FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

a) Prepare the statement of

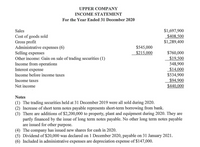

Transcribed Image Text:UPPER COMPANY

INCOME STATEMENT

For the Year Ended 31 December 2020

Sales

$1,697,900

$408,500

$1,289,400

Cost of goods sold

Gross profit

Administrative expenses (6)

Selling expenses

Other income: Gain on sale of trading securities (1)

Income from operations

Interest expense

$545,000

$215,000

$760,000

$19,500

548,900

$14,000

$534,900

$94,900

$440,000

Income before income taxes

Income taxes

Net income

Notes

(1) The trading securities held at 31 December 2019 were all sold during 2020.

(2) Increase of short term notes payable represents short-term borrowing from bank.

(3) There are additions of $2,200,000 to property, plant and equipment during 2020. They are

partly financed by the issue of long term notes payable. No other long term notes payable

are issued for other purpose.

(4) The company has issued new shares for cash in 2020.

(5) Dividend of $20,000 was declared on 1 December 2020, payable on 31 January 2021.

(6) Included in administrative expenses are depreciation expense of $147,000.

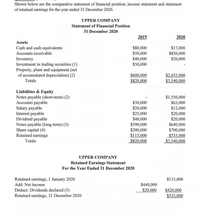

Transcribed Image Text:Shown below are the comparative statement of financial position, income statement and statement

of retained earnings for the year ended 31 December 2020.

UPPER COMPANY

Statement of Financial Position

31 December 2020

2019

2020

Assets

$80,000

$50,000

$40,000

$50,000

$17,000

$850,000

$20,000

Cash and cash equivalents

Accounts receivable

Inventory

Investment in trading securities (1)

Property, plant and equipment (net

of accumulated depreciation) (2)

$600,000

$820,000

$2,653.000

$3,540,000

Totals

Liabilities & Equity

Notes payable (short-term) (2)

Accounts payable

Salary payable

Interest payable

Dividend payable

Notes payable (long-term) (3)

Share capital (4)

Retained earnings

$30,000

$20,000

$25,000

$40,000

$390,000

$200,000

$115,000

$820,000

$1,550,000

$63,000

$12,000

$20,000

$20,000

$640,000

$700,000

$535,000

$3,540,000

Totals

UPPER COMPANY

Retained Earnings Statement

For the Year Ended 31 December 2020

Retained earnings, 1 January 2020

$115,000

$440,000

$20,000

Add: Net income

Deduct: Dividends declared (5)

Retained earnings, 31 December 2020

$420,000

$535,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the following information from Dubuque Company’s financial statements to prepare the operating activities section of the statement of cash flows (indirect method) for the year 2018.arrow_forwardOn a statement of cash flows , the net amount of cash provided by (or used for ) items that normally appear on the income statement are : Financing activities Investing activities Operating activitiesarrow_forwardWhat is Target’s balance of cash equivalents for the fiscal year ended January 30,2016?arrow_forward

- When using the indirect method of determining net cash flows from operating activities, how are revenues and expenses reported on the statement of cash flows if their cash effects are identical to the amounts reported in the income statement?arrow_forwardThe income statement and the cash flows from operating activities section of the statement of cash flows are provided below for Syntric Company. The merchandise inventory account balance neither increased nor decreased during the reporting period. Syntric had no liability for insurance, deferred income taxes, or interest at any time during the period. Sales Cost of goods sold Gross margin Salaries expense Insurance expense Depreciation expense Depletion expense Interest expense Gains and losses: Gain on sale of equipment Loss on sale of land Income before tax Income tax expense SYNTRIC COMPANY Income Statement For the Year Ended December 31, 2024 ($ in thousands) Net income Cash Flows from Operating Activities: Cash received from customers Cash paid to suppliers Cash paid to employees Cash paid for interest Cash paid for insurance Cash paid for income tax Net cash flows from operating activities $35.0 16.9 9.0 3.4 10.4 $ 271.7 (168.8) 102.9 (74.7) 19.0 (6.4) 40.8 (20.4) $ 20.4 $225.0…arrow_forwardUse the following information from Isthmus Company's financial statements to prepare the operating activities section of the statement of cash flows (indirect method) for the year 2018. What is the net cash flows from operating activities for 2018? Cash Account Receivable Inventory Accounts Payable Salaries Payable Additional information: Net income Depreciation expense $77,600 $45,200 $11,900 $36,000 Dec. 31, 2018 $295,000 45,300 92,200 23,000 1,700 45,200 33,300 Dec. 31, 2017 $259,000 48,700 91,000 26,300 1,500arrow_forward

- Activity reported in the Financing Activities section of the statement of cash flows would include accounts classified as a.current assets and current liabilities. b.long-term assets and long-term liabilities. c.long-term liabilities and stockholders' equity. d.current liabilities and stockholders' equity.arrow_forwardHamburger Heaven's income statement for the current year and selected balance sheet data for the current and prior years ended December 31 are presented below. Income Statement Sales Revenue $1,860 Expenses: Cost of Goods Sold 850 Depreciation Expense Salaries and Wages Expense Rent Expense 150 450 200 Insurance Expense 75 Interest Expense Utilities Expense 45 Net Income 35 Selected Balance Sheet Accounts Current Year Prior Year 72 Inventory Accounts Receivable 55 355 400 Accounts Payable Salaries/Wages Payable Utilities Payable Prepaid Rent Prepaid Insurance 225 260 39 25 25 10 14 TIP: Prepaid Rent decreased because the amount taken out of Prepaid Rent (and subtracted from net income as Rent Expense) was more than the amount paid for rent in cash during the current year. Required: Prepare the cash flows from operating activities section of the statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.)arrow_forwardPrepare the Cash Flow for the year 2021arrow_forward

- Requirement 1. Prepare the statement of cash flows of Morston Educational Supply for the year ended Dec 31,2024. Use the indirect method to report cash flows from operating. Requirement 2. If morston plans similar activity for 2025 what is it’s expected free cash flow? Select the labels and enter the amounts to calculate morstons expected free cash flow for 2025arrow_forwardPlease explain how to prepare a statement of cash flows (indirect method) including analyzing tables for a two year period such as : Statement of Cash Flows As of December 31, 2022 and 2021 Please provide an example. Thank you,arrow_forwardExercise 12-12 (Algo) Indirect: Preparing statement of cash flows LO P2, P3, A1 [The following information applies to the questions displayed below.] The following financial statements and additional information are reported. IKIBAN INCORPORATED Comparative Balance Sheets 2021 At June 30 Assets Cash Accounts receivable, net Inventory Prepaid expenses Total current assets 2020 $ 94,900 96,500 84,800 6,500 282,700 145,000 (37,500) $ 390,200 $ 65,000 72,000 118,000 9,600 264,600 136,000 (19,500) $ 381,100 Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Wages payable Income taxes payable Total current liabilities Notes payable (long term) Total liabilities Equity Common stock, $5 par value Retained earnings $ 46,000 8,100 5,500 59,600 51,000 110,600 $ 61,500 19,200 8,000 88,700 81,000 169,700 262,000 17,600 181,000 30,400 $ 381,100 Total liabilities and equity $ 390,200 IKIBAN INCORPORATED Income Statement For Year Ended June 30, 2021 $…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education