Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

A 38.

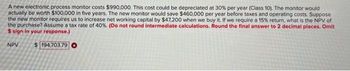

Transcribed Image Text:A new electronic process monitor costs $990,000. This cost could be depreciated at 30% per year (Class 10). The monitor would

actually be worth $100,000 in five years. The new monitor would save $460,000 per year before taxes and operating costs. Suppose

the new monitor requires us to increase net working capital by $47,200 when we buy it. If we require a 15% return, what is the NPV of

the purchase? Assume a tax rate of 40%. (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit

$ sign in your response.)

NPV $ 194,703.79 O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Concept.

VIEW Step 2: Computation of depreciation , Tax savings on depreciation and WDV at the end of year 5.

VIEW Step 3: Computation of cash inflows on sale of monitor at the end of year 5.

VIEW Step 4: Computation of cash inflows from year 1 to year 5.

VIEW Step 5: Computation of NPV.

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- To develop Olympic hopefuls, a municipality will construct a dual-purpose facility: a refrigerated parking garage that can also be used as a ski tunnel for training skiers. Estimates for two proposals are given below. The municipality uses an annual interest rate of 10%. Project Life Initial Investment Present Worth of Benefits Present Worth of O&M Costs Benefit-Cost ratio (10%) Proposal 1 50 years $10,000,000 $21,812,592 $1,982,963 ? Proposal 2 50 years $15,000,000 $32,223,147 $3,965,926 1.70 a. What is the Benefit-Cost ratio for "Proposal 1?" [Select] b. Based on a Benefit-Cost analysis, which proposal should be selected? [ Select] 2arrow_forwardCh. 5 Practice Questions Pg. 387 #4 The formula for estimating cost behavior is y=a + bx. Explain what each term represents.arrow_forwardDetermine the range of the following set of values. 48 42 55 28 112 79 95 27 36 14 96 193 191arrow_forward

- Data: So 101; X= 114; 1+r= 1.12. The two possibilities for sr are 143 and 85.arrow_forwardductarrow_forwardHansen Corporation. a C Corporation (mot a manufacturer) reports the following items in income and expenses for 2021 Gross Revenue $900,000 Dividend Received from 30% owned Corp 200,000 LTCG 30,000 STCL 12000 City of Lee's Summit Bond Interest 10000 COGS 375000 Administrative Expenses 325000 Charitable Contribution 60,000 Compute Hansen's C Corp Taxable income?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education