FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

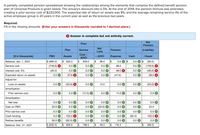

Transcribed Image Text:A partially completed pension spreadsheet showing the relationships among the elements that comprise the defined benefit pension

plan of Universal Products is given below. The actuary's discount rate is 5%. At the end of 2019, the pension formula was amended,

creating a prior service cost of $220,000. The expected rate of return on assets was 8%, and the average remaining service life of the

active employee group is 20 years in the current year as well as the previous two years.

Required:

Fill in the missing amounts. (Enter your answers in thousands rounded to 1 decimal place.)

Answer is complete but not entirely correct.

Net

Pension

Prior

Net

Plan

Service

Pension

(Liability)

Loss

($ in thousands)

Cost -

AOCI

I Asset

PBO

Assets

- AOCI

Expense

Cash

Balance, Jan. 1, 2021

$ (580.0)

$ 520.0

$ 209.0

$

58.0

0.0 O $

0.0 O $

(60.0)

Service cost

(118.0) 8

0.0 O

0.0

0.0

98.0

0.0 V

(118.0) X

Interest cost, 5%

(29.0)

0.0 O

0.0 V

0.0

49.0 X

0.0 O

(49.0) X

Expected return on assets

0.0 O

57.6 X

0.0 V

0.0 O

(41.6)

0.0

58.0 X

Adjust for:

Loss on assets

0.0 O

(23.0) X

0.0 O

13.0

0.0 O

0.0 V

(23.0) X

Amortization:

Prior service cost

0.0 O

0.0 O

(11.0) O

0.0

11.0

0.0

0.0

Amortization:

Net loss

0.0 V

0.0 O

0.0 V

0.0 O

0.0 O

0.0 O

0.0

Gain on PBO

22.0 V

0.0 O

0.0 O

(22.0) O

0.0

0.0 O

22.0

Prior service cost

0.0 O

0.0 O

0.0 O

0.0 V

0.0

0.0 O

0.0

Cash funding

0.0 O

102.0 X

0.0 O

0.0 O

0.0 O

(82.0)

102.0 X

Retiree benefits

50.0 V

(50.0) O

0.0 O

0.0

0.0 O

0.0 O

0.0

Balance, Dec. 31, 2021

$ (635.0)

$ 606.6

198.0

49.0

116.4

(68.0)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Do not give image formatarrow_forwardClark Industries has a defined benefit pension plan that specifies annual, year-end retirement benefits equal to: 1.6% × Service years × Final year's salary Stanley Mills was hired by Clark at the beginning of 2005. • Mills is expected to retire at the end of 2049 after 45 years of service. • His retirement is expected to span 15 years. At the end of 2024, 20 years after being hired, his salary is $84,000. • The company's actuary projects Mills's salary to be $310,000 at retirement. The actuary's discount rate is 6%. For all requirements, round final answers to the nearest whole dollars. Do not round intermediate calculations. Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. Estimate the amount of Stanley Mills's annual retirement payments for the 15 retirement years earned as of the end of 2024. 2. Suppose Clark's pension plan permits a lump-sum payment at retirement in lieu of annuity payments. Determine…arrow_forwardSachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.6% x service years x final year's salary. payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2010 and is expected to retire at the end of 2044 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $84,000 at the end of 2024 and the company's actuary projects her salary to be $250,000 at retirement. The actuary's discount rate is 6%. Note: Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. EVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) Required: 2. Estimate by the projected benefits approach the amount of Davenport's annual retirement payments earned as of the end of 2024. 3. What is the company's projected benefit obligation at the end of 2024 with respect to Davenport? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar. 4. If no estimates are changed in…arrow_forward

- Tesla, Inc. sponsors a defined-benefit pension plan. The following data relates to theoperation of the plan for the year 2021.Service cost $ 545,000Contributions to the plan 330,000Actual return on plan assets 270,000Projected benefit obligation (beginning of year) 3,600,000Fair value of plan assets (beginning of year) 2,400,000The expected return on plan assets and the settlement rate were both 10%. The amountof pension expense reported for 2021 isa. $545,000.b. $635,000.c. $665,000.d. $905,000.arrow_forwardKath Company's pension plan began on 1/1/20. During 2020 it earned $21 more on its assets than it expected and changes in actuarial assumptions caused the PBO to increase by $13. In 2021, actual earnings on plan assets was $9 and expected return was $14. During 2021, actuaries determined that life expectancies are longer than originally estimated, causing the PBO to change by $12. Gain/loss did not need to be amortized in 2020 or 2021. What is unamortized gain or loss on 12/31/21? Provide a dollar amount and circle gain or loss.arrow_forwardThe Kollar Company has a defined benefit pension plan. Pension information concerning the fiscal years 2024 and 2025 are presented below ($ in millions): Information Provided by Pension Plan Actuary: a. Projected benefit obligation as of December 31, 2023 = $3,350. b. Prior service cost from plan amendment on January 2, 2024 = $650 (straight-line amortization for 10-year average remaining service period). c. Service cost for 2024 = $650. d. Service cost for 2025 = $700. e. Discount rate used by actuary on projected benefit obligation for 2024 and 2025 = 10%. f. Payments to retirees in 2024 $510. g. Payments to retirees in 2025 $580. h. No changes in actuarial assumptions or estimates. 1. Net gain-AOCI on January 1, 2024 = $375. J. Net gains and losses are amortized for 10 years in 2024 and 2025. Information Provided by Pension Fund Trustee: a. Plan asset balance at fair value on January 1, 2024 = $2,400. b. 2024 contributions $670. c. 2025 contributions $720. d. Expected long-term rate…arrow_forward

- Presented below is pension information related to Tyre Recycling Inc., for the calendar year 2019. The corporation uses ASPE. Current service costs $ 50,000 Contributions to the plan 55,000 Actual return on plan assets 40,000 Defined benefit obligation (beginning of year) 600,000 Fair value of plan assets (beginning of year) 400,000 Interest cost on the obligation 10% The pension expense to be reportedfor 2019 is Select one: a. $110,000. b. $70,000. c. $65,000. d. $50,000. e. None of the above.arrow_forwardNonearrow_forwardAt January 1, 2020, Cullumber Company had plan assets of $305,800 and a projected benefit obligation of the same amount. During 2020, service cost was $27,100, the settlement rate was 10%, actual and expected return on plan assets were $24,900, contributions were $20,200, and benefits paid were $17,300.Prepare a pension worksheet for Cullumber Company for 2020. CULLUMBER COMPANY General Journal Entries Memo Record Items PensionExpense Cash PensionAsset/Liability ProjectedBenefitObligation PlanAssets 1/1/20 $enter a dollar amount select a debit or credit $enter a dollar amount select a debit or credit $enter a dollar amount select a debit or credit $enter a dollar amount select a debit or credit…arrow_forward

- Richmond Company's defined benefit pension plan had a Projected Benefit Obligation (PBO) of $250,000 on January 1, 2021. During 2021, a) Richmond paid pension benefit: of $30,000, b) the plan's discount rate was 10%; c) the plan's service cost was $95,000; and d) the plan assets increased by $70,000. What is the value of Richmond's PBO at December 31, 2021? Multiple Choice $270,000 O $340,000 O $245,000 O $410,000arrow_forwardCoparrow_forwardClark Industries has a defined benefit pension plan that specifies annual, year-end retirement benefits equal to: 1.5% × Service years Final year's salary Stanley Mills was hired by Clark at the beginning of 2005. Mills is expected to retire at the end of 2049 after 45 years of service. His retirement is expected to span 15 years. At the end of 2024, 20 years after being hired, his salary is $94,000. The company's actuary projects Mills's salary to be $410,000 at retirement. The actuary's discount rate is 6% For all requirements, round final answers to the nearest whole dollars. Do not round Intermediate calculations. Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. EVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) Required: 1. Estimate the amount of Stanley Mills's annual retirement payments for the 15 retirement years earned as of the end of 2024. 2. Suppose Clark's pension plan permits a lump-sum payment at retirement In lieu of annuity payments. Determine the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education