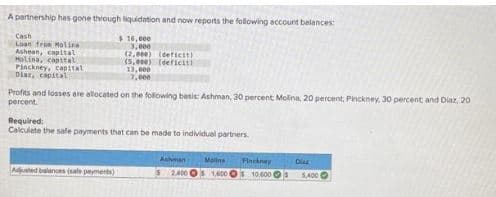

A partnership has gone through liquidation and now reports the following account balances $ 16,000 3,000 (2.000) (deficit) (5,000) (deficit 13,000 Cash Loan from Malin capital Molina, capital Pinckney, capital Diar, capital Profits and losses are allocated on the following besis: Ashman, 30 percent Molina, 20 percent, Pinckney, 30 percent and Diar, 20 percent Required: Calculete the safe payments that can be made to individual partners. Aded balances (sale payments) Male 1600 OS 10.600 Dias s 1,400 -

A partnership has gone through liquidation and now reports the following account balances $ 16,000 3,000 (2.000) (deficit) (5,000) (deficit 13,000 Cash Loan from Malin capital Molina, capital Pinckney, capital Diar, capital Profits and losses are allocated on the following besis: Ashman, 30 percent Molina, 20 percent, Pinckney, 30 percent and Diar, 20 percent Required: Calculete the safe payments that can be made to individual partners. Aded balances (sale payments) Male 1600 OS 10.600 Dias s 1,400 -

Chapter11: Property Dispositions

Section: Chapter Questions

Problem 53P

Related questions

Question

Transcribed Image Text:A partnership has gone through liquidation and now reports the following account balances:

Cash

$16,000

3,000

Loan from Malina

Ashean, capital

Molina, capital

Pinckney, capital

Diaz, capital

(2,000) (deficit)

(5,000) (deficit!

13,000

7,000

Profits and losses are allocated on the following basis: Ashman, 30 percent Molina, 20 percent, Pinckney, 30 percent and Diaz, 20

percent.

Required:

Calculate the safe payments that can be made to individual partners.

Adjusted balances (sale payments)

Molina

Finckney

Dies

5 2.400 $ 16000 10,000 $ 5,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,