ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

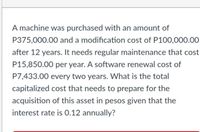

Transcribed Image Text:A machine was purchased with an amount of

P375,000.00 and a modification cost of P100,000.00

after 12 years. It needs regular maintenance that cost

P15,850.00 per year. A software renewal cost of

P7,433.00 every two years. What is the total

capitalized cost that needs to prepare for the

acquisition of this asset in pesos given that the

interest rate is 0.12 annually?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Paul works for a government agency in southern California making $65,000 per year. He is now being transferred to a branch office in Tennessee. The salary reduction associated with this transfer is cost of is cost living in by this in pay Tennessee is 96. Over the next five years, what is the FW of Paul's extra income/improved life style (through the reduced cost of living) from having made this move? Paul's MARR is 10% per year ( that in Click the icon to view the interest and annuity table for discrete compounding when/-10% per year The FW of Paul's extra income/improved life style is $(Round to the nearest dollar)arrow_forwardOn August 6, 2021, Nike purchased new cash registers for their stores for $105,000 total. They will realize a $9,700 profit on the first Friday of every month ( Hint: You will need a calendar) starting on 9/3/2021 for an entire year (ending on July 1, 2022). What is the rate of return of this project? (X.X%)arrow_forwardLittrell's Nursery needs a new irrigation system. System one will cost $145,000, have annual maintenance costs of $10,000, and need an overhaul at the end of year six costing $30,000. System two will have first year maintenance costs of $5,000 with increases of $500 each year thereafter. System two would not require an overhaul. Both systems will have no salvage value after 12 years. If Littrell's cost of capital is 4%, using annual worth analysis determine the maximum Littrell's should be willing to pay for system two.arrow_forward

- A transit system is considering buying 6 more buses to provide better service. It will cost $100,000 for buying a new bus and $15,000 per year for maintenance and operation for the following 8 years. If the city’s MARR is 8%, what is the equivalent uniform annual cost of this project? Assume the bus has no value at the end of 8 years.arrow_forward* 8arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education