Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

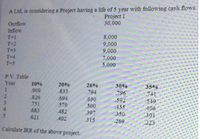

Transcribed Image Text:A Ltd. is considering a Project having a life of 5 year with following cash flows

Project I

30,000

Outflow

Inflow

T-1

T-2

8,000

9,000

T-3

T-4

T-5

9,000

7,000

5,000

P.V. Table

Year

10%

909

20

269

309%

35%6

741

.833

.794

796

2.

.826

.694

.630

500

592

751

.683

549

406

301

579

455

482

397

350

.621

402

315

269

223

Calculate IRR of the above project.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Crenshaw Enterprises has gathered projected cash flows for two projects. Year Project Project J 0 1234 -$260,000-$260,000 114,000 105,000 89,000 78,000 91,000 100,000 a. Interest rate b. 102,000 109,000 a. At what interest rate would the company be indifferent between the two projects? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. Which project is better if the required return is above this interest rate? do %arrow_forwardAn investment project provides cash inflows of $740 per year for 9 years. What is the project payback period if the initial cost is $1,480? A. 2.00 years B. 2.02 years C. 1.90 years D. 1.94 years E. 2.04 years What is the project payback period if the initial cost is $4,958? A. 6.70 years B. 6.77 years C. 6.37 years D. 6.83 years E. 6.50 years What is the project payback period if the initial cost is $7,400? A. 3.01 years B. Never C. 4.95 years D. 5.25 years E. 1.35 yearsarrow_forwardHansabenarrow_forward

- Pm.4arrow_forwardA company is considering a project with a cost of $248,000. The cash flows for the project are provided in the table below. If the required return for the project is 14.2%, what is the project's NPV? Year CF 1 $68,500 2 $72,800 3 $75,300 4 $81,400 5 $78,200 $81,422 $128,200 $6,481 $222,838 $254,481arrow_forwardi need the answer quicklyarrow_forward

- Duo Corporation is evaluating a project with the following cash flows: Year Cash Flow -$ 30,000 012345 12,200 14,900 16,800 13,900 -10,400 The company uses an interest rate of 8 percent on all of its projects. Calculate the MIRR of the project. (Do not round intermediate calculation your answer as a percent rounded to 2 decimal places, e.g., 32.16.) MIRR %arrow_forwardWhat is Project A's Modified Internal Rate of Return with a WACC of 7.75%? YEAR 0 1 2 3 4 CASH FLOWS Project A -$1050 675 650 Project B -$1050 360 360 360 360arrow_forwardHere are the expected cash flows for three projects: Cash Flows (dollars) Year 2 Project A C Year 8 -6,588 -2,580 -6,500 Year 1 +1,375 +1,375 +2,588 +1,375 +1,375 Year 3 +3,758 +2,758 +3,750 Year 4 8 +3,750 +5,758 a. What is the payback period on each of the projects? b. If you use the payback rule with a cutoff period of 2 years, which projects will you accept? c. If you use a cutoff period of 3 years, which projects will you accept? d-1. If the opportunity cost of capital is 12%, calculate the NPV for projects A, B, and C. Note: Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places. d-2. Which projects have positive NPVs? e. "Payback gives too much weight to cash flows that occur after the cutoff date." True or false? a. Payback period b. If you use the payback rule with a cutoff period of 2 years, which projects will you accept? c. If you use a cutoff period of 3 years, which projects will you accept?…arrow_forward

- 6.arrow_forwardDuo Corporation is evaluating a project with the following cash flows: Year Cash Flow 0 -$ 28,400 1 10,600 2345 13,300 15,200 S 12,300 -8,800 The company uses an interest rate of 8 percent on all of its projects. a. Calculate the MIRR of the project using the discounting approach. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. Calculate the MIRR of the project using the reinvestment approach. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. Calculate the MIRR of the project using the combination approach. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Discounting approach MIRR b. Reinvestment approach MIRR c. Combination approach MIRR % % %arrow_forwardA project will require an initial outlay of $2000 and will result in the following cash inflows in the years shown. If the cost of capital is 3%, what is the NPV of the project? a. $321 Ob. $388 O c. $318 O d. $460 Year 2 Cash Flow $770 $880 $810arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education