FC VC 0% 5% 10% 15% 20%arrow_forward

- Don’t use excel Show workarrow_forwardA project with uncertainty is under consideration for implementation. The values are shown in the table below. Calculate the Expected Value of the Net Present Worth of this project. n Proba FC Annual Benefit ProbaB 7% ($100,500) ($100,500) ($100,500) ($100,500) ($100,500) ($100,500) $50,000 $22,000 $37,000 $20,000 $5,000 $95,000 8 23% 43% 55% 35% 7% 8. 35% 7% 8 21% 7% 7% 7% 27% 65% 10 75% 10 85% 10 10% 5%arrow_forwardIC OM B D Life/years X OY OZ OW OV Y $420,000 $45,000 $110,000 $20,000 10 Z $540,000 $35,000 $260,000 $45,000 20 W V $500,000 $200,000 $50,000 $20,000 $80,000 $180,000 $10,000 $30,000 10 20 $250,000 $40,000 $90,000 $10,000 15 based on the above ME alternatives and using the B/C analysis, which alternative we should select?i=10%. Xarrow_forward

- 20 O It costs a pharmaceutical company $35,000 to produce a 1000-pound batch of a drug. The average yield from a batch is unknown but the best case is 90% yield (that is, 900 pounds of good drug will be produced), the most likely case is 85% yield, and the worst case is 70% yield. The annual demand for the drug is unknown, with the best case being 22,000 pounds, the most likely case 18,000 pounds, and the worst case 12.000 pounds. The drug sells for $60 per pound and leftover amounts of the drug can be sold for $8 per pound. To maximize annual expected profit, how many batches of the drug should the company produce? You can assume that it will produce the batches only once, before demand for the drug is known. You should consider a range of batches between 13 and 22.arrow_forwardThe annual profit from an investment is $20,000 each year for 5 years and the cost of investment is $80,000 with a salvage value of $50,000. The discount rate (cost of capital) at this risk level is 12%. Based on the given information, the net present value of the investment = $ 20,467 (round your response to the nearest whole number).arrow_forwardManagement Kdan Cloud main-2-11 2 A= Outlines Q Search R Share Tool TT Ov Comment & Markup ►Functions of two variables Solutions 195% + T Annotation FAX OCR Q Editor OCR Convert Fax Search ii. Add a contour plot for the profit function and use this to estimate the maximum profit that the company can realize with this budget and the corresponding production amounts. iii. Now find the exact values for the production amounts and the maximum profit by compu- tation. 19. A firm produces two product: ⚫ a niche product with inverse demand function given by p₁ = 100-291, and • a standard product with fixed price of 2 monetary units, so p2 = 2. The variable production cost for the niche product is 5 monetary units per unit of production; for the standard product it is 1 monetary unit per unit of production. There is a fixed production cost of 100. (a) Find the equation of the revenue function R (91,92), as well as its domain. (b) Show on a graph which production amounts for the two products…arrow_forward

- 300 +A 250 200 150 100 (intel CORE IS 50- 06. The Average Total Cost (AC) reaches a minimum at O (a) Q=6 O (b) Q=10 0 Q 0 2 4 6 8 10 12 14 16 18 20 (c) Q=12 O (d) Q=15 # TC Type here to search TVC St TFC 30 25 20 15 10 5 Click Save and Submit to save and submit. Click Save All Answers to save all answers. SA 0 0 2 4 6 8 10 12 14 16 18 20 Save All Answers MC AC AVC AFC (? Save and Submit DELLarrow_forwardPlease do not give solution in image format thankuarrow_forwardMcBurger Inc., wants to redesign its kitchen to improve productivity and quality. Three designs,called B1, B2, and B3, are under consideration. No matter which design is used, daily demandfor sandwiches at a typical McBurger restaurant is 500 sandwiches. A sandwich costs 500 baizato produce. Non-defective sandwich sell, on average, for 1 OR per sandwich. Defective sandwichcannot be sold and are scrapped. The goal is to chose a design that maximizes the expected profitat a typical restaurant over a period of one year (365 days). Designs B1, B2, and B3 cost 40,0003OR, 50,000 OR, and 70,000 OR, respectively. Under design B1, there is 0.8 chance that 90 outof each 100 sandwiches are non-defective and 0.2 chance that 70 out of each 100 sandwiches arenon-defective. Under design B2, there is 0.85 chance that 90 out of each 100 sandwiches are nondefective and 0.15 chance that 75 out of each 100 sandwiches are non-defective. Under design B3,there is 0.9 chance that 95 out of each 100 sandwiches…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education