Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

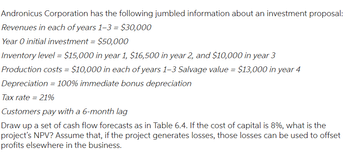

Transcribed Image Text:Andronicus Corporation has the following jumbled information about an investment proposal:

Revenues in each of years 1-3 = $30,000

Year O initial investment = $50,000

Inventory level = $15,000 in year 1, $16,500 in year 2, and $10,000 in year 3

Production costs = $10,000 in each of years 1-3 Salvage value = $13,000 in year 4

Depreciation = 100% immediate bonus depreciation

Tax rate=21%

Customers pay with a 6-month lag

Draw up a set of cash flow forecasts as in Table 6.4. If the cost of capital is 8%, what is the

project's NPV? Assume that, if the project generates losses, those losses can be used to offset

profits elsewhere in the business.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What is the NPV of the estimated cash flows for the following project using a Weighted Average Cost of Capital of 7.0%? Year 0 1 2 3 Cash Flow -140 50 70 90 Group of answer choices 47.54 38.63 59.94 70.00 41.34arrow_forwardA project has the cash flows shown in the following table. If the cost of capital is 9%, what is the NPV of the project? Year 0 1 2 3 4 5 6 Incremental Free Cash Flow -913 281 281 281 281 281 191 Question 5Answer a. $294 b. $272 c. $312 d. $325arrow_forwardConsider the following project: Period Net cash flow 0 -100 1 0 2 78.55 3 78.55 The internal rate of return is 20%. The NPV, assuming a 20% opportunity cost of capital, is exactly zero. Calculate the expected economic income and economic depreciation in each year. (Negative answers should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places.) 1 Period 2 3 Change in value (economic depreciation) (20.00) 54.55 65.46 Expected economic incomearrow_forward

- The internal rate of return is defined as the: OOO rate of return a project will generate if the project is financed solely with internal funds. maximum rate of return a firm expects to earn on a project. discount rate that equates the net cash inflows of a project to zero. discount rate that causes the profitability index for a project to equal zero. discount rate which causes the net present value of a project to equal zero.arrow_forwardIf a project has a positive net present value, then which of the following statements are correct? I. The present value of all cash inflows must equal the costs of the project. The IRR is equal to the required rate of return. II. A increase in the project's initial cost will cause the project to have a higher positive NPV. III. Any delay in receiving the projected cash inflows will cause the project to have a higher positive NPV. IV. IRR must equal zero. Only II Only III All None of themarrow_forwardFor the given cash flows, suppose the firm uses the NPV decision rule. Year Cash Flow 0 –$ 148,000 1 64,000 2 75,000 3 59,000 a. At a required return of 12 percent, what is the NPV of the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. At a required return of 21 percent, what is the NPV of the project? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education